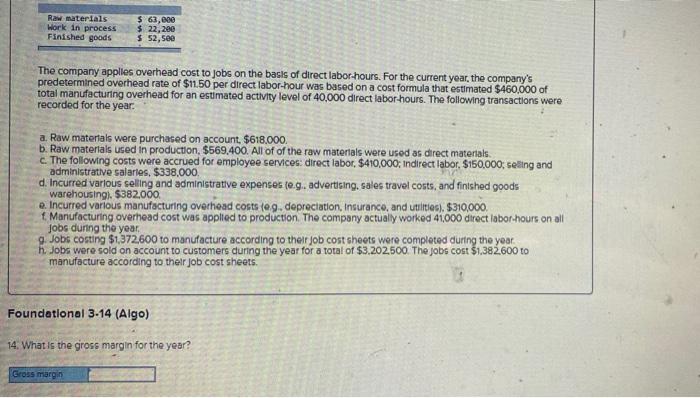

Question: Raw materials Work in process Finished goods $ 63,000 $ 22,200 $ 52,500 The company applies overhead cost to jobs on the basis of direct

Raw materials Work in process Finished goods $ 63,000 $ 22,200 $ 52,500 The company applies overhead cost to jobs on the basis of direct labor hours. For the current year, the company's predetermined overhead rate of $11.50 per direct labor-hour was based on a cost formula that estimated $460,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year. a. Raw materials were purchased on account, $618,000. b. Raw materials used in production, $569.400. All of of the raw materials were used as direct materials c. The following costs were accrued for employee services: direct labor, $410,000; Indirect labor, $150,000, setting and administrative salaries, $338,000 d. Incurred various selling and administrative expenses (eg. advertising, sales travel costs, and finished goods warehousing). $382.000 o. Incurred various manufacturing overhead costs (9. depreciation, Insurance, and utilities), $310,000, f Manufacturing overhead cost was applied to production. The company actually worked 41.000 direct labor-hours on all Jobs during the year. 9 Jobs costing $1,372,600 to manufacture according to their job cost sheets were completed during the year. h Jobs were sold on account to customers during the year for a total of $3.202,500 The jobs cost $1.382.600 to manufacture according to their job cost sheets Foundational 3-14 (Algo) 14. What is the gross margin for the year? Gross margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts