Question: Read Case Problem 28-3 on page 610. The issue is whether David Gain, his brother Mark and/or Gill Raz have violated SEC Rule 10b-5. One

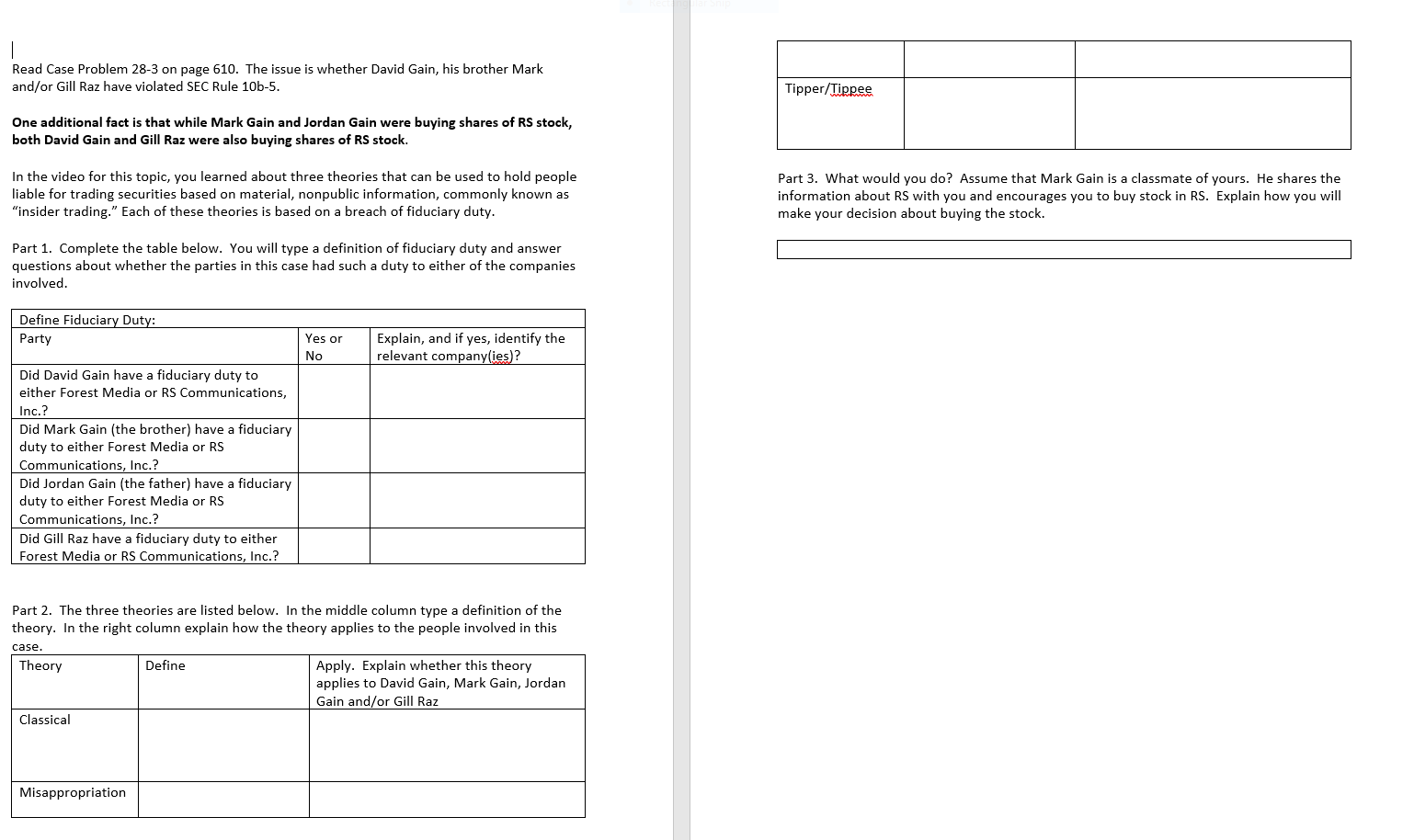

Read Case Problem 28-3 on page 610. The issue is whether David Gain, his brother Mark and/or Gill Raz have violated SEC Rule 10b-5. One additional fact is that while Mark Gain and Jordan Gain were buying shares of RS stock, both David Gain and Gill Raz were also buying shares of RS stock. In the video for this topic, you learned about three theories that can be used to hold people liable for trading securities based on material, nonpublic information, commonly known as "insider trading." Each of these theories is based on a breach of fiduciary duty. Part 1. Complete the table below. You will type a definition of fiduciary duty and answer questions about whether the parties in this case had such a duty to either of the companies involved. Part 3. What would you do? Assume that Mark Gain is a classmate of yours. He shares the information about RS with you and encourages you to buy stock in RS. Explain how you will make your decision about buying the stock. Part 2. The three theories are listed below. In the middle column type a definition of the theory. In the right column explain how the theory applies to the people involved in this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts