Question: Read case study and write SWOT analysis, porter's 5 forces and pestle analysis THE SECURITIES BROKERAGE INDUSTRY Brokerages, which were essentially trading platforms that facilitated

Read case study and write SWOT analysis, porter's 5 forces and pestle analysis

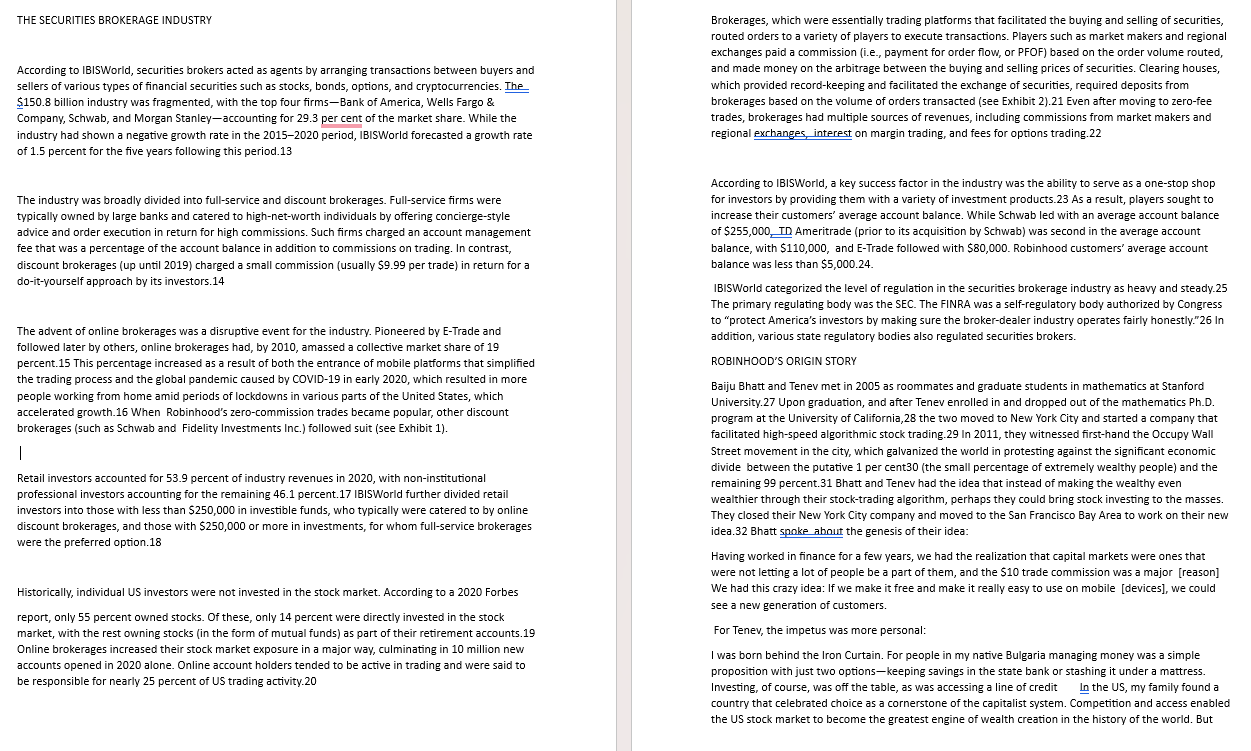

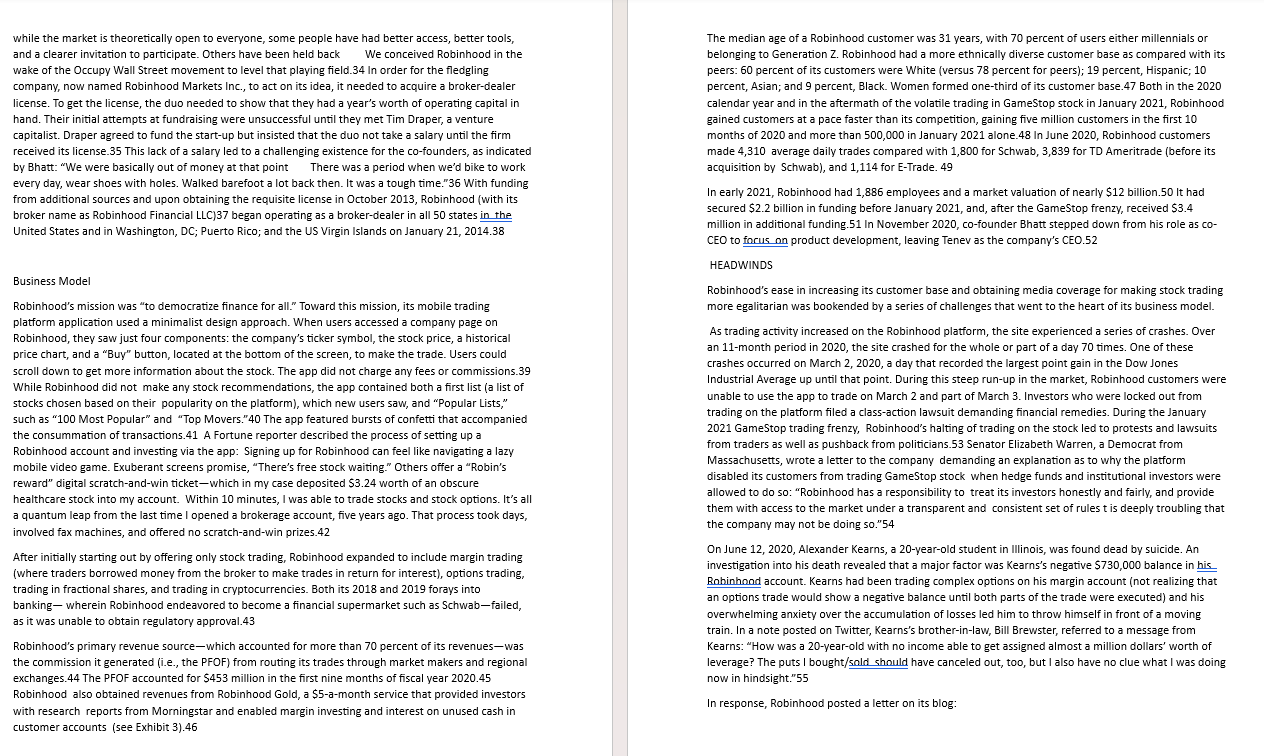

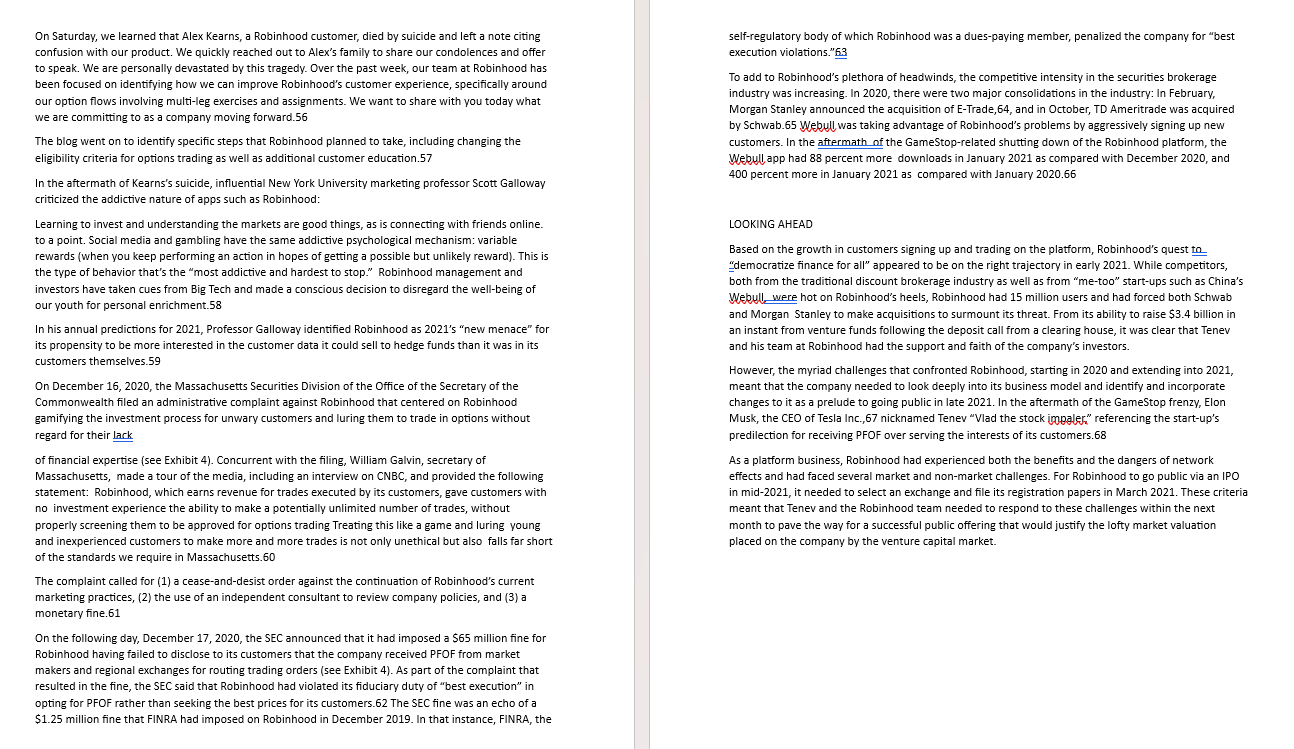

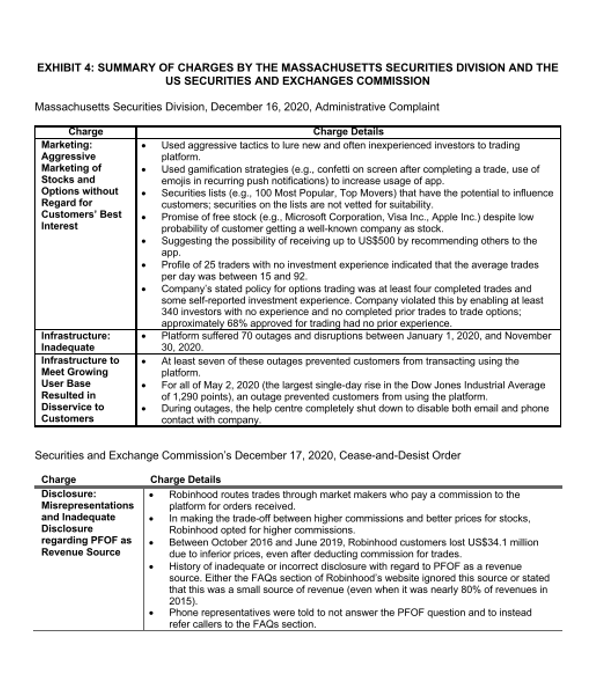

THE SECURITIES BROKERAGE INDUSTRY Brokerages, which were essentially trading platforms that facilitated the buying and selling of securities, routed orders to a variety of players to execute transactions. Players such as market makers and regional exchanges paid a commission (i.e., payment for order flow, or PFOF) based on the order volume routed, and made money on the arbitrage between the buying and selling prices of securities. Clearing houses, which provided record-keeping and facilitated the exchange of securities, required deposits from brokerages based on the volume of orders transacted (see Exhibit 2).21 Even after moving to zero-fee trades, brokerages had multiple sources of revenues, including commissions from market makers and regional exrhanges, interest on margin trading, and fees for options trading. 22 According to IBISWorld, a key success factor in the industry was the ability to serve as a one-stop shop for investors by providing them with a variety of investment products. 23 As a result, players sought to increase their customers' average account balance. While Schwab led with an average account balance of $255,000 LD Ameritrade (prior to its acquisition by Schwab) was second in the average account balance, with $110,000, and E-Trade followed with $80,000. Robinhood customers' average account balance was less than $5,000.24. IBISWorld categorized the level of regulation in the securities brokerage industry as heavy and steady. 25 The primary regulating body was the SEC. The FINRA was a self-regulatory body authorized by Congress to "protect America's investors by making sure the broker-dealer industry operates fairly honestly." 26 In addition, various state regulatory bodies also regulated securities brokers. The advent of online brokerages was a disruptive event for the industry. Pioneered by E-Irade and percent. 15 This percentage increased as a result of both the entrance of mobile platforms that simplified the trading process and the global pandemic caused by COVID-19 in early 2020, which resulted in more people working from home amid periods of lockdowns in various parts of the United States, which accelerated growth. 16 When Robinhood's zero-commission trades became popular, other discount brokerages (such as Schwab and Fidelity Investments Inc.) followed suit (see Exhibit 1). 1 Retail investors accounted for 53.9 percent of industry revenues in 2020 , with non-institutional professional investors accounting for the remaining 46.1 percent. 17 IBISWorld further divided retail investors into those with less than $250,000 in investible funds, who typically were catered to by online discount brokerages, and those with $250,000 or more in investments, for whom full-service brokerages were the preferred option. 18 Historically, individual US investors were not invested in the stock market. According to a 2020 Forbes report, only 55 percent owned stocks. Of these, only 14 percent were directly invested in the stock market, with the rest owning stocks (in the form of mutual funds) as part of their retirement accounts.19 Online brokerages increased their stock market exposure in a major way, culminating in 10 million new accounts opened in 2020 alone. Online account holders tended to be active in trading and were said to be responsible for nearly 25 percent of US trading activity. 20 ROBINHOOD'S ORIGIN STORY Baiju Bhatt and Tenev met in 2005 as roommates and graduate students in mathematics at Stanford University. 27 Upon graduation, and after Tenev enrolled in and dropped out of the mathematics Ph.D. program at the University of California, 28 the two moved to New York City and started a company that facilitated high-speed algorithmic stock trading. 29 In 2011, they witnessed first-hand the Occupy Wall Street movement in the city, which galvanized the world in protesting against the significant economic divide between the putative 1 per cent 30 (the small percentage of extremely wealthy people) and the remaining 99 percent.31 Bhatt and Tenev had the idea that instead of making the wealthy even wealthier through their stock-trading algorithm, perhaps they could bring stock investing to the masses. They closed their New York City company and moved to the San Francisco Bay Area to work on their new idea.32 Bhatt spoke about the genesis of their idea: Having worked in finance for a few years, we had the realization that capital markets were ones that were not letting a lot of people be a part of them, and the $10 trade commission was a major [reason] We had this crazy idea: If we make it free and make it really easy to use on mobile [devices], we could see a new generation of customers. For Tenev, the impetus was more personal: I was born behind the Iron Curtain. For people in my native Bulgaria managing money was a simple proposition with just two options-keeping savings in the state bank or stashing it under a mattress. Investing, of course, was off the table, as was accessing a line of credit the US, my family found a country that celebrated choice as a cornerstone of the capitalist system. Competition and access enabled the US stock market to become the greatest engine of wealth creation in the history of the world. But On Saturday, we learned that Alex Kearns, a Robinhood customer, died by suicide and left a note citing confusion with our product. We quickly reached out to Alex's family to share our condolences and offer to speak. We are personally devastated by this tragedy. Over the past week, our team at Robinhood has been focused on identifying how we can improve Robinhood's customer experience, specifically around our option flows involving multi-leg exercises and assignments. We want to share with you today what we are committing to as a company moving forward.56 The blog went on to identify specific steps that Robinhood planned to take, including changing the eligibility criteria for options trading as well as additional customer education.57 In the aftermath of Kearns's suicide, influential New York University marketing professor Scott Galloway criticized the addictive nature of apps such as Robinhood: Learning to invest and understanding the markets are good things, as is connecting with friends online. to a point. Social media and gambling have the same addictive psychological mechanism: variable rewards (when you keep performing an action in hopes of getting a possible but unlikely reward). This is the type of behavior that's the "most addictive and hardest to stop." Robinhood management and investors have taken cues from Big Tech and made a conscious decision to disregard the well-being of our youth for personal enrichment.58 In his annual predictions for 2021, Professor Galloway identified Robinhood as 2021's "new menace" for its propensity to be more interested in the customer data it could sell to hedge funds than it was in its customers themselves. 59 On December 16, 2020, the Massachusetts Securities Division of the Office of the Secretary of the Commonwealth filed an administrative complaint against Robinhood that centered on Robinhood gamifying the investment process for unwary customers and luring them to trade in options without regard for their lack of financial expertise (see Exhibit 4). Concurrent with the filing, William Galvin, secretary of Massachusetts, made a tour of the media, including an interview on CNBC, and provided the following statement: Robinhood, which earns revenue for trades executed by its customers, gave customers with no investment experience the ability to make a potentially unlimited number of trades, without properly screening them to be approved for options trading Treating this like a game and luring young and inexperienced customers to make more and more trades is not only unethical but also falls far short of the standards we require in Massachusetts.60 The complaint called for (1) a cease-and-desist order against the continuation of Robinhood's current marketing practices, (2) the use of an independent consultant to review company policies, and (3) a monetary fine. 61 On the following day, December 17,2020 , the SEC announced that it had imposed a $65 million fine for Robinhood having failed to disclose to its customers that the company received PFOF from market makers and regional exchanges for routing trading orders (see Exhibit 4). As part of the complaint that resulted in the fine, the SEC said that Robinhood had violated its fiduciary duty of "best execution" in opting for PFOF rather than seeking the best prices for its customers.62 The SEC fine was an echo of a \$1.25 million fine that FINRA had imposed on Robinhood in December 2019. In that instance, FINRA, the self-regulatory body of which Robinhood was a dues-paying member, penalized the company for "best execution violations." 63 To add to Robinhood's plethora of headwinds, the competitive intensity in the securities brokerage industry was increasing. In 2020, there were two major consolidations in the industry: In February, Morgan Stanley announced the acquisition of E-Trade, 64, and in October, TD Ameritrade was acquired by Schwab. 65 Webull, was taking advantage of Robinhood's problems by aggressively signing up new customers. In the aftermath of the GameStop-related shutting down of the Robinhood platform, the Webull app had 88 percent more downloads in January 2021 as compared with December 2020, and 400 percent more in January 2021 as compared with January 2020.66 LOOKING AHEAD Based on the growth in customers signing up and trading on the platform, Robinhood's quest to. "democratize finance for all" appeared to be on the right trajectory in early 2021. While competitors, both from the traditional discount brokerage industry as well as from "me-too" start-ups such as China's Webull were hot on Robinhood's heels, Robinhood had 15 million users and had forced both Schwab and Morgan Stanley to make acquisitions to surmount its threat. From its ability to raise $3.4 billion in an instant from venture funds following the deposit call from a clearing house, it was clear that Tenev and his team at Robinhood had the support and faith of the company's investors. However, the myriad challenges that confronted Robinhood, starting in 2020 and extending into 2021 , meant that the company needed to look deeply into its business model and identify and incorporate changes to it as a prelude to going public in late 2021. In the aftermath of the GameStop frenzy, Elon Musk, the CEO of Tesla Inc., 67 nicknamed Tenev "Vlad the stock impaler." referencing the start-up's predilection for receiving PFOF over serving the interests of its customers. 68 As a platform business, Robinhood had experienced both the benefits and the dangers of network effects and had faced several market and non-market challenges. For Robinhood to go public via an IPO in mid-2021, it needed to select an exchange and file its registration papers in March 2021. These criteria meant that Tenev and the Robinhood team needed to respond to these challenges within the next month to pave the way for a successful public offering that would justify the lofty market valuation placed on the company by the venture capital market. EXHIBIT 1: PROFILE OF SELECTED BROKERAGES EXHIBIT 3: REVENUE SOURCES FOR SELECTED COMPETITORS (AVERAGE \% OF TOTAL REVENUES FOR 2019, 2018, AND 2017) EXHIBIT 4: SUMMARY OF CHARGES BY THE MASSACHUSETTS SECURITIES DIVISION AND THE US SECURITIES AND EXCHANGES COMMISSION Massachusetts Securities Division, December 16, 2020, Administrative Complaint Securities and Exchange Commission's December 17, 2020, Cease-and-Desist Order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts