Question: Re: Accounting Changes and Error Corrections Date: March 2 3 , Year 5 Attachment ( s ) : Draft Unadjusted Balance Sheet and Income Statement,

Re: Accounting Changes and Error Corrections

Date: March Year

Attachments: Draft Unadjusted Balance Sheet and Income Statement, Years and

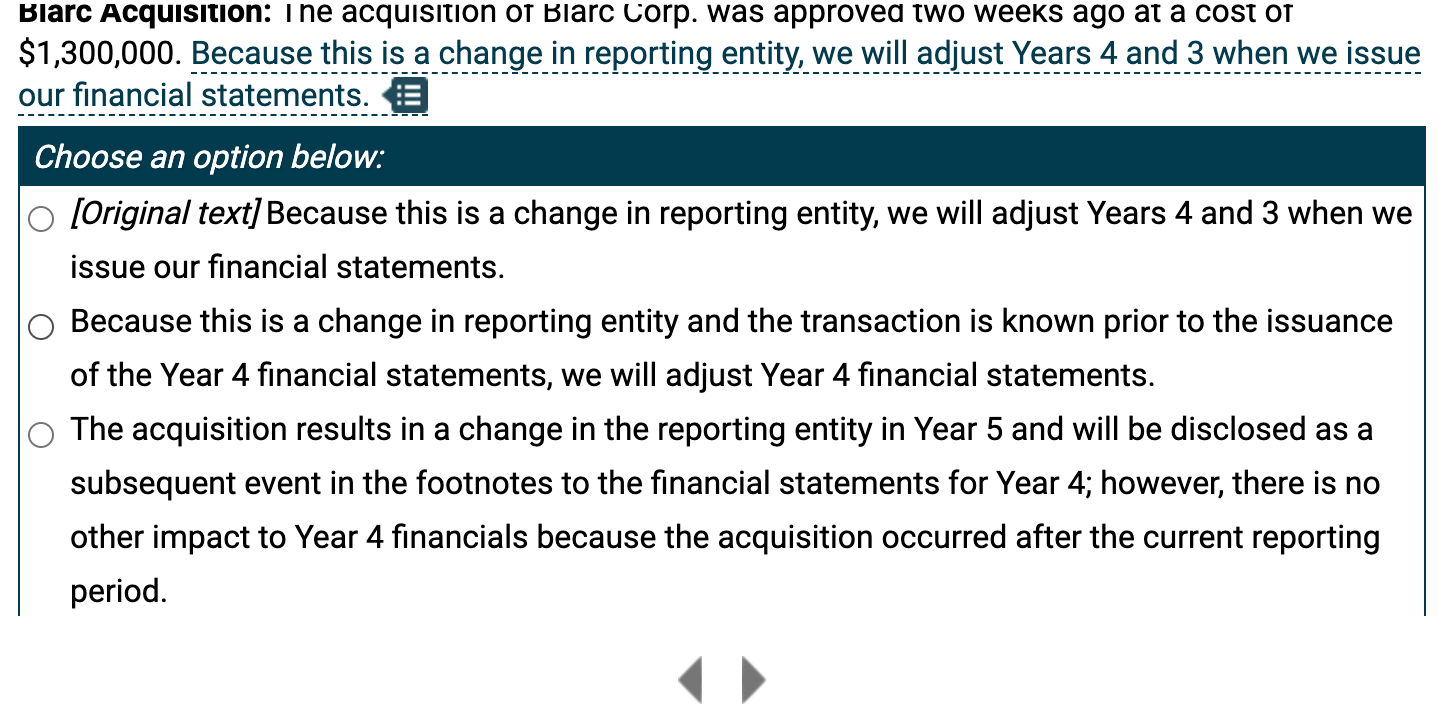

For your information and review in advance of our upcoming meeting, I am providing a copy of the company's draft unadjusted balance sheet and draft unadjusted income statement for Years and along with a summary below of the classification and impact of key accounting entries identified during Year including those we believe to be accounting changes and error corrections we will need to record in the unadjusted financials. At our meeting, I would like to discuss your feedback so we can make adjustments before giving the unaudited financial statements to JRM CPAs, who will be onsite for our annual audit April Barc Acquisition: ne acquisition biarc corp. was approved two weeks ago at a cost OT $ Because this is a change in reporting entity, we will adjust Years and when we issue our financial statements.

Choose an option below:

Original text Because this is a change in reporting entity, we will adjust Years and when we issue our financial statements.

Because this is a change in reporting entity and the transaction is known prior to the issuance of the Year financial statements, we will adjust Year financial statements.

The acquisition results in a change in the reporting entity in Year and will be disclosed as a subsequent event in the footnotes to the financial statements for Year ; however, there is no other impact to Year financials because the acquisition occurred after the current reporting period.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock