Question: Read New Science: Pioneering the inside sales force. Afterwords, answer the following questions. How could New Science achieve balance in the sales force activity of

Read New Science: Pioneering the inside sales force. Afterwords, answer the following questions.

- How could New Science achieve balance in the sales force activity of bringing in new business while not losing renewal business. (You must consider organization as well as compensation solutions)?

- How could Carter afford additional headcount to support his plan to change the organizational structure?

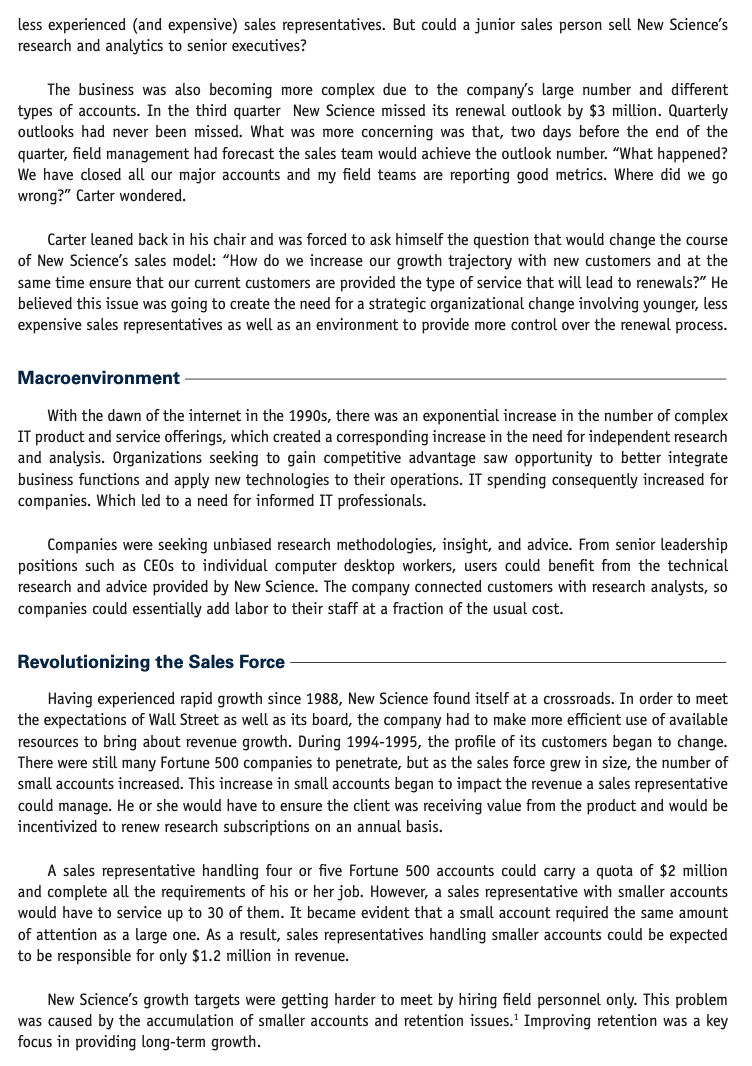

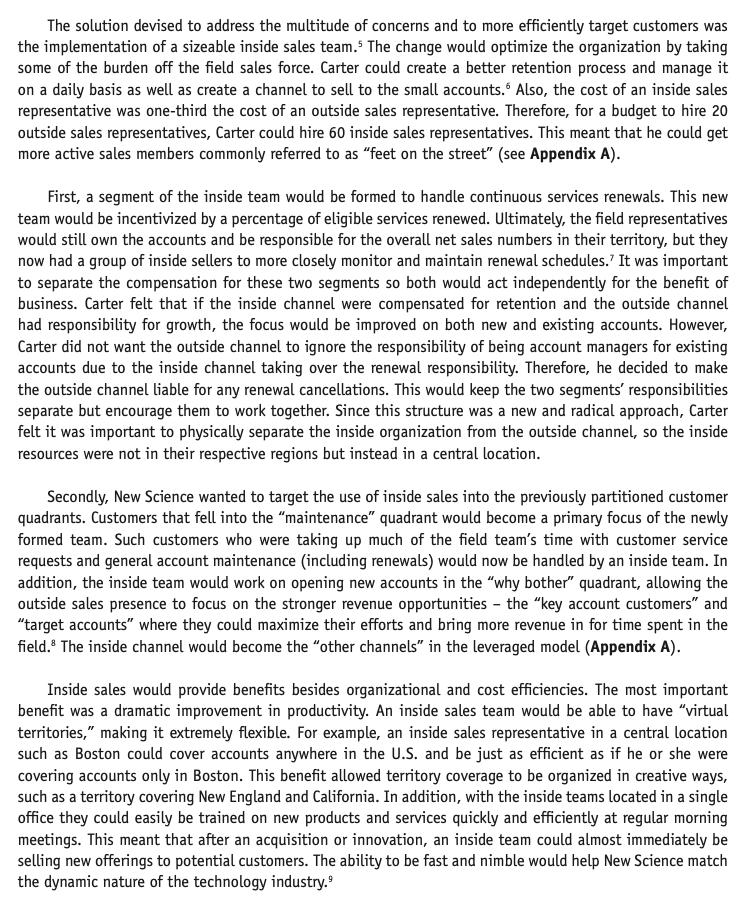

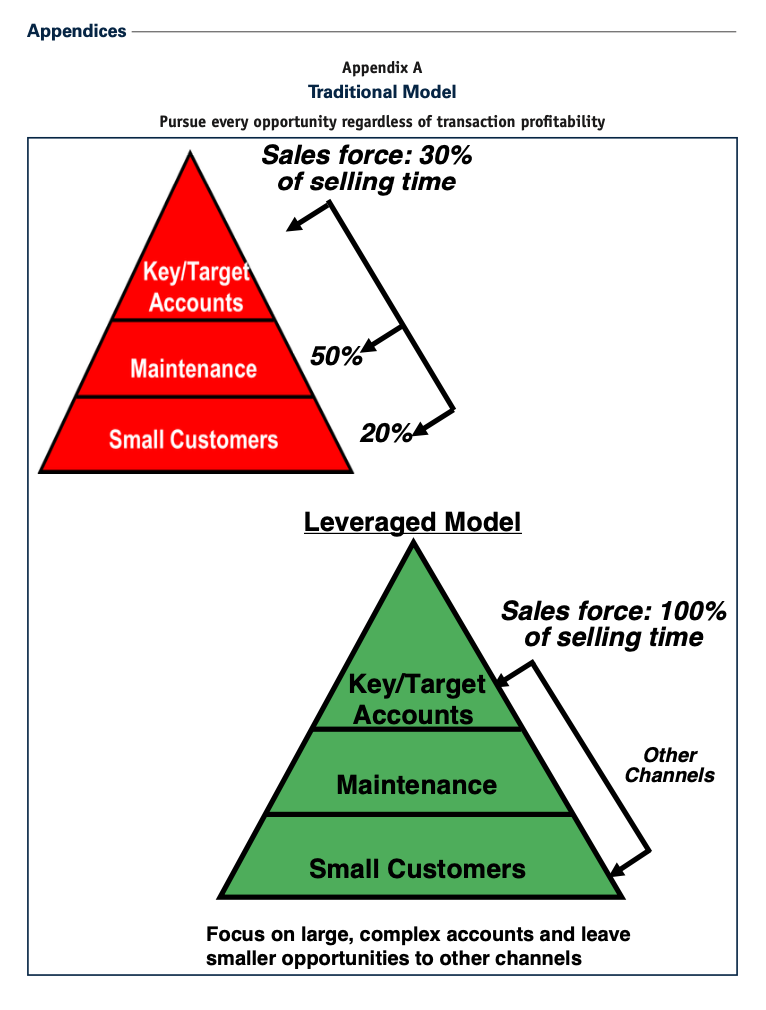

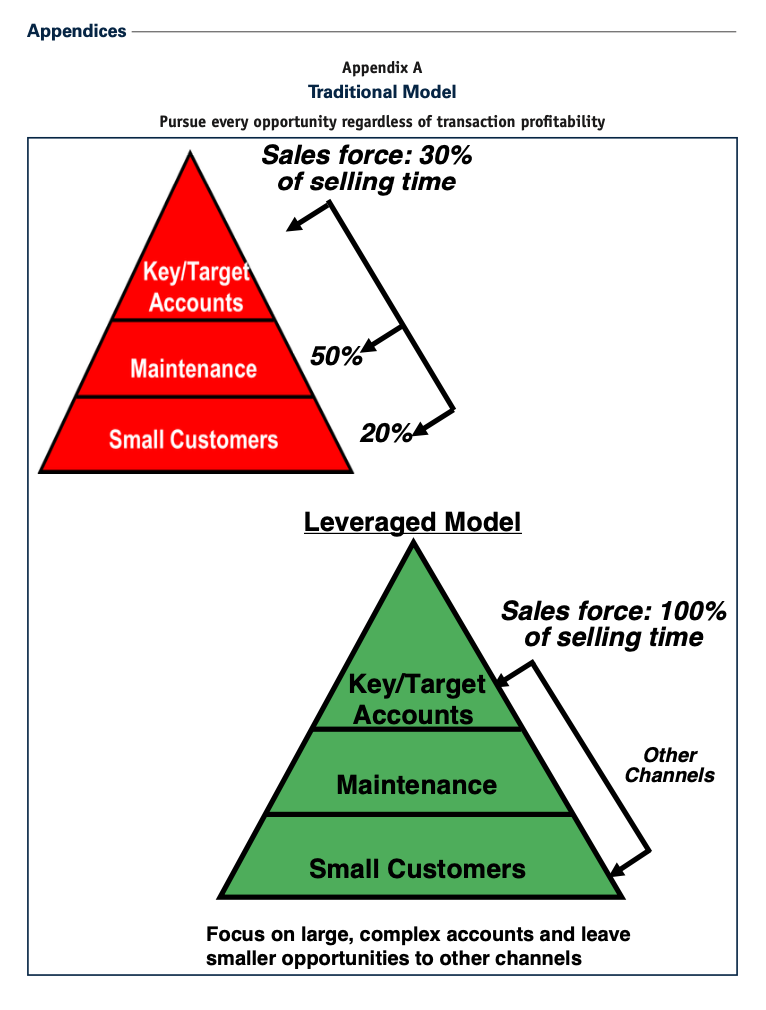

New Science: Pioneering the Inside Sales Revolution Follett Carter, executive vice president of sales and marketing for New Science a Boston-based research and analytics firm sat in his office looking at the sales performance numbers for the quarter. The company's aggressive 1995 revenue target of $395 million represented 72% growth over the previous year, with just one quarter left. He was worried about two issues: 1) Would he attain the aggressive 1996 growth target? 2) How would the company continue this growth in future years? With 1,000 outside sales representatives at a cost of approximately $400,000 a year each, it was clear the company could not continue to fund the manpower Carter believed the company needed to sustain its aggressive growth trajectory. It would be Carter's responsibility to create a less expensive sales model for the company. New Science - IT Research and Analytics Steve Trumble founded New Science in 1979 as an IT research and analytics firm primarily focused on IBM products. The company quickly expanded its business to over 13 fields of technology including software, personal computers, mainframes, networks, and benchmarking. Managers of small organizations, as well as Fortune 500 companies, faced difficult decisions on a broad range of technical innovations for which New Science provided objective research and advice. The company had steadily grown by providing buyers and sellers of computer technology with subscriptions to customized research and advisory services. Instead of offering the typical, lengthy, often-ignored studies, New Science distilled complex subject matter into relevant, readable, one-page memos for its customers. The business created strategic planning assumptions around fields of technology, providing its customers with forecasting regarding what could be expected in a particular technology field over the next three to five years. New Science felt that its objectivity set the company apart from its competitors. As a result of this objectivity, there was strong demand from vendors who wanted to understand New Science's strategic planning assumptions so they could better manage their own customers. During its first ten years of operation, New Science grew to over $27 million in annual revenue and had offices in North America and Europe. In 1988 it was purchased by Saatchi & Saatchi. New Science benefited from this acquisition because its new owner was able to offer the still-growing company capital support, as well as help it increase its market share on an international level. Meanwhile, Saatchi & Saatchi benefited from New Science's in-depth knowledge of the industry, which allowed it to pursue additional acquisitions with wisdom and agility. In 1990, New Science was part of a leveraged buyout by management with the help of Dun & Bradstreet. In 1993, the company went public. Post IPO, New Science was able to deploy the additional capital acquired to grow its business organically, as well as through acquisitions of companies that complemented its product line, such as Jupiter and Data Analytics, both subscription-based IT research and analysis companies. The acquisition of Beckett, an IT benchmarking, measurement, and evaluation company, helped New Science reach sales revenues of $169 million in 1993 and $229.2 million in 1994 (see Table 1). Profits grew in these two years, reaching $15 million in 1993 and $25.5 million in 1994. By the end of 1995, the company had expanded its global reach of research analysts and sales representatives, which increased New Science's international share of the information technology consulting and research space to more than 70%. Table 1 New Science Revenues (1993-1995) New Science Revenue Year Revenue (millions) 1993 $169 1994 $229 1995 $395 Source: Created from disguised sources. New Science at a Crossroads The core of New Science's business was annual, renewable research subscription. The major advantage of this subscription-based business model was its considerable predictability in performance. The stock market appreciated the predictability of the renewable and growth rates, and from 1992-1995, the company's stock appreciated 742%. However, increasing renewable revenue meant that it was critical that the sales force provide quality customer service to ensure the product was properly installed. It was also crucial for the sales force to find new accounts to grow the business. Additionally, the profile of new and renewable business added complexity to sales territory design and created a limitation on annual quotas. If too much growth revenue was assigned, the sales representatives did not spend enough time with existing accounts and renewals were impacted. If the sales force was asked to spend more time with renewals, new business was impacted. Carter felt the perfect balance was for a sales representative to achieve $1.5 million of renewable business and $500,000 of new business. This meant that for every $2 million of growth assigned, the company would need to hire four new sales representatives. As Carter looked two to three years on the horizon, it was clear the business could not continue to grow significantly with just outside sales representatives. With a cost of $400,000 per sales representative, it was not going to be affordable in the long term. Carter felt there were two solutions. First, the company could improve the rate at which clients renewed their research subscriptions, which was currently at 80%. With a $500-million revenue target for 1996, a 1% improvement in retention would add $5 million to profits. This could help fund the additional sales people he felt would be needed. The second solution was to hire less experienced (and expensive) sales representatives. But could a junior sales person sell New Science's research and analytics to senior executives? The business was also becoming more complex due to the company's large number and different types of accounts. In the third quarter New Science missed its renewal outlook by $3 million. Quarterly outlooks had never been missed. What was more concerning was that, two days before the end of the quarter, field management had forecast the sales team would achieve the outlook number. "What happened? We have closed all our major accounts and my field teams are reporting good metrics. Where did we go wrong?" Carter wondered. Carter leaned back in his chair and was forced to ask himself the question that would change the course of New Science's sales model: "How do we increase our growth trajectory with new customers and at the same time ensure that our current customers are provided the type of service that will lead to renewals?" He believed this issue was going to create the need for a strategic organizational change involving younger, less expensive sales representatives as well as an environment to provide more control over the renewal process. Macroenvironment With the dawn of the internet in the 1990s, there was an exponential increase in the number of complex IT product and service offerings, which created a corresponding increase in the need for independent research and analysis. Organizations seeking to gain competitive advantage saw opportunity to better integrate business functions and apply new technologies to their operations. IT spending consequently increased for companies. Which led to a need for informed IT professionals. Companies were seeking unbiased research methodologies, insight, and advice. From senior leadership positions such as CEOs to individual computer desktop workers, users could benefit from the technical research and advice provided by New Science. The company connected customers with research analysts, so companies could essentially add labor to their staff at a fraction of the usual cost. Revolutionizing the Sales Force Having experienced rapid growth since 1988, New Science found itself at a crossroads. In order to meet the expectations of Wall Street as well as its board, the company had to make more efficient use of available resources to bring about revenue growth. During 1994-1995, the profile of its customers began to change. There were still many Fortune 500 companies to penetrate, but as the sales force grew in size, the number of small accounts increased. This increase in small accounts began to impact the revenue a sales representative could manage. He or she would have to ensure the client was receiving value from the product and would be incentivized to renew research subscriptions on an annual basis. A sales representative handling four or five Fortune 500 accounts could carry a quota of $2 million and complete all the requirements of his or her job. However, a sales representative with smaller accounts would have to service up to 30 of them. It became evident that a small account required the same amount of attention as a large one. As a result, sales representatives handling smaller accounts could be expected to be responsible for only $1.2 million in revenue. a New Science's growth targets were getting harder to meet by hiring field personnel only. This problem was caused by the accumulation of smaller accounts and retention issues. Improving retention was a key focus in providing long-term growth. New Science was facing a challenge in addition to the diminishing returns of hiring additional field representatives. In 1995, 78% of company revenues were being generated from continuous services. The company reported that 80% of customers renewed all of their continuous services. Along with their renewals, customers frequently purchased additional services, increasing their commitment to New Science. When continuous service renewals were cancelled, sales representatives took a negative charge to their quotas and had to make up for the cancellations. As business for New Science continued to grow, customer service, which was in most cases handled by sales representatives, began to suffer. Sales representatives were having difficulties addressing customer service questions regarding billing, delivery, and renewals while trying to find revenue from new customers." A new sales model would be needed to help New Science simultaneously reach new customers and manage existing customers more effectively, all while doing so at a dramatically lower cost. Carter considered several options for achieving growth targets: 1) Begin to hire more junior people into the outside sales force. This approach would decrease the average total cost of a sales person by 50% to $200,000. This direction would allow the company to hire two sales representatives for the price of one. 2) Expand New Science's presence internationally where New Science had limited visibility. Globally, New Science was active in only the major European countries plus Australia. Carter felt there was significant opportunity with distributors in Finland, Spain, the Middle East, Africa, and the Pacific Rim as well as China and Japan. 3) Create something new and untested in a business-to-business environment - an inside sales channel. Here junior sales people would cover accounts over the telephone. If this model could be developed, it would reduce sales costs significantly and have a dramatic effect on sales force productivity. . . In deciding on a solution, Carter decided to segment the market into four quadrants: Key Accounts: Accounts that were very attractive, offering good opportunity with a strong sales position. Would receive a high volume of sales calls. Maintenance Accounts: Somewhat attractive accounts, but the sales potential had been reached. Focus was mostly on renewals and customer service. Target Accounts: Potentially attractive accounts with high opportunity, but sales had a weak position on the accounts. Why Bother: Unattractive accounts that offered low opportunity and sales had a weak position. These accounts would receive minimal attention. . In studying the numbers, it was clear that sales representatives were spending too much time in the "why bother accounts. Analysis showed that they were very demanding and were clearly impacting customer service on larger accounts. Considering the third-quarter outlook that had been missed by $3 million, Carter could not help but think that it had been caused by sales representatives ignoring a large number of very small accounts. What had happened was that the representatives were focused on the big renewals of $50,000 and more, and thought little about a pending $3,000 renewal. This territory strategy made sense, but if the company had 1,000 territories miss their mark by $3,000, the impact to the corporate outlook was a $3-million miss. The solution devised to address the multitude of concerns and to more efficiently target customers was the implementation of a sizeable inside sales team. The change would optimize the organization by taking some of the burden off the field sales force. Carter could create a better retention process and manage it on a daily basis as well as create a channel to sell to the small accounts. Also, the cost of an inside sales representative was one-third the cost of an outside sales representative. Therefore, for a budget to hire 20 outside sales representatives, Carter could hire 60 inside sales representatives. This meant that he could get more active sales members commonly referred to as "feet on the street (see Appendix A). First, a segment of the inside team would be formed to handle continuous services renewals. This new team would be incentivized by a percentage of eligible services renewed. Ultimately, the field representatives would still own the accounts and be responsible for the overall net sales numbers in their territory, but they now had a group of inside sellers to more closely monitor and maintain renewal schedules. It was important to separate the compensation for these two segments so both would act independently for the benefit of business. Carter felt that if the inside channel were compensated for retention and the outside channel had responsibility for growth, the focus would be improved on both new and existing accounts. However, Carter did not want the outside channel to ignore the responsibility of being account managers for existing accounts due to the inside channel taking over the renewal responsibility. Therefore, he decided to make the outside channel liable for any renewal cancellations. This would keep the two segments' responsibilities separate but encourage them to work together. Since this structure was a new and radical approach, Carter felt it was important to physically separate the inside organization from the outside channel, so the inside resources were not in their respective regions but instead in a central location. Secondly, New Science wanted to target the use of inside sales into the previously partitioned customer quadrants. Customers that fell into the "maintenance" quadrant would become a primary focus of the newly formed team. Such customers who were taking up much of the field team's time with customer service requests and general account maintenance (including renewals) would now be handled by an inside team. In addition, the inside team would work on opening new accounts in the "why bother quadrant, allowing the outside sales presence to focus on the stronger revenue opportunities - the key account customers and "target accounts where they could maximize their efforts and bring more revenue in for time spent in the field. The inside channel would become the "other channels in the leveraged model (Appendix A). Inside sales would provide benefits besides organizational and cost efficiencies. The most important benefit was a dramatic improvement in productivity. An inside sales team would be able to have "virtual territories," making it extremely flexible. For example, an inside sales representative in a central location such as Boston could cover accounts anywhere in the U.S. and be just as efficient as if he or she were covering accounts only in Boston. This benefit allowed territory coverage to be organized in creative ways, such as a territory covering New England and California. In addition, with the inside teams located in a single office they could easily be trained on new products and services quickly and efficiently at regular morning meetings. This meant that after an acquisition or innovation, an inside team could almost immediately be selling new offerings to potential customers. The ability to be fast and nimble would help New Science match the dynamic nature of the technology industry. Appendices Appendix A Traditional Model Pursue every opportunity regardless of transaction profitability Sales force: 30% of selling time Key/Target Accounts 50% Maintenance Small Customers 20% Leveraged Model Sales force: 100% of selling time Key/Target Accounts Other Channels Maintenance Small Customers Focus on large, complex accounts and leave smaller opportunities to other channels