Question: Read and respond to the text i9-78 Minimum 2 paragraphs Adjusted basis Tax preparation fees 2,000 750 Compute Dan and Cheryl's income tax liability for

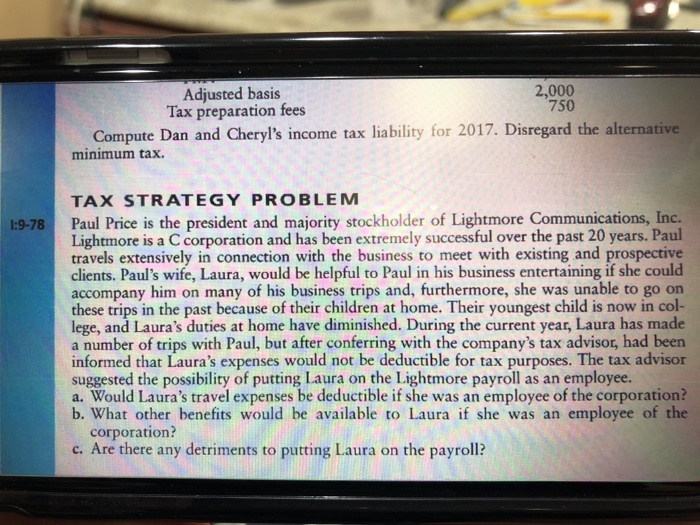

Adjusted basis Tax preparation fees 2,000 750 Compute Dan and Cheryl's income tax liability for 2017. Disregard the alternative minimum tax. TAX STRATEGY PROBLEM 1:9-78 Paul Price is the president and majority stockholder of Lightmore Communications, Inc. Lightmore is a C corporation and has been extremely successful over the past 20 years. Paul travels extensively in connection with the business to meet with existing and prospective clients. Paul's wife, Laura, would be helpful to Paul in his business entertaining if she could accompany him on many of his business trips and, furthermore, she was unable to go on these trips in the past because of their children at home. Their youngest child is now in col- lege, and Laura's duties at home have diminished. During the current year, Laura has made a number of trips with Paul, but after conferring with the company's tax advisor, had been informed that Laura's expenses would not be deductible for tax purposes. The tax advisor suggested the possibility of putting Laura on the Lightmore payroll as an employee. a. Would Laura's travel expenses be deductible if she was an employee of the corporation? b. What other benefits would be available to Laura if she was an employee of the corporation? c. Are there any detriments to putting Laura on the payroll

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts