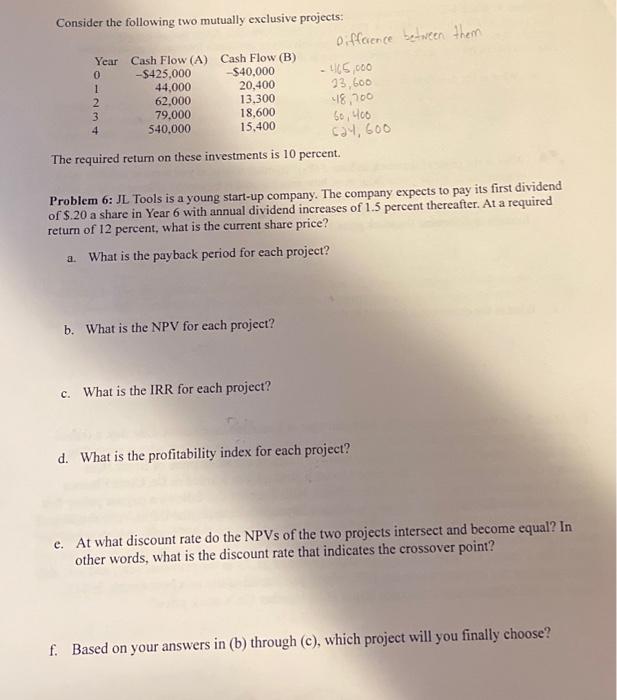

Question: read and solve Consider the following two mutually exclusive projects: Difference The required return on these investments is 10 percent. Problem 6: JL Tools is

Consider the following two mutually exclusive projects: Difference The required return on these investments is 10 percent. Problem 6: JL Tools is a young start-up company. The company expects to pay its first dividend of $.20 a share in Year 6 with annual dividend increases of 1.5 percent thereafter. At a required return of 12 percent, what is the current share price? a. What is the payback period for each project? b. What is the NPV for each project? c. What is the IRR for each project? d. What is the profitability index for each project? e. At what discount rate do the NPVs of the two projects intersect and become equal? In other words, what is the discount rate that indicates the crossover point? f. Based on your answers in (b) through (c), which project will you finally choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts