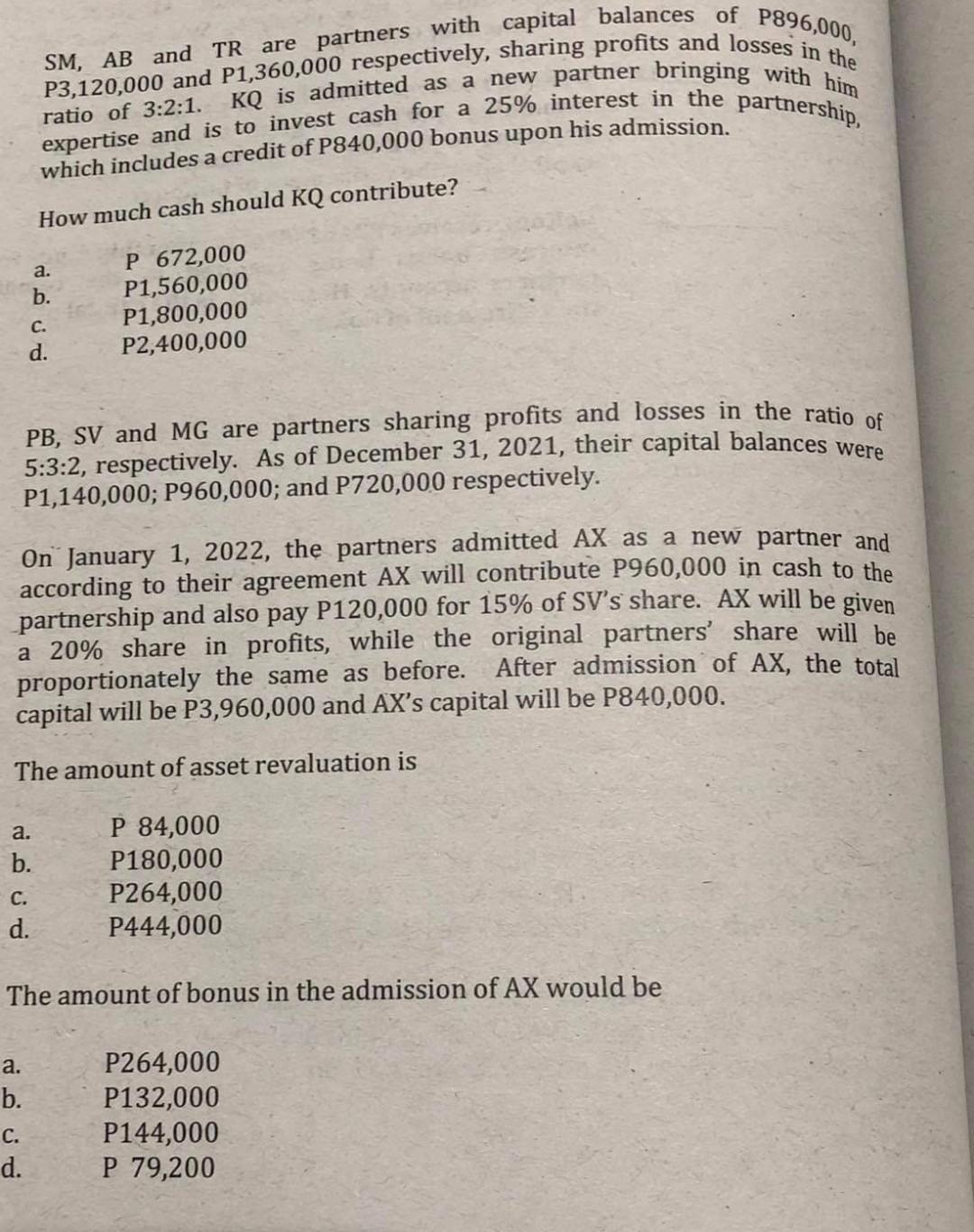

Question: Read carefully. Answer it with solutions. Complete solution please answer it thank you. i need to know why the answer on #1 is B (1,560,000)

Read carefully. Answer it with solutions. Complete solution please answer it thank you. i need to know why the answer on #1 is B (1,560,000) because there is no solution.

Please answer number 1,2,3,4 and 5 with solution please thank you

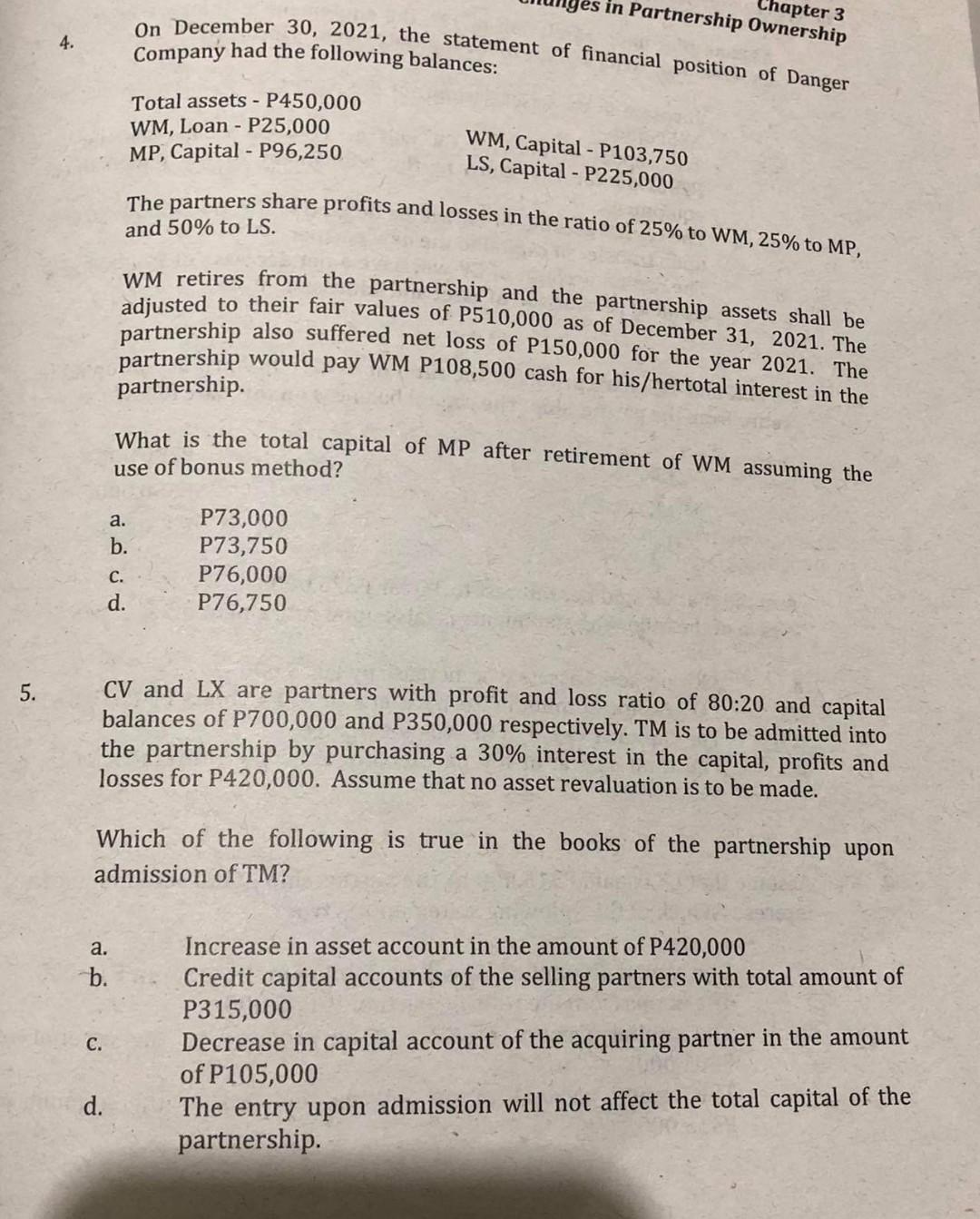

P3,120,000 and P1,360,000 respectively, sharing profits and losses in the SM, AB and TR are partners with capital balances of P896,000, ratio of 3:2:1. KQ is admitted as a new partner bringing with him expertise and is to invest cash for a 25% interest in the partnership, which includes a credit of P840,000 bonus upon his admission. How much cash should KQ contribute? a. b. P 672,000 P1,560,000 P1,800,000 P2,400,000 C. d. PB, SV and MG are partners sharing profits and losses in the ratio of 5:3:2, respectively. As of December 31, 2021, their capital balances were P1,140,000; P960,000; and P720,000 respectively. On January 1, 2022, the partners admitted AX as a new partner and according to their agreement AX will contribute P960,000 in cash to the partnership and also pay P120,000 for 15% of SV's share. AX will be given a 20% share in profits, while the original partners' share will be proportionately the same as before. After admission of AX, the total capital will be P3,960,000 and AX's capital will be P840,000. The amount of asset revaluation is a. b. P 84,000 P180,000 P264,000 P444,000 C. d. The amount of bonus in the admission of AX would be a. b. C. d. P264,000 P132,000 P144,000 P 79,200 Chapter 3 in Partnership Ownership 4. On December 30, 2021, the statement of financial position of Danger Company had the following balances: Total assets - P450,000 WM, Loan - P25,000 MP, Capital - P96,250 WM, Capital - P103,750 LS, Capital - P225,000 The partners share profits and losses in the ratio of 25% to WM, 25% to MP, and 50% to LS. WM retires from the partnership and the partnership assets shall be adjusted to their fair values of P510,000 as of December 31, 2021. The partnership also suffered net loss of P150,000 for the year 2021. The partnership would pay WM P108,500 cash for his/hertotal interest in the partnership. What is the total capital of MP after retirement of WM assuming the use of bonus method? a. b. P73,000 P73,750 P76,000 P76,750 C. d. 5. CV and LX are partners with profit and loss ratio of 80:20 and capital balances of P700,000 and P350,000 respectively. TM is to be admitted into the partnership by purchasing a 30% interest in the capital, profits and losses for P420,000. Assume that no asset revaluation is to be made. Which of the following is true in the books of the partnership upon admission of TM? a. b. C. Increase in asset account in the amount of P420,000 Credit capital accounts of the selling partners with total amount of P315,000 Decrease in capital account of the acquiring partner in the amount of P105,000 The entry upon admission will not affect the total capital of the partnership d. P3,120,000 and P1,360,000 respectively, sharing profits and losses in the SM, AB and TR are partners with capital balances of P896,000, ratio of 3:2:1. KQ is admitted as a new partner bringing with him expertise and is to invest cash for a 25% interest in the partnership, which includes a credit of P840,000 bonus upon his admission. How much cash should KQ contribute? a. b. P 672,000 P1,560,000 P1,800,000 P2,400,000 C. d. PB, SV and MG are partners sharing profits and losses in the ratio of 5:3:2, respectively. As of December 31, 2021, their capital balances were P1,140,000; P960,000; and P720,000 respectively. On January 1, 2022, the partners admitted AX as a new partner and according to their agreement AX will contribute P960,000 in cash to the partnership and also pay P120,000 for 15% of SV's share. AX will be given a 20% share in profits, while the original partners' share will be proportionately the same as before. After admission of AX, the total capital will be P3,960,000 and AX's capital will be P840,000. The amount of asset revaluation is a. b. P 84,000 P180,000 P264,000 P444,000 C. d. The amount of bonus in the admission of AX would be a. b. C. d. P264,000 P132,000 P144,000 P 79,200 Chapter 3 in Partnership Ownership 4. On December 30, 2021, the statement of financial position of Danger Company had the following balances: Total assets - P450,000 WM, Loan - P25,000 MP, Capital - P96,250 WM, Capital - P103,750 LS, Capital - P225,000 The partners share profits and losses in the ratio of 25% to WM, 25% to MP, and 50% to LS. WM retires from the partnership and the partnership assets shall be adjusted to their fair values of P510,000 as of December 31, 2021. The partnership also suffered net loss of P150,000 for the year 2021. The partnership would pay WM P108,500 cash for his/hertotal interest in the partnership. What is the total capital of MP after retirement of WM assuming the use of bonus method? a. b. P73,000 P73,750 P76,000 P76,750 C. d. 5. CV and LX are partners with profit and loss ratio of 80:20 and capital balances of P700,000 and P350,000 respectively. TM is to be admitted into the partnership by purchasing a 30% interest in the capital, profits and losses for P420,000. Assume that no asset revaluation is to be made. Which of the following is true in the books of the partnership upon admission of TM? a. b. C. Increase in asset account in the amount of P420,000 Credit capital accounts of the selling partners with total amount of P315,000 Decrease in capital account of the acquiring partner in the amount of P105,000 The entry upon admission will not affect the total capital of the partnership d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts