Question: Read carefully the question, solve it and show all work. Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% service years

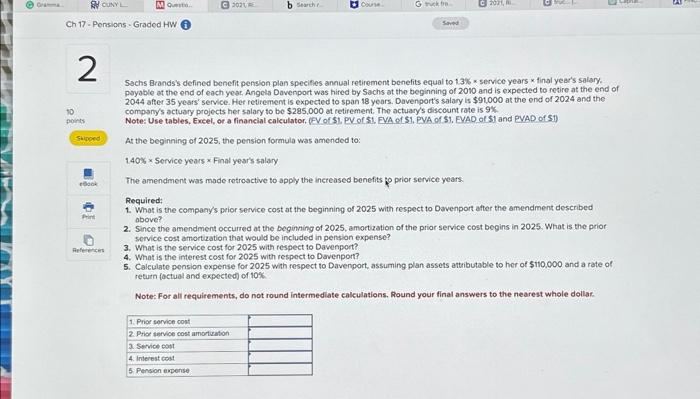

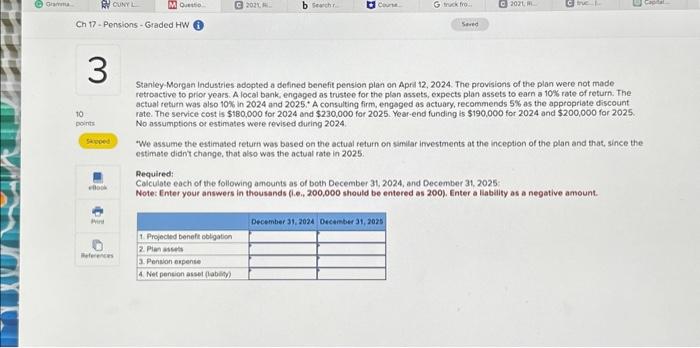

Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% service years final year's salary. paysble ot the end of each year, Angets Davenport was hired by Sachs at the beginning of 20% and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $91,000 at the end of 2024 and the company's actuary projects her salary to be $285,000 at retirement. Tho actuary's discount rate is 9k. Note: Use tables. Exeel, or a financial calculator. (FV of S1. PV of S1. EVA ef S1, PVA of S1, EYAD of S1 and PVAP of S1) At the beginning of 2025 , the pension formula was amended to: 1.40% Service years Final year's salary The amendment was mode retroactive to apply the increased benefits po prior service years. Required; 1. What is the company's peior service cost at the beginning of 2025 with respect to Davenport after the amendment described above? 2. Since the amendment occurred at the beginning of 2025 , amprtiation of the prior service cost begins in 2025 . What is the prior service cost amortization that would be included in pension expense? 3. What is the service cost for 2025 with respect to Davenport? 4. What is the interest cost for 2025 with respect to Davenport? 5. Calculato ponsion expense for 2025 with respect to Davenport, assuming plan assets attributable to her of sito.000 and a rate of return (actual and expected) of 10% Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollaf. Stanley-Morgan Industries adopted a defined benefit pension plan on Apra 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10\% rate of return. The actual return was also 10% in 2024 and 2025 . A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $180,000 for 2024 and $230,000 for 2025 . Year-end funding is $190,000 for 2024 and $200,000 for 2025 . No assumptions or estimates were revised during 2024 "We assume the estimated return was based on the actual return on similar ifvestments at the inception of the plan and that, since the estimate didnt change, that also was the actual rate in 2025. Pequired: Calculate each of the following amounts as of both December 31, 2024, and December 31. 2025 Note: Enter your answers in thousands (1.6.,200,000 should be entered as 200), Enter a liabality as a negative amount

Step by Step Solution

There are 3 Steps involved in it

The question appears to involve a twopart pension problem with two different companies defined benefit plans Lets break it down step by step based on the images youve provided Part 1 Sachs Brands 1 Pr... View full answer

Get step-by-step solutions from verified subject matter experts