Question: Raymond Inc. has two bond issues outstanding. The first bond issue has a face value of $80 million, a 7% coupon, and sells at a

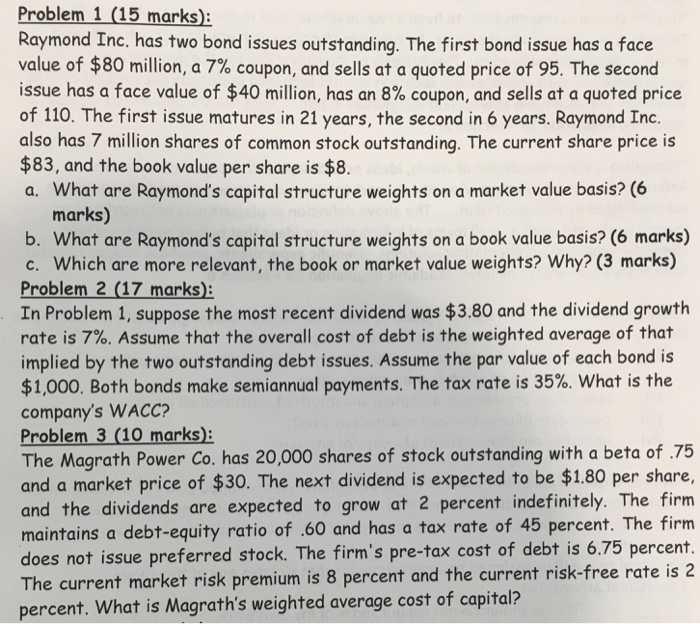

Raymond Inc. has two bond issues outstanding. The first bond issue has a face value of $80 million, a 7% coupon, and sells at a quoted price of 95. The second issue has a face value of $40 million, has an 8% coupon, and sells at a quoted price of 110. The first issue matures in 21 years, the second in 6 years. Raymond Inc. also has 7 million shares of common stock outstanding. The current share price is $83, and the book value per share is $8. What are Raymond's capital structure weights on a market value basis? What are Raymond's capital structure weights on a book value basis? Which are more relevant, the book or market value weights? Why? In Problem 1, suppose the most recent dividend was $3.80 and the dividend growth rate is 7%. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Assume the par value of each bond is $1,000. Both bonds make semiannual payments. The tax rate is 35%. What is the company's WACC? The Magrath Power Co. has 20,000 shares of stock outstanding with a beta of .75 and a market price of $30. The next dividend is expected to be $1.80 per share, and the dividends are expected to grow at 2 percent indefinitely. The firm maintains a debt-equity ratio of .60 and has a tax rate of 45 percent. The firm does not issue preferred stock. The firm's pre-tax cost of debt is 6.75 percent. The current market risk premium is 8 percent and the current risk-free rate is 2 percent. What is Magrath's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts