Question: Read case study 8.1 and answer the following... You may also need to use the Internet to answer some of these questions. Remember to cite

Read case study 8.1 and answer the following...

- You may also need to use the Internet to answer some of these questions. Remember to cite in APA format and follow the assignment guidelines as presented below.

- Would you expect demand for Daraprim to be elastic or inelastic? (hint* This is a necessary drug for a rare infection)

- What change in the market would make demand for Daraprim more elastic?

- Could a company have raised the price of a drug like this in Canada? France? Australia?

- What are other examples of large price increases for off-patent drugs?

- What should the United States do about cases like Daraprim? (think from the perspective of policy)

- Should the federal government negotiate pharmaceutical prices? Why or Why not?

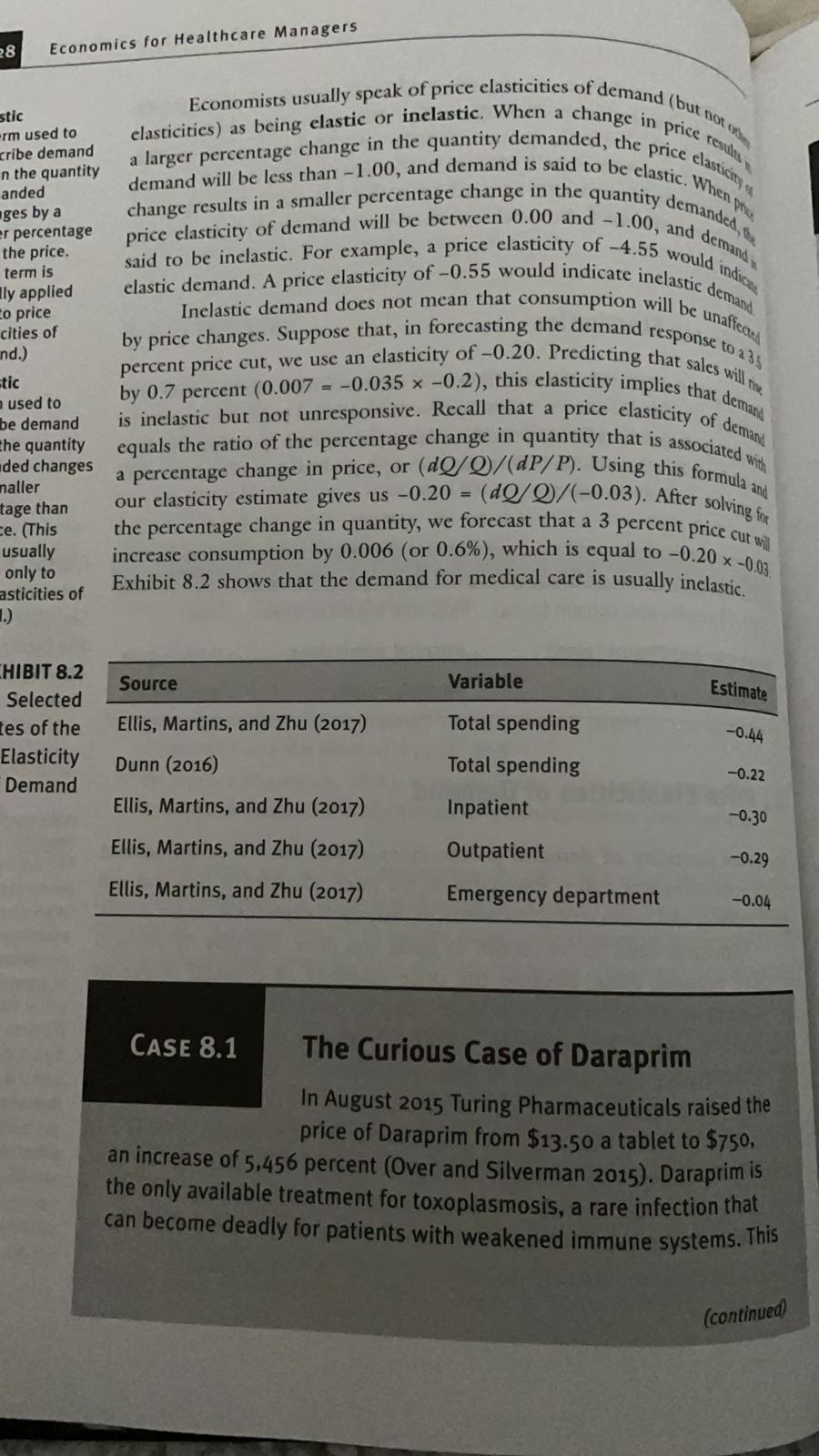

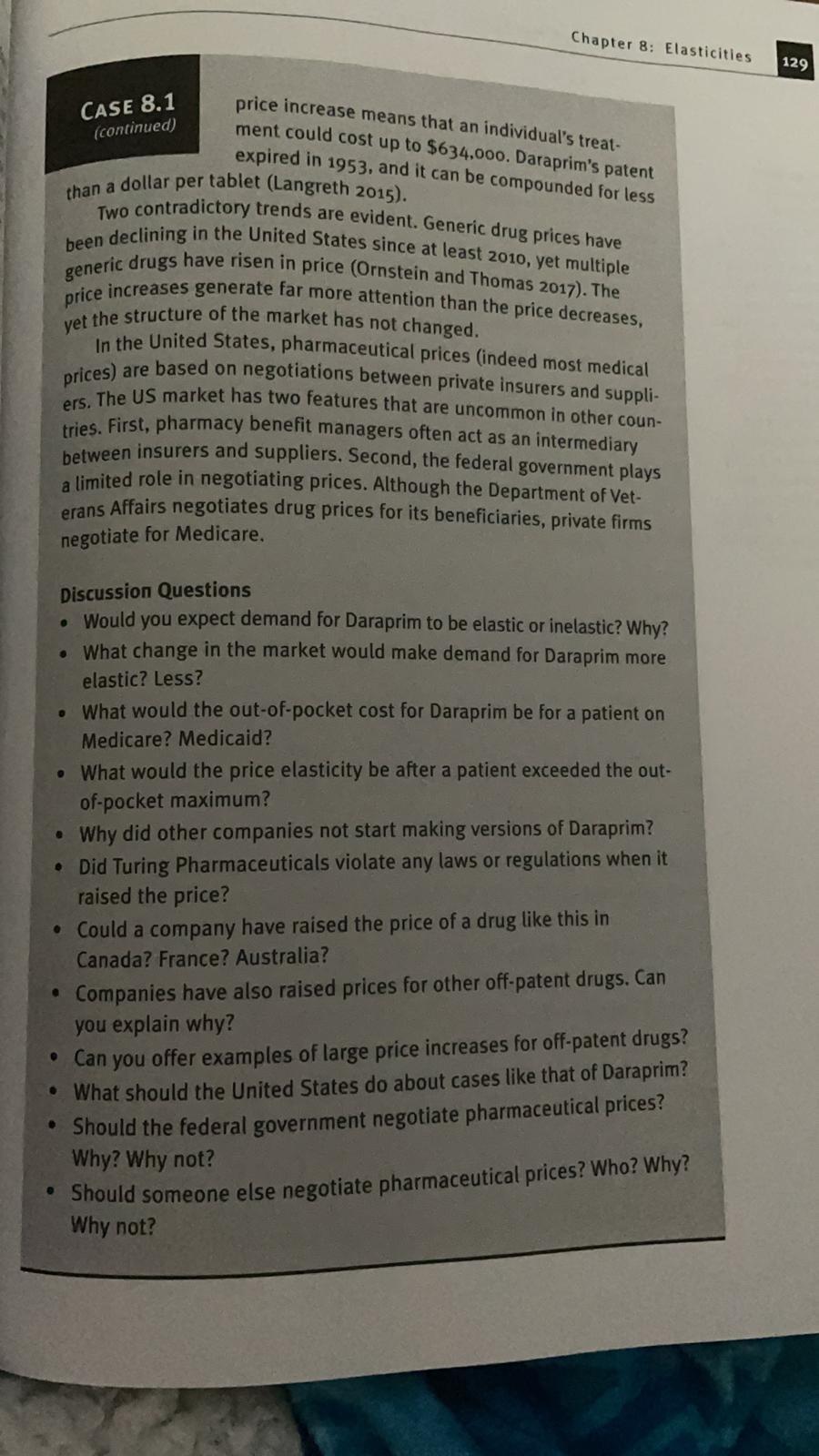

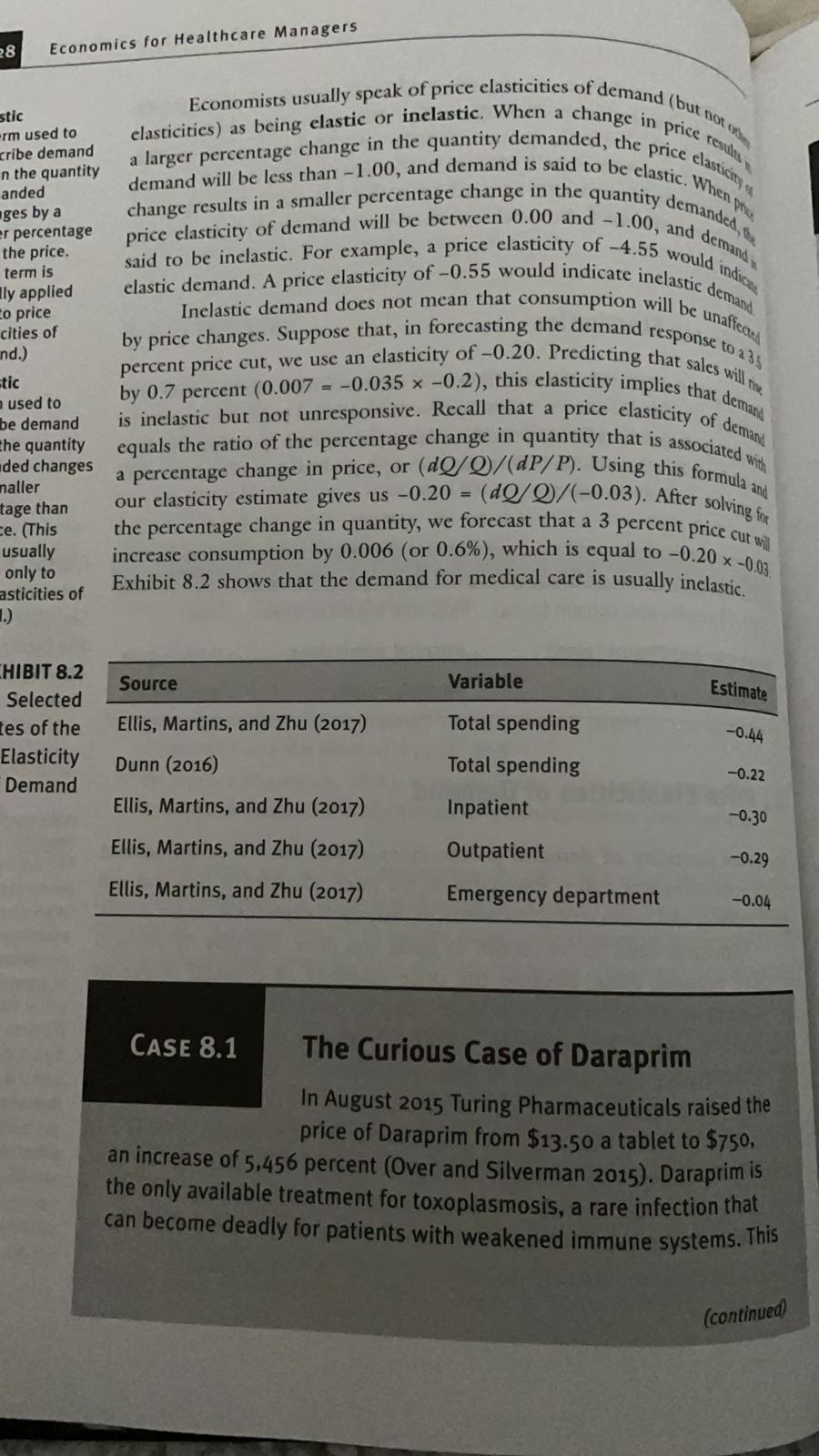

28 Economics for Healthcare Managers elasticities) as being elastic or inelastic. When a stic -rm used to cribe demand n the quantity anded nges by a er percentage the price. term is Ily applied Co price cities of ind.) Economists usually speak of price elasticities of demand (but not change in price results demand will be less than -1.00, and demand is said to be elastic. When you a larger percentage change in the quantity demanded, the price elasticity price elasticity of demand will be between 0.00 and -1.00, and demand change results in a smaller percentage change in the quantity demanded, elastic demand. A price elasticity of -0.55 would indicate inelastic demand, said to be inelastic. For example, a price elasticity of -4.55 would indice by price changes. Suppose that, in forecasting the demand response to a 35 Inelastic demand does not mean that consumption will be unaffect percent price cut, we use an elasticity of -0.20. Predicting that sales will rise by 0.7 percent (0.007 = -0.035 x -0.2), this elasticity implies that demand is inelastic but not unresponsive. Recall that a price elasticity of demand equals the ratio of the percentage change in quantity that is associated with a percentage change in price, or (dQ/Q/(dP/P). Using this formula and (dQ/Q/(-0.03). After solving for our elasticity estimate gives us -0.20 the percentage change in quantity, we forecast that a 3 percent price cut will increase consumption by 0.006 (or 0.6%), which is equal to -0.20 -0.03. Exhibit 8.2 shows that the demand for medical care is usually inelastic. Etic used to be demand the quantity ded changes naller tage than ce. (This usually only to asticities of CHIBIT 8.2 Source Variable Estimate Selected tes of the Ellis, Martins, and Zhu (2017) Total spending -0.44 Elasticity Demand Dunn (2016) Total spending -0.22 Ellis, Martins, and Zhu (2017) Inpatient -0.30 Ellis, Martins, and Zhu (2017) Outpatient -0.29 Ellis, Martins, and Zhu (2017) Emergency department -0.04 CASE 8.1 The Curious Case of Daraprim In August 2015 Turing Pharmaceuticals raised the price of Daraprim from $13.50 a tablet to $750, an increase of 5,456 percent (Over and Silverman 2015). Daraprim the only available treatment for toxoplasmosis, a rare infection that can become deadly for patients with weakened immune systems. This (continued) Chapter 8: Elasticities 129 CASE 8.1 (continued) price increase means that an individual's treat- ment could cost up to $634,000. Daraprim's patent expired in 1953, and it can be compounded for less than a dollar per tablet (Langreth 2015). Two contradictory trends are evident. Generic drug prices have been declining in the United States since at least 2010, yet multiple generic drugs have risen in price (Ornstein and Thomas 2017). The price increases generate far more attention than the price decreases, yet the structure of the market has not changed. in the United States, pharmaceutical prices (indeed most medical prices) are based on negotiations between private insurers and suppli- ers. The US market has two features that are uncommon in other coun- tries. First, pharmacy benefit managers often act as an intermediary between insurers and suppliers. Second, the federal government plays a limited role in negotiating prices. Although the Department of Vet- erans Affairs negotiates drug prices for its beneficiaries, private firms negotiate for Medicare. Discussion Questions . Would you expect demand for Daraprim to be elastic or inelastic? Why? What change in the market would make demand for Daraprim more elastic? Less? What would the out-of-pocket cost for Daraprim be for a patient on Medicare? Medicaid? What would the price elasticity be after a patient exceeded the out- of-pocket maximum? Why did other companies not start making versions of Daraprim? Did Turing Pharmaceuticals violate any laws or regulations when it raised the price? Could a company have raised the price of a drug like this in Canada? France? Australia? Companies have also raised prices for other off-patent drugs. Can you explain why? Can you offer examples of large price increases for off-patent drugs? What should the United States do about cases like that of Daraprim? Should the federal government negotiate pharmaceutical prices? Why? Why not? Should someone else negotiate pharmaceutical prices? Who? Why? Why not