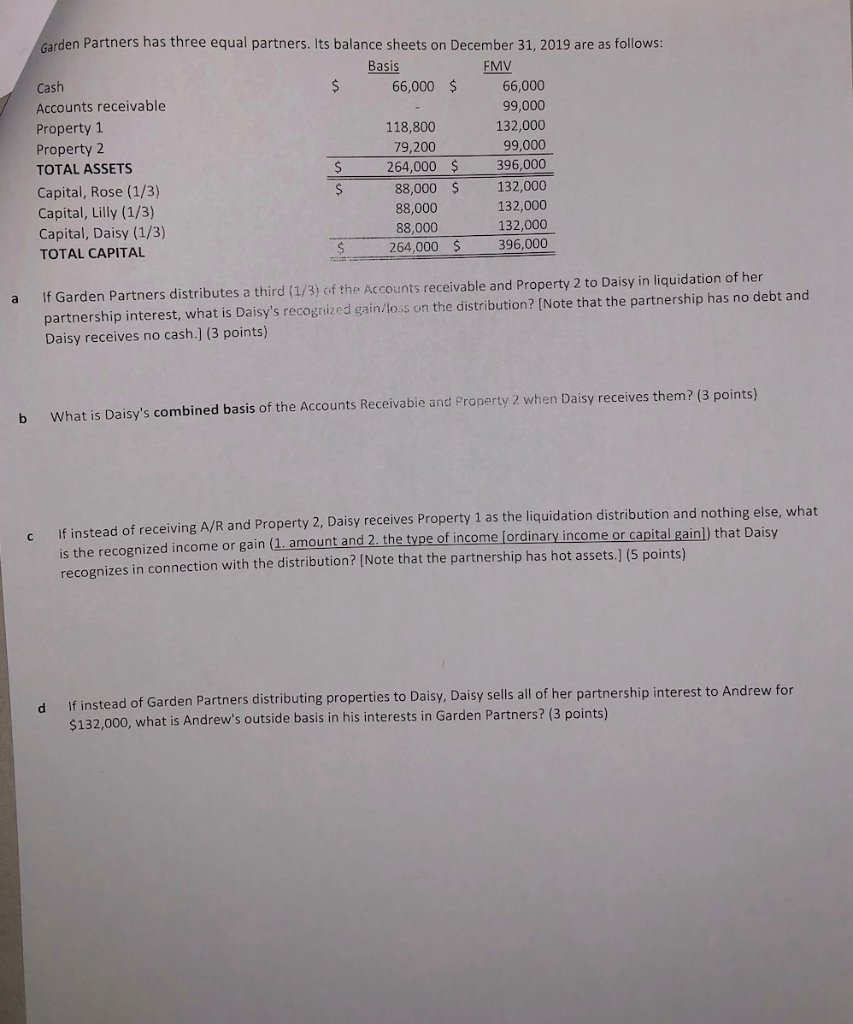

Question: rden Partners has three equal partners. Its balance sheets on December 31, 2019 are as follows: Basi Cash Accounts receivable Property 1 Property 2 TOTAL

rden Partners has three equal partners. Its balance sheets on December 31, 2019 are as follows: Basi Cash Accounts receivable Property 1 Property 2 TOTAL ASSETS Capital, Rose (1/3) Capital, Lilly (1/3) Capital, Daisy (1/3) TOTAL CAPITAL 66,000 $ 66,000 99,000 132,000 99,000 264,000 $ 396,000 88,000 132,000 132,000 132,000 264,000 S396,000 118,800 79,200 88,000 88,000 If Garden Partners distributes a third (1/3) of the Accounts receivable and Property 2 to Daisy in liquidation of her partnership interest, what is Daisy's recognized gain/loss on the distribution? [Note that the partnership has no debt and Daisy receives no cash.l (3 points) a What is Daisy's combined basis of the Accounts Receivabie and Property 2 when Daisy receives them? (3 points) b c If instead of receiving A/R and Property 2, Daisy receives Property 1 as the liquidation distribution and nothing else, what is the recognized income or gain (1. amount and 2 the type of income fordinary income or capital g recognizes in connection with the distribution? (Note that the partnership has hot assets.] (5 points) inl) that Daisy If instead of Garden Partners distributing properties to Daisy, Daisy sells all of her partnership interest to Andrew for $132,000, what is Andrew's outside basis in his interests in Garden Partners? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts