Question: read carefully & provide formulas BB FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW secretulestrom the Internet co FORMAS DALA REVIEW WEW m es you need

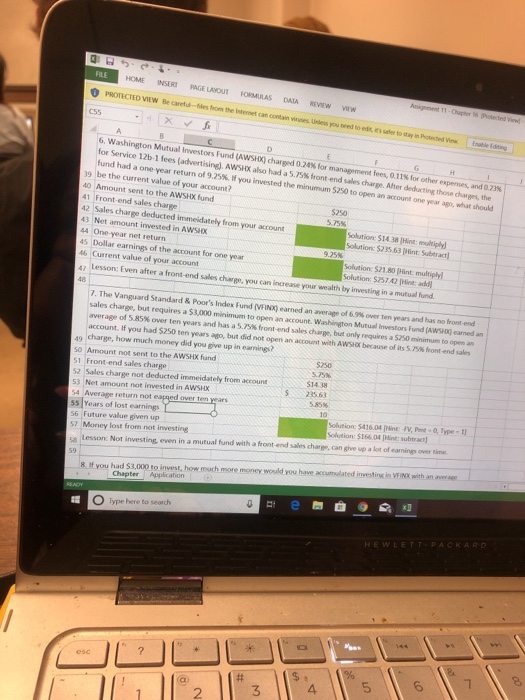

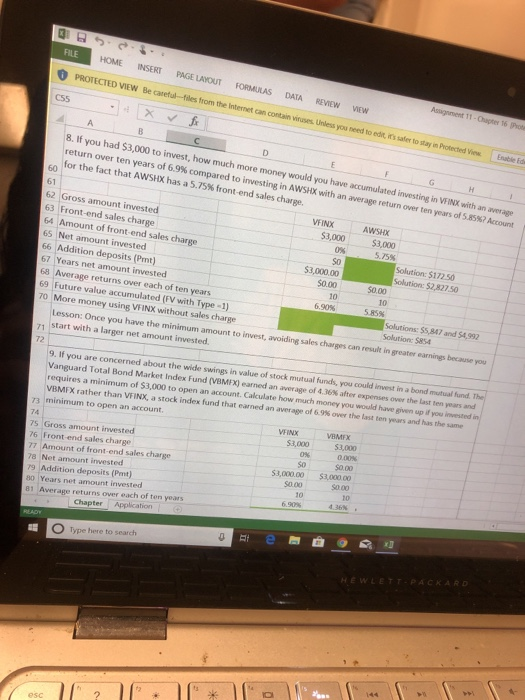

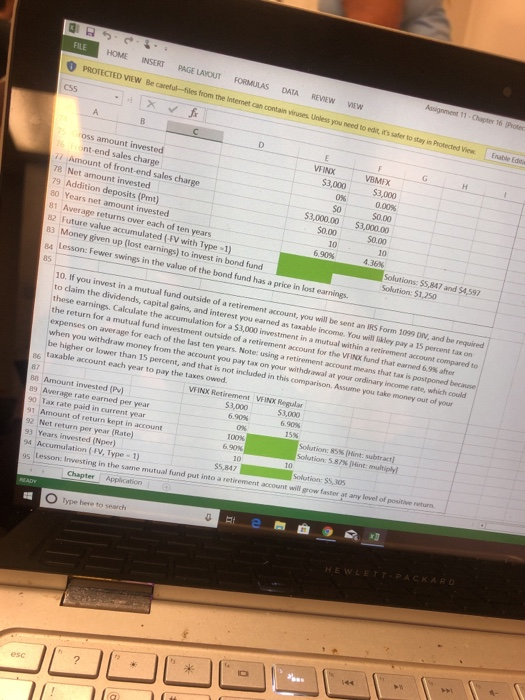

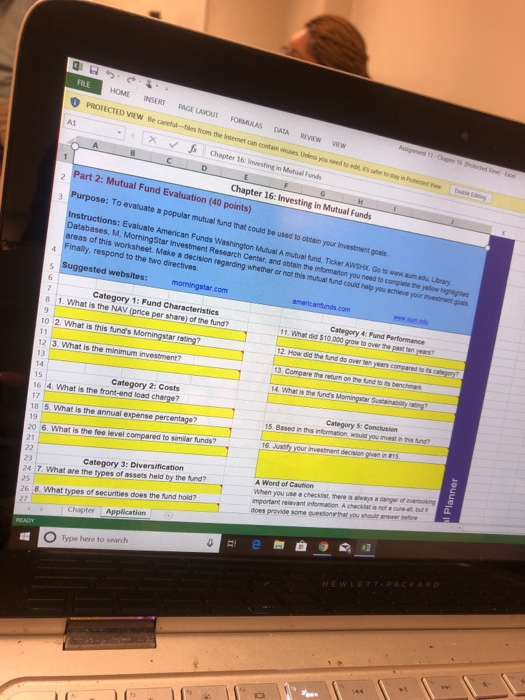

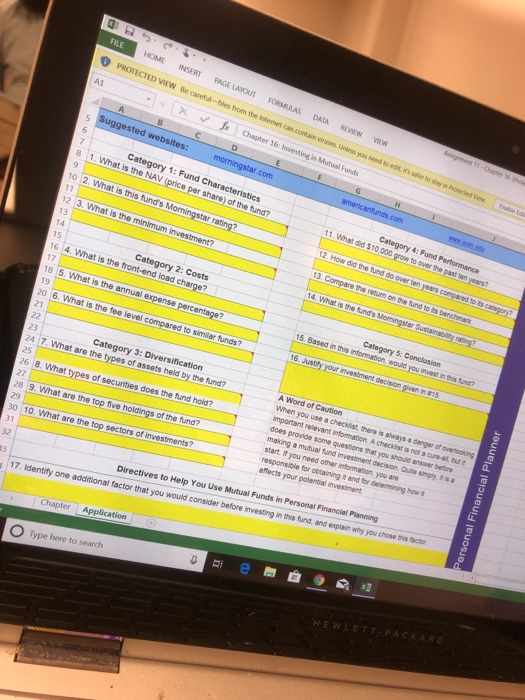

BB FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW secretulestrom the Internet co FORMAS DALA REVIEW WEW m es you need t 11. Cha o stay in Potched 6. Washington Mutual Investors Fund (AWS) charged 0.20% for management fees, 0.11% for other expenses and 0.23% for Service 12b-1 fees (advertising AWSHX also had a 5.75% front-end sales charge. Aber deducting those change the fund had a one-year return of 9.25%. If you invested the minimum 5250 to open an account one year 19 be the current value of your account? 40 Amount sent to the AWSHX fund 41 Front-end sales charge 42 Sales charge deducted immedately from your account what should 43 Net amount invested in AWSHOX One-year net return 45 Dollar earnings of the account for one year Solution $14.3 Solution $235.63 in multiply 16 Current value of your account Subtract 2 Lesson: Even after a front-end sales charge you can increase your wealth by investing in a mutual fund. Solution: $21. Mint multiply Solution 52572 Minta $250 5.75% 7. The Vanguard Standard & Poor's Index Fund (VFX) earned an average of 60% over ten years and has no frontend sales charge, but requires a $3,000 minimum to open an account. Washington Mutual investorslund (AWS wverage of 5.85% over ten years and has a 5.75% front-end sales charge, but only requires a $250 account. If you had $250 ten years ago, but did not open an account with AWSHX because of its charge, how much money did you give up in aming? and mm topen SO Amount not sent to the AWS fund front and 51 Front-end sales charge 52 Sales charge not deducted immediately from 3.5% 53 Net amount not invested in AWSX $1418 S4 Average return not eared over ten year 5 235.63 55 Years of lost earnings 56 Future value given up 57 Money lost from not investing Solution: SAI6.04 Pene: PV, Pane = 0, Type - 11 Lesson Not investing, even in a mutual fund with a front and Solution: 5166.04 Mitsubrat charang S250 5.85 If you had $3,000 to invest, how much more money would you have com Chapter Application e investing in with O Type here to search 8 3 53 FILE HOME INSERT O PROTECTED VIEW PAGE LAYOUT Be careful--files from the Internet can contain viruses. Unless you need to edit FORMULAS CSS DATA - REVIEW X WEW Fx Agent 11-Opter 16 afer to stay in Protected Vine 8. If you had $3,000 to invest, how much more money would you have accumulated investing in VFINX with an average return over ten years of 6.9% compared to investing in AWSHX with an average return over ten years of 5.8592 Account for the fact that AWSHX has a 5.75% front-end sales charge, $3,000 62 Gross amount invested 63 Front-end sales charge 64 Amount of front-end sales charge VFINX 65 Net amount invested AWSHX 66 Addition deposits (Pmt) $3,000 67 Years net amount invested 5.75% 68 Average returns over each of ten years Solution: 517250 69 Future value accumulated (FV with Type - 1) Solution: 52,82750 70 More money using VFINX without sales charge Lesson: Once you have the minimum amount to invest, avoiding sales charges can result in greater earnings because you 5.85% 71 start with a larger net amount invested Solutions: 55 817 and 54,992 Solutions SRS $3,000.00 $0.00 $0.00 6.90 10 9. If you are concerned about the wide swings in value of stock mutual funds, you could invest in a bond mutual fund. The Vanguard Total Bond Market Index Fund (IMF) earned an average of 4.36 after expenses over the best ten years and requires a minimum of $3,000 to open an account. Calculate how much money you would have given up if you nested in VBMFX rather than VFINX, a stock index fund that earned an average of 6.9% over the last ten years and has the same 73 minimum to open an account, 75 Gross amount invested 76 Front-end sales charge VFINEX VEMEX 77 Amount of front-end sales charge S2,000 S2,000 78 Net amount invested 0.00% 79 Addition deposits (Pet) S2000.00 80 Years net amount invested 1,000.00 81 Average returns over each often years Chapter Application SO SO DO S0.00 6.90% O Type here to search O e HEWLETT-PACKARD osc 2 .. OSS. FILE HOME O INSERT PROTECTED VIEW PAGE LAYOUT Be careful--les from the Internet can contain viruses. Unless you need to edit, is FORMULAS DATA REVIEW NEW 055 Assignment 11 Chapter 16 Protec er to stay in Protected View Fatto oss amount invested ant-end sales charge 77 Amount of front-end sales charge 78 Net amount invested 79 Addition deposits (Pet) VBMFX 80 Years net amount invested 81 Average returns over each of ten years 0.00% 82 Future value accumulated (FV with Type - 1) $0.00 83 Money given up lost earnings) to invest in bond fund $3,000.00 $0.00 Lesson: Fewer swings in the value of the bond fund has a price in lost earnings 6.90% 4.36% Solutions: 55.847 and 54,597 Solution: $1,250 VFINX $3,000 0% SO $3,000.00 $3.000 $0.00 10. If you invest in a mutual fund outside of a retirement account, you will be sent an IRS Form 1099 DIV, and be required to claim the dividends, capital gains, and interest you earned as taxable income. You will dey pay a 15 percent taxon these earnings. Calculate the accumulation for a $3,000 investment in a mutual within a retirement account compared to the return for a mutual fund investment outside of a retirement account for the VINX fund that earned 6 expenses on average for each of the last ten years. Note: using a retirement account means that taxis postponed because when you withdraw money from the account you pay tax on your withdrawal at your ordinary income rate, which could be higher or lower than 15 percent, and that is not included in this comparison. Assume you take money out of your taxable account each year to pay the taxes owed. after 38 Amount invested (P) 19 Average rate earned per year VFINX Retirement VFINX Real 90 Tax rate paid in current year $3,000 91 Amount of return kept in account 32 Net return per year (late) 93 Years invested (per) TOON 94 Accumulation (V. Type - 1) Solution 85Mint subtract) 95 LessonInvesting in the same mutual fund put into a retirement account will grow faster at any level of positive return Solution: 587 Hint multiply Chapter Application Solution: 55305 6.30 53,000 5.SOK 60 55.87 O Type here to search HELEPACKARD FILE HOME O INSERTIGE AROUT FORMAS PROTECTED VIEW Be care -les from the Internet DATA X REVIEW WW ft con Chapter 16 Investing in Mutual Funds n ess you need to edit - Part 2: Mutual Fund Evaluation (40 points) Purpose: To evaluate a popular mutual fund that could be used to obtain your investment goals Chapter 16: Investing in Mutual Funds ale to stay in Hotected Instructions: Evaluate American Funds Washington Mutual Amutual fund. Ticher AWSHK. Go to www Databases, M. Morning Star Investment Research Center and obtain the informaton you need to come they low high areas of this worksheet. Make a decision regarding whether or not is mutual fund could help you achieve your investments Finally, respond to the two directives Suggested websites: morningstar.com .Library americanas.com 8 1. What is the NAV (price per share) of the fund? Category 1: Fund Characteristics 10 2. What is this fund's Morningstar rating? 11. What did $10.000 grow to over the past Category 4: Fund Performance 12 3. What is the minimum invest 16 4. What is the front-end load charge? Category 2: Costs 18 5. What the annual expense percentage 20 6. What is the fee level compared to similar tu 15. Based in this information would you invest in this Category : Conclusion 24 7. What are the types of assets held by the fund? Category 3: Diversification 26 8. What types of securities does the fund hold? A Word of Caution When you use a checklist there important relevant information Acha a does provide some question you should Planner Chapter Application re t be Type here to search 0 e @ o B FILE HOME 0 PROTECTED VIEW Be caresses from the steret can continues Unies you need to con INSERT . PAGE LAYOUT FORSKAS X Suggested websites: DATA ft REVIEW VW Chapter 16: bevesting in Mutual Funds 8 1. What is the NAV (price per share) of the fund? Category 1: Fund Characteristics morningstar.com 10 2. What is this fund's Morningstar rating? testo stay istedes Vio 12 3. What is the minimum investment? americantunds.com Erbeid 11. What did $10.000 grow to over the past ten years? Category 4: Fund Performance 16 4. What is the front-end load charge? Category 2: Costs 12. How did the fund do over ten years compared to its categoria 18 5. What is the annual expense percentage 13. Compare the return on the fund to its benchman 20 6. What is the fee level compared to similar funds? 14. What is the funds Momingstar Sustainabi 24 7. What are the types of assets held by the fund? Category 3: Diversification 15. Based in this information would you invest in this Category 5: Conclusion n g 26 8. What types of securities does the fund hold? 16. Justify your investment decision 28 9. What are the top five holdings of the fund? 30 10. What are the top sectors of investments? 32 A Word of Caution When you use a checklist there is always a danger of over important relevant information. A check it is not a cual does provide some questions that you should answer before making a mutual fund investment decision. Quem start. If you need other information, you are responsible for obtaining affects your potential investment and for determining how it 17. Identify one additional factor that you would consider before investing in this fund, and explain why you chose this Directives to Help You Use Mutual Funds in Personal Financial Planning Chapter Personal Financial Planner Application Type here to search HEWLETT-PACKARD BB FILE HOME INSERT PAGE LAYOUT PROTECTED VIEW secretulestrom the Internet co FORMAS DALA REVIEW WEW m es you need t 11. Cha o stay in Potched 6. Washington Mutual Investors Fund (AWS) charged 0.20% for management fees, 0.11% for other expenses and 0.23% for Service 12b-1 fees (advertising AWSHX also had a 5.75% front-end sales charge. Aber deducting those change the fund had a one-year return of 9.25%. If you invested the minimum 5250 to open an account one year 19 be the current value of your account? 40 Amount sent to the AWSHX fund 41 Front-end sales charge 42 Sales charge deducted immedately from your account what should 43 Net amount invested in AWSHOX One-year net return 45 Dollar earnings of the account for one year Solution $14.3 Solution $235.63 in multiply 16 Current value of your account Subtract 2 Lesson: Even after a front-end sales charge you can increase your wealth by investing in a mutual fund. Solution: $21. Mint multiply Solution 52572 Minta $250 5.75% 7. The Vanguard Standard & Poor's Index Fund (VFX) earned an average of 60% over ten years and has no frontend sales charge, but requires a $3,000 minimum to open an account. Washington Mutual investorslund (AWS wverage of 5.85% over ten years and has a 5.75% front-end sales charge, but only requires a $250 account. If you had $250 ten years ago, but did not open an account with AWSHX because of its charge, how much money did you give up in aming? and mm topen SO Amount not sent to the AWS fund front and 51 Front-end sales charge 52 Sales charge not deducted immediately from 3.5% 53 Net amount not invested in AWSX $1418 S4 Average return not eared over ten year 5 235.63 55 Years of lost earnings 56 Future value given up 57 Money lost from not investing Solution: SAI6.04 Pene: PV, Pane = 0, Type - 11 Lesson Not investing, even in a mutual fund with a front and Solution: 5166.04 Mitsubrat charang S250 5.85 If you had $3,000 to invest, how much more money would you have com Chapter Application e investing in with O Type here to search 8 3 53 FILE HOME INSERT O PROTECTED VIEW PAGE LAYOUT Be careful--files from the Internet can contain viruses. Unless you need to edit FORMULAS CSS DATA - REVIEW X WEW Fx Agent 11-Opter 16 afer to stay in Protected Vine 8. If you had $3,000 to invest, how much more money would you have accumulated investing in VFINX with an average return over ten years of 6.9% compared to investing in AWSHX with an average return over ten years of 5.8592 Account for the fact that AWSHX has a 5.75% front-end sales charge, $3,000 62 Gross amount invested 63 Front-end sales charge 64 Amount of front-end sales charge VFINX 65 Net amount invested AWSHX 66 Addition deposits (Pmt) $3,000 67 Years net amount invested 5.75% 68 Average returns over each of ten years Solution: 517250 69 Future value accumulated (FV with Type - 1) Solution: 52,82750 70 More money using VFINX without sales charge Lesson: Once you have the minimum amount to invest, avoiding sales charges can result in greater earnings because you 5.85% 71 start with a larger net amount invested Solutions: 55 817 and 54,992 Solutions SRS $3,000.00 $0.00 $0.00 6.90 10 9. If you are concerned about the wide swings in value of stock mutual funds, you could invest in a bond mutual fund. The Vanguard Total Bond Market Index Fund (IMF) earned an average of 4.36 after expenses over the best ten years and requires a minimum of $3,000 to open an account. Calculate how much money you would have given up if you nested in VBMFX rather than VFINX, a stock index fund that earned an average of 6.9% over the last ten years and has the same 73 minimum to open an account, 75 Gross amount invested 76 Front-end sales charge VFINEX VEMEX 77 Amount of front-end sales charge S2,000 S2,000 78 Net amount invested 0.00% 79 Addition deposits (Pet) S2000.00 80 Years net amount invested 1,000.00 81 Average returns over each often years Chapter Application SO SO DO S0.00 6.90% O Type here to search O e HEWLETT-PACKARD osc 2 .. OSS. FILE HOME O INSERT PROTECTED VIEW PAGE LAYOUT Be careful--les from the Internet can contain viruses. Unless you need to edit, is FORMULAS DATA REVIEW NEW 055 Assignment 11 Chapter 16 Protec er to stay in Protected View Fatto oss amount invested ant-end sales charge 77 Amount of front-end sales charge 78 Net amount invested 79 Addition deposits (Pet) VBMFX 80 Years net amount invested 81 Average returns over each of ten years 0.00% 82 Future value accumulated (FV with Type - 1) $0.00 83 Money given up lost earnings) to invest in bond fund $3,000.00 $0.00 Lesson: Fewer swings in the value of the bond fund has a price in lost earnings 6.90% 4.36% Solutions: 55.847 and 54,597 Solution: $1,250 VFINX $3,000 0% SO $3,000.00 $3.000 $0.00 10. If you invest in a mutual fund outside of a retirement account, you will be sent an IRS Form 1099 DIV, and be required to claim the dividends, capital gains, and interest you earned as taxable income. You will dey pay a 15 percent taxon these earnings. Calculate the accumulation for a $3,000 investment in a mutual within a retirement account compared to the return for a mutual fund investment outside of a retirement account for the VINX fund that earned 6 expenses on average for each of the last ten years. Note: using a retirement account means that taxis postponed because when you withdraw money from the account you pay tax on your withdrawal at your ordinary income rate, which could be higher or lower than 15 percent, and that is not included in this comparison. Assume you take money out of your taxable account each year to pay the taxes owed. after 38 Amount invested (P) 19 Average rate earned per year VFINX Retirement VFINX Real 90 Tax rate paid in current year $3,000 91 Amount of return kept in account 32 Net return per year (late) 93 Years invested (per) TOON 94 Accumulation (V. Type - 1) Solution 85Mint subtract) 95 LessonInvesting in the same mutual fund put into a retirement account will grow faster at any level of positive return Solution: 587 Hint multiply Chapter Application Solution: 55305 6.30 53,000 5.SOK 60 55.87 O Type here to search HELEPACKARD FILE HOME O INSERTIGE AROUT FORMAS PROTECTED VIEW Be care -les from the Internet DATA X REVIEW WW ft con Chapter 16 Investing in Mutual Funds n ess you need to edit - Part 2: Mutual Fund Evaluation (40 points) Purpose: To evaluate a popular mutual fund that could be used to obtain your investment goals Chapter 16: Investing in Mutual Funds ale to stay in Hotected Instructions: Evaluate American Funds Washington Mutual Amutual fund. Ticher AWSHK. Go to www Databases, M. Morning Star Investment Research Center and obtain the informaton you need to come they low high areas of this worksheet. Make a decision regarding whether or not is mutual fund could help you achieve your investments Finally, respond to the two directives Suggested websites: morningstar.com .Library americanas.com 8 1. What is the NAV (price per share) of the fund? Category 1: Fund Characteristics 10 2. What is this fund's Morningstar rating? 11. What did $10.000 grow to over the past Category 4: Fund Performance 12 3. What is the minimum invest 16 4. What is the front-end load charge? Category 2: Costs 18 5. What the annual expense percentage 20 6. What is the fee level compared to similar tu 15. Based in this information would you invest in this Category : Conclusion 24 7. What are the types of assets held by the fund? Category 3: Diversification 26 8. What types of securities does the fund hold? A Word of Caution When you use a checklist there important relevant information Acha a does provide some question you should Planner Chapter Application re t be Type here to search 0 e @ o B FILE HOME 0 PROTECTED VIEW Be caresses from the steret can continues Unies you need to con INSERT . PAGE LAYOUT FORSKAS X Suggested websites: DATA ft REVIEW VW Chapter 16: bevesting in Mutual Funds 8 1. What is the NAV (price per share) of the fund? Category 1: Fund Characteristics morningstar.com 10 2. What is this fund's Morningstar rating? testo stay istedes Vio 12 3. What is the minimum investment? americantunds.com Erbeid 11. What did $10.000 grow to over the past ten years? Category 4: Fund Performance 16 4. What is the front-end load charge? Category 2: Costs 12. How did the fund do over ten years compared to its categoria 18 5. What is the annual expense percentage 13. Compare the return on the fund to its benchman 20 6. What is the fee level compared to similar funds? 14. What is the funds Momingstar Sustainabi 24 7. What are the types of assets held by the fund? Category 3: Diversification 15. Based in this information would you invest in this Category 5: Conclusion n g 26 8. What types of securities does the fund hold? 16. Justify your investment decision 28 9. What are the top five holdings of the fund? 30 10. What are the top sectors of investments? 32 A Word of Caution When you use a checklist there is always a danger of over important relevant information. A check it is not a cual does provide some questions that you should answer before making a mutual fund investment decision. Quem start. If you need other information, you are responsible for obtaining affects your potential investment and for determining how it 17. Identify one additional factor that you would consider before investing in this fund, and explain why you chose this Directives to Help You Use Mutual Funds in Personal Financial Planning Chapter Personal Financial Planner Application Type here to search HEWLETT-PACKARD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts