Question: Read the 3 passages below and write a paragraph that will bring a new viewpoint to the 3 passages below. HONG KONG-China's currency has dropped

Read the 3 passages below and write a paragraph that will bring a new viewpoint to the 3 passages below.

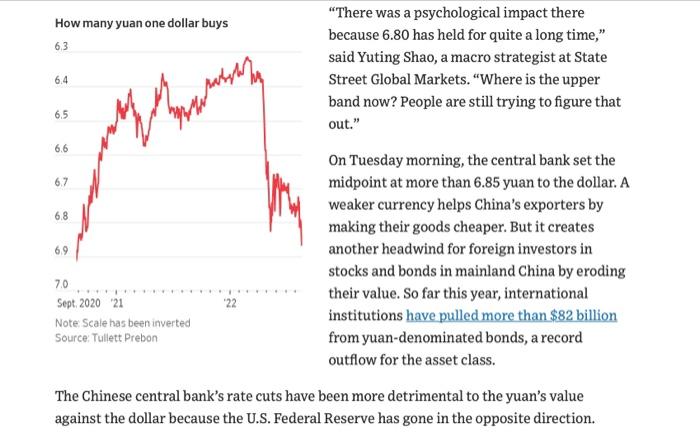

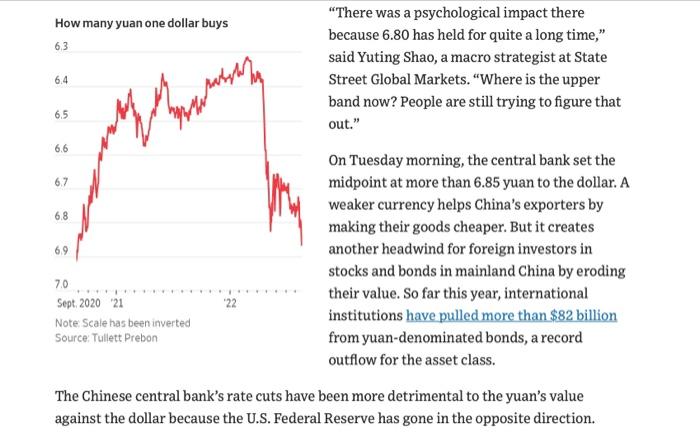

HONG KONG-China's currency has dropped to its weakest level against the U.S. dollar in two years. It is likely to depreciate further as the country's central bank moves to combat a slowing economy and a deep housing downturn. On Tuesday, the yuan traded at more than 6.86 to the dollar in China's tightly controlled onshore market, hitting levels last seen in August 2020, according to FactSet. The currency weakened past 6.88 in the more freely traded offshore market, taking its year-to-date decline against the dollar to more than 8%. The latest selloff in the yuan, also known as the renminbi, was partly a result of the U.S. dollar's continued march higher. It was also fueled by a series of recent data releases that appeared to show China's economy in poor health. Factory output, investment, consumer spending and youth employment numbers in July all pointed to broad economic weakness. Last week, the People's Bank of China surprised the markets with 0.1 percentage point cuts to two key interest rates, actions aimed at stimulating more lending activity. On Monday, large commercial banks in the country followed suit with cuts to their lending rates, including a widely referenced benchmark for mortgages. On Aug. 19, the central bank also signaled its preference for a weaker yuan by setting its daily midpoint for onshore trading, known as the fix, at more than 6.80 against the dollarthe first time it had crossed that level in 23 months. The PBOC allows the currency to trade within a daily range of 2% up or down against the dollar from its target level. "There was a psychological impact there because 6.80 has held for quite a long time," said Yuting Shao, a macro strategist at State Street Global Markets. "Where is the upper band now? People are still trying to figure that out." On Tuesday morning, the central bank set the midpoint at more than 6.85 yuan to the dollar. A weaker currency helps China's exporters by making their goods cheaper. But it creates another headwind for foreign investors in stocks and bonds in mainland China by eroding their value. So far this year, international institutions have pulled more than $82 billion from yuan-denominated bonds, a record outflow for the asset class. The Chinese central bank's rate cuts have been more detrimental to the yuan's value against the dollar because the U.S. Federal Reserve has gone in the opposite direction. The Chinese central bank's rate cuts have been more detrimental to the yuan's value against the dollar because the U.S. Federal Reserve has gone in the opposite direction. The Fed raised its benchmark rate by three quarters of a percentage point in both June and July, marking its most aggressive campaign of rate increases since the 1980 s. Traders are divided about whether the Fed will do the same at its next meeting in September, or whether it will settle for a half-percentage point increase. The market is awaiting a speech by Fed Chairman Jerome Powell at a gathering of economists in Jackson Hole, Wyo., this Friday, for clues about which way the central bank is leaning. SHAREYOURTHOUGHTSwidespreadselloffinAsiancurrenciesthisyear,Whatisyouroutlookfortheyuan?Jointheconversationbelow.tradershavebetonthelong-termhealthofChinaseconomy,saidChaopingZhu,globalmarketstrategistatJ.P.MorganAssetManagement.TheFedstighteningcyclehastriggeredaincludingmorethan10%declinesfortheJapaneseyenandtheKoreanwon.Theyuanhasalsobeenhardhit,butithasfoundmoresupportthanothercurrenciesas HONG KONG-China's currency has dropped to its weakest level against the U.S. dollar in two years. It is likely to depreciate further as the country's central bank moves to combat a slowing economy and a deep housing downturn. On Tuesday, the yuan traded at more than 6.86 to the dollar in China's tightly controlled onshore market, hitting levels last seen in August 2020, according to FactSet. The currency weakened past 6.88 in the more freely traded offshore market, taking its year-to-date decline against the dollar to more than 8%. The latest selloff in the yuan, also known as the renminbi, was partly a result of the U.S. dollar's continued march higher. It was also fueled by a series of recent data releases that appeared to show China's economy in poor health. Factory output, investment, consumer spending and youth employment numbers in July all pointed to broad economic weakness. Last week, the People's Bank of China surprised the markets with 0.1 percentage point cuts to two key interest rates, actions aimed at stimulating more lending activity. On Monday, large commercial banks in the country followed suit with cuts to their lending rates, including a widely referenced benchmark for mortgages. On Aug. 19, the central bank also signaled its preference for a weaker yuan by setting its daily midpoint for onshore trading, known as the fix, at more than 6.80 against the dollarthe first time it had crossed that level in 23 months. The PBOC allows the currency to trade within a daily range of 2% up or down against the dollar from its target level. "There was a psychological impact there because 6.80 has held for quite a long time," said Yuting Shao, a macro strategist at State Street Global Markets. "Where is the upper band now? People are still trying to figure that out." On Tuesday morning, the central bank set the midpoint at more than 6.85 yuan to the dollar. A weaker currency helps China's exporters by making their goods cheaper. But it creates another headwind for foreign investors in stocks and bonds in mainland China by eroding their value. So far this year, international institutions have pulled more than $82 billion from yuan-denominated bonds, a record outflow for the asset class. The Chinese central bank's rate cuts have been more detrimental to the yuan's value against the dollar because the U.S. Federal Reserve has gone in the opposite direction. The Chinese central bank's rate cuts have been more detrimental to the yuan's value against the dollar because the U.S. Federal Reserve has gone in the opposite direction. The Fed raised its benchmark rate by three quarters of a percentage point in both June and July, marking its most aggressive campaign of rate increases since the 1980 s. Traders are divided about whether the Fed will do the same at its next meeting in September, or whether it will settle for a half-percentage point increase. The market is awaiting a speech by Fed Chairman Jerome Powell at a gathering of economists in Jackson Hole, Wyo., this Friday, for clues about which way the central bank is leaning. SHAREYOURTHOUGHTSwidespreadselloffinAsiancurrenciesthisyear,Whatisyouroutlookfortheyuan?Jointheconversationbelow.tradershavebetonthelong-termhealthofChinaseconomy,saidChaopingZhu,globalmarketstrategistatJ.P.MorganAssetManagement.TheFedstighteningcyclehastriggeredaincludingmorethan10%declinesfortheJapaneseyenandtheKoreanwon.Theyuanhasalsobeenhardhit,butithasfoundmoresupportthanothercurrenciesas

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock