Question: Read all steps in the audit program for cash found on Work Paper 16-1 and familiarize yourself with work papers 16-1 through 16-7. Complete

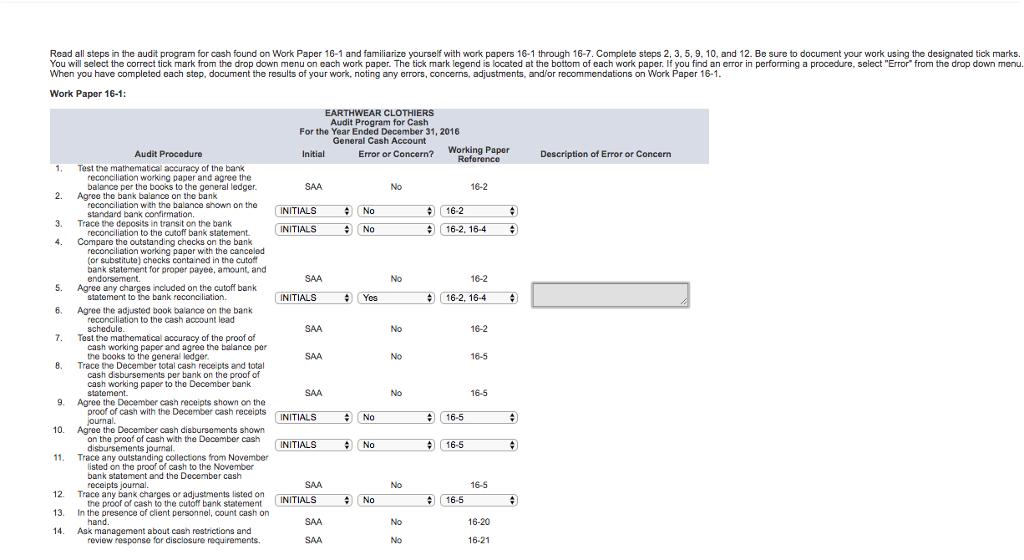

Read all steps in the audit program for cash found on Work Paper 16-1 and familiarize yourself with work papers 16-1 through 16-7. Complete steps 2, 3, 5, 9, 10, and 12. Be sure to document your work using the designated tick marks. You will select the correct tick mark from the drop down menu on each work paper. The tick mark legend is located at the bottom of each work paper. If you find an error in performing a procedure, select "Error" from the drop down menu. When you have completed each step, document the results of your work, noting any errors, concerns, adjustments, and/or recommendations on Work Paper 16-1: Paper 16-1, 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Audit Procedure Test the mathematical accuracy of the bank reconciliation working paper and agree the balance per the books to the general ledger. Agree the bank balance on the bank reconciliation with the balance shown on the standard bank confirmation. Trace the deposits in transit on the bank reconciliation to the cutoff bank statement. Compare the outstanding checks on the bank reconciliation working paper with the canceled (or substitute) checks contained in the cutoff bank statement for proper payee, amount, and endorsement. Agree any charges included on the cutoff bank statement to the bank reconciliation. Agree the adjusted book balance on the bank. reconciliation to the cash account lead schedule. Test the mathematical accuracy of the proof of cash working paper and agree the balance per the books to the general ledger. Trace the December total cash receipts and total cash disbursements per bank on the proof of cash working paper to the December bank statement. Agree the December cash receipts shown on the proof of cash with the December cash receipts journal. Agree the December cash disbursements shown on the proof of cash with the December cash disbursements journal. Trace any outstanding collections from November listed on the proof of cash to the November bank statement and the December cash receipts journal. Trace any bank charges or adjustments listed on the proof of cash to the cutoff bank statement In the presence of client personnel, count cash on hand. Ask management about cash restrictions and review response for disclosure requirements. EARTHWEAR CLOTHIERS Audit Program for Cash For the Year Ended December 31, 2016 General Cash Account Error or Concern? Initial SAA INITIALS INITIALS SAA INITIALS SAA SAA SAA INITIALS INITIALS SAA INITIALS SAA SAA # # No No # Yes # No : No # No No No No No No No No No + Working Paper Reference ; 16-2 16-2, 16-4 + 16-5 16-2 16-2, 16-4 16-2 16-5 16-5 16-2 16-5 16-5 16-5 16-20 16-21 + +) # # Description of Error or Concern On the worksheet labeled "Cash Audit Procedures Evaluation", identify at least one assertion substantiated (tested) by the audit procedures you performed (steps 2, 3, 5, 9, 10, and 12 listed in Work Paper 16-1) and identify what potential errors could be detected by performing the procedure. Steps 2 3 5 9 10 12 EARTHWEAR CLOTHIERS Cash Audit Procedures Evaluation December 31, 2016 Audit Procedure Agree the bank balance on the bank reconciliation with the balance shown on the standard bank confirmation. Trace the deposits in transit on the bank reconciliation to the cutoff bank statement. Agree any charges included on the cutoff bank statement to the bank reconciliation. Agree the December cash receipts shown on the proof of cash with the December cash receipts journal. Agree the December cash disbursements shown on the proof of cash with the December cash disbursements journal. Trace any bank charges or adjustments listed on the proof of cash to the cutoff bank statement Assertion(s) Substantiated (Tested) by the Procedure Errors Detected by Procedure

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

2 3 5 9 10 and 12 documented in a table format Working Paper Audit Procedure Error or Concern Description of Error or Concern 162 Test mathematical accuracy of bank reconciliation and agree balance to ... View full answer

Get step-by-step solutions from verified subject matter experts