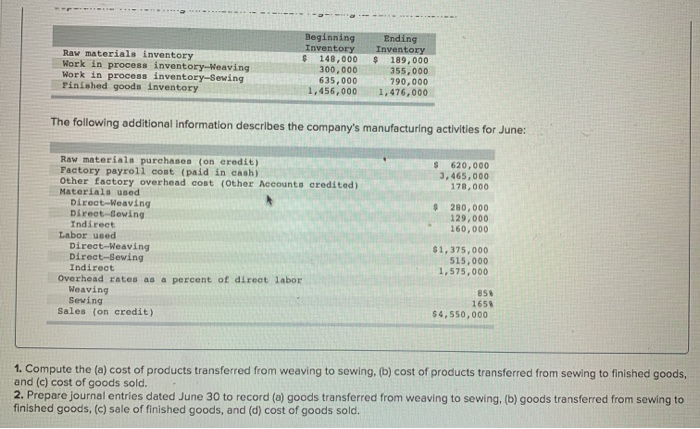

Question: Raw materials inventory Work in process inventory-Weaving Work in process inventory-Sewing Finished goods inventory Beginning Inventory $ 148,000 300,000 635,000 1,456,000 Ending Inventory $ 189,000

Raw materials inventory Work in process inventory-Weaving Work in process inventory-Sewing Finished goods inventory Beginning Inventory $ 148,000 300,000 635,000 1,456,000 Ending Inventory $ 189,000 355,000 790,000 1,476,000 The following additional information describes the company's manufacturing activities for June: S 620,000 3, 465,000 178,000 $ 280,000 129,000 160,000 Raw materials purchases (on credit) Factory payroll coat (paid in cash) Other factory overhead coat (Other Accounts credited) Materials used Direct-Weaving Direct-Sewing Indirect Labor used Direct-Weaving Direct-Sewing Indirect Overhead rates as a percent of direct labor Weaving Sewing Sales (on credit) $1,375,000 515,000 1,575,000 858 1658 $ 4,550,000 1. Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred from sewing to finished goods, and (c) cost of goods sold. 2. Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, (c) sale of finished goods, and (d) cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts