Question: reached, operating income will increase by the gross margin per unit for each additional unit sold. fixed costs per unit for each additional unit sold.

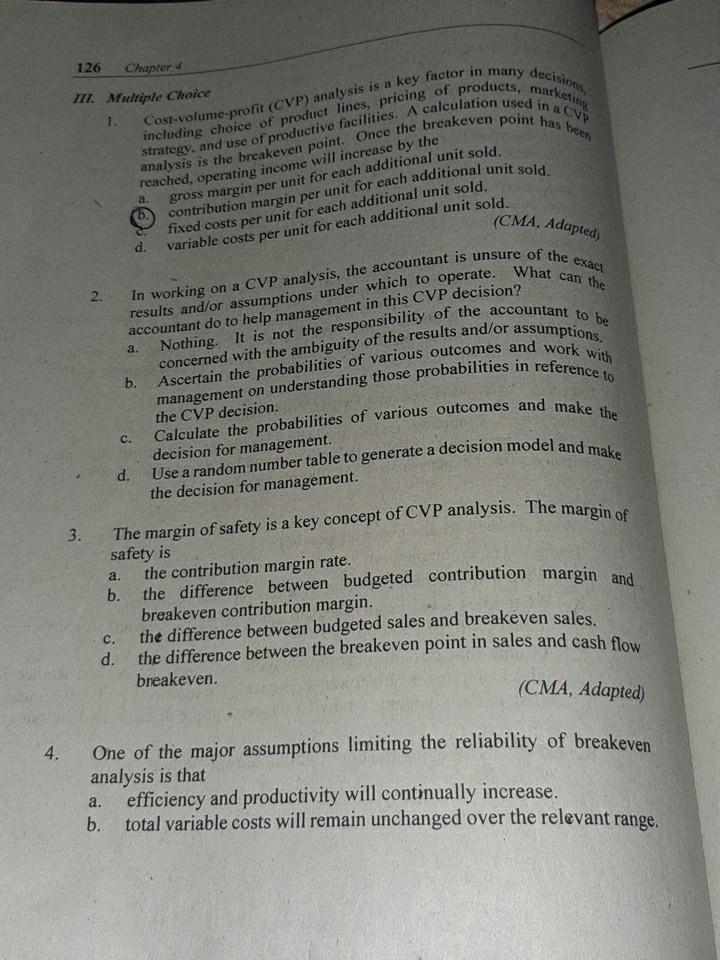

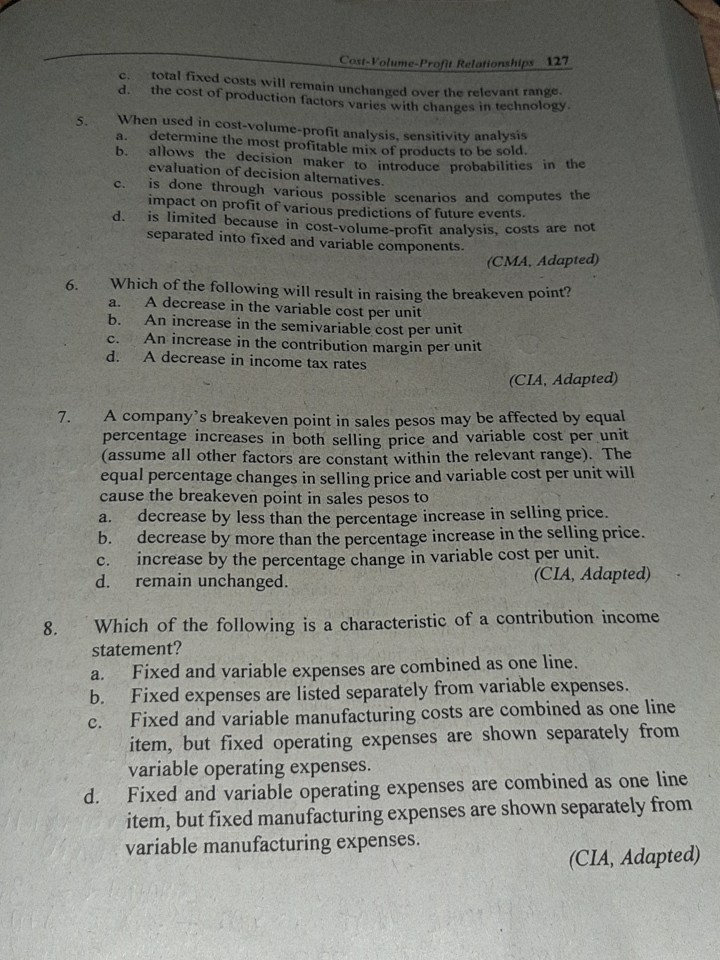

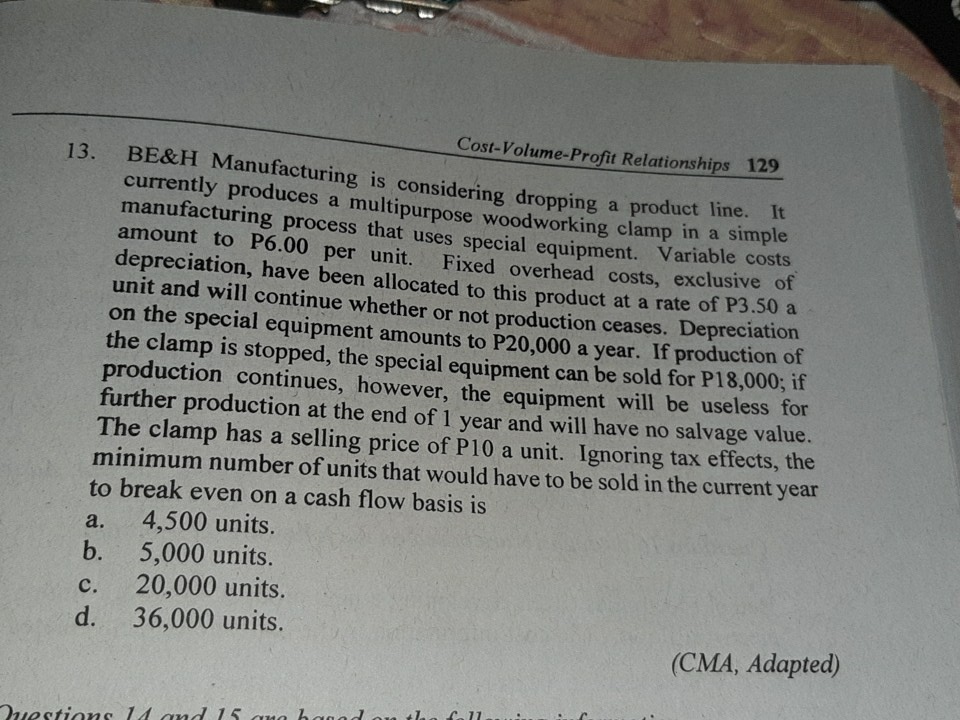

reached, operating income will increase by the gross margin per unit for each additional unit sold. fixed costs per unit for each additional unit sold. variable costs per unit for each additional unit sold. (CMA, Adapted accountant do to help management in this CVP decision? a. Cost-volume-profit (CVP) analysis is a key factor in many decisions, analysis is the breakeven point. Once the breakeven point has been strategy, and use of productive facilities. A calculation used in a CVP including choice of product lines, pricing of products, marketing 6.) contribution margin per unit for each additional unit sold. results and/or assumptions under which to operate. What can the In working on a CVP analysis, the accountant is unsure of the exact Nothing. It is not the responsibility of the accountant to be Ascertain the probabilities of various outcomes and work with concerned with the ambiguity of the results and/or assumptions. management on understanding those probabilities in reference to Calculate the probabilities of various outcomes and make the Use a random number table to generate a decision model and make The margin of safety is a key concept of CVP analysis. The margin of 126 Chapter III. Multiple Choice 1. a. d. 2. b. c. d. the decision for management. 3. safety is a. the contribution margin rate. b. the difference between budgeted contribution margin and breakeven contribution margin. c. the difference between budgeted sales and breakeven sales. d. the difference between the breakeven point in sales and cash flow breakeven. (CMA, Adapted) the CVP decision. decision for management. 4. One of the major assumptions limiting the reliability of breakeven analysis is that a. efficiency and productivity will continually increase. b. total variable costs will remain unchanged over the relevant range. c. d. S. a. b. Cost-Volume-Profit Relationships 127 total fixed costs will remain unchanged over the relevant range the cost of production factors varies with changes in technology When used in cost-volume-profit analysis, sensitivity analysis allows the decision maker to introduce probabilities in the evaluation of decision alternatives. is done through various possible scenarios and computes the impact on profit of various predictions of future events. d. is limited because in cost-volume-profit analysis, costs are not separated into fixed and variable components. c. (CMA, Adapted) 6. a. b. c. Which of the following will result in raising the breakeven point? A decrease in the variable cost per unit An increase in the semivariable cost per unit An increase in the contribution margin per unit d. A decrease in income tax rates (CIA, Adapted) 7. A company's breakeven point in sales pesos may be affected by equal percentage increases in both selling price and variable cost per unit (assume all other factors are constant within the relevant range). The equal percentage changes in selling price and variable cost per unit will cause the breakeven point in sales pesos decrease by less than the percentage increase in selling price. b. decrease by more than the percentage increase in the selling price. increase by the percentage change in variable cost per unit. d. remain unchanged. (CIA, Adapted) to a. c. 8. a. c. Which of the following is a characteristic of a contribution income statement? Fixed and variable expenses are combined as one line. b. Fixed expenses are listed separately from variable expenses. Fixed and variable manufacturing costs are combined as one line item, but fixed operating expenses are shown separately from variable operating expenses. d. Fixed and variable operating expenses are combined as one line item, but fixed manufacturing expenses are shown separately from variable manufacturing expenses. (CIA, Adapted) 13. Cost-Volume-Profit Relationships 129 BE&H Manufacturing is considering dropping a product line. currently produces a multipurpose woodworking clamp in a simple . It manufacturing process that uses special equipment. Variable costs amount to P6.00 per unit. Fixed overhead costs, exclusive of depreciation, have been allocated to this product at a rate of P3.50 a unit and will continue whether or not production ceases. Depreciation on the special equipment amounts to P20,000 a year. If production of the clamp is stopped, the special equipment can be sold for P18,000; if production continues, however, the equipment will be useless for further production at the end of 1 year and will have no salvage value. The clamp has a selling price of P10 a unit. Ignoring tax effects, the minimum number of units that would have to be sold in the current year to break even on a cash flow basis is 4,500 units. a. b. c. d. 5,000 units. 20,000 units. 36,000 units. (CMA, Adapted) Puestions 14 and 15 au haqed on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts