Question: READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION READ

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

READ QUESTION CAREFULLY ANSWER IS NOT 17.34 MILLION

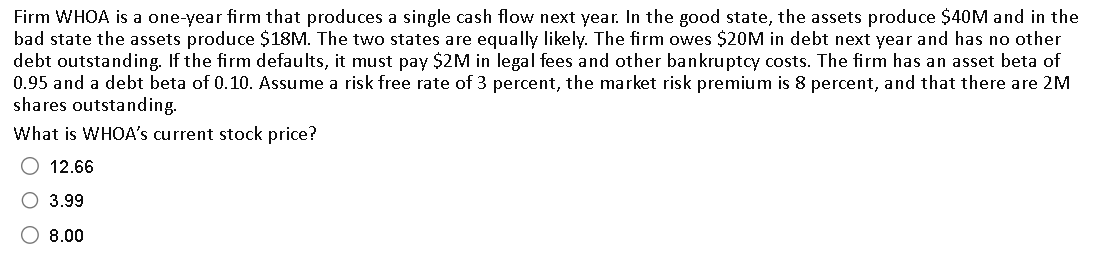

Firm WHOA is a one-year firm that produces a single cash flow next year. In the good state, the assets produce $40M and in the bad state the assets produce $18M. The two states are equally likely. The firm owes $20M in debt next year and has no other debt outstanding. If the firm defaults, it must pay $2M in legal fees and other bankruptcy costs. The firm has an asset beta of 0.95 and a debt beta of 0.10. Assume a risk free rate of 3 percent, the market risk premium is 8 percent, and that there are 2M shares outstanding. What is WHOA's current stock price? 12.663.998.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts