Question: . Raw Materials Inventory Work in Process Inventory Finished Goods Inventory During October, the following transactions took place. Raw materials were purchased on account, $150,000.

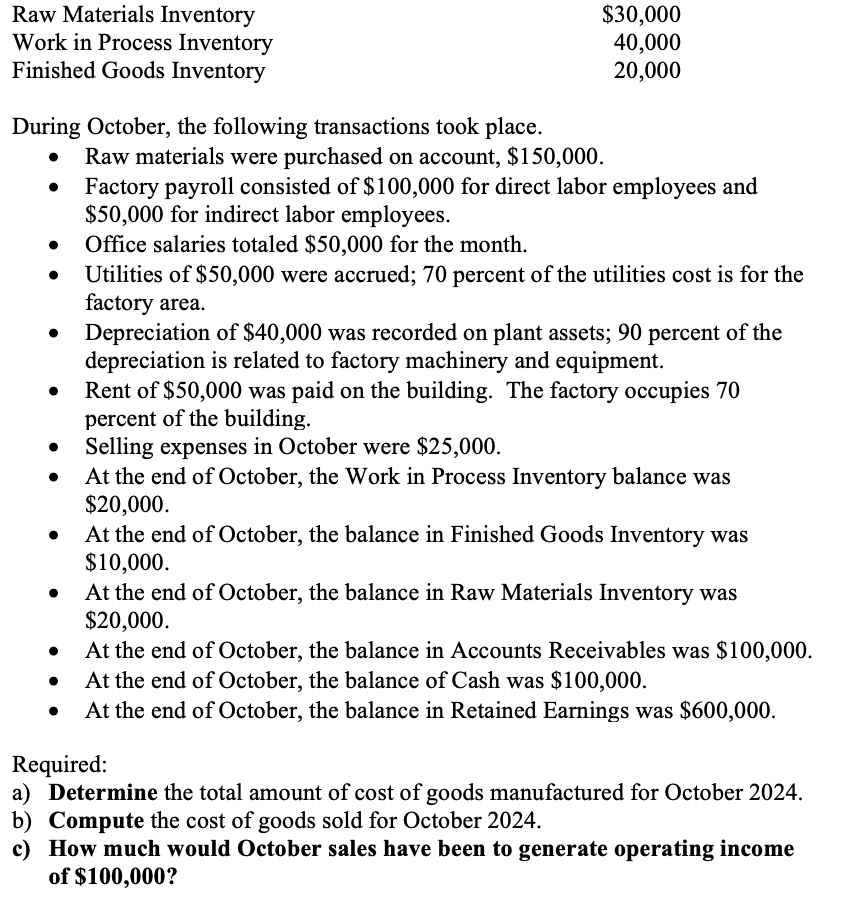

Raw Materials Inventory Work in Process Inventory Finished Goods Inventory During October, the following transactions took place. Raw materials were purchased on account, $150,000. $30,000 40,000 20,000 Factory payroll consisted of $100,000 for direct labor employees and $50,000 for indirect labor employees. Office salaries totaled $50,000 for the month. Utilities of $50,000 were accrued; 70 percent of the utilities cost is for the factory area. Depreciation of $40,000 was recorded on plant assets; 90 percent of the depreciation is related to factory machinery and equipment. Rent of $50,000 was paid on the building. The factory occupies 70 percent of the building. Selling expenses in October were $25,000. At the end of October, the Work in Process Inventory balance was $20,000. At the end of October, the balance in Finished Goods Inventory was $10,000. At the end of October, the balance in Raw Materials Inventory was $20,000. At the end of October, the balance in Accounts Receivables was $100,000. At the end of October, the balance of Cash was $100,000. At the end of October, the balance in Retained Earnings was $600,000. Required: a) Determine the total amount of cost of goods manufactured for October 2024. b) Compute the cost of goods sold for October 2024. c) How much would October sales have been to generate operating income of $100,000?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts