Question: Read the above question and answer it in the above blank space of Cash budget forma. show working notes clearly Consider the following financial information

Read the above question and answer it in the above blank space of Cash budget forma.

show working notes clearly

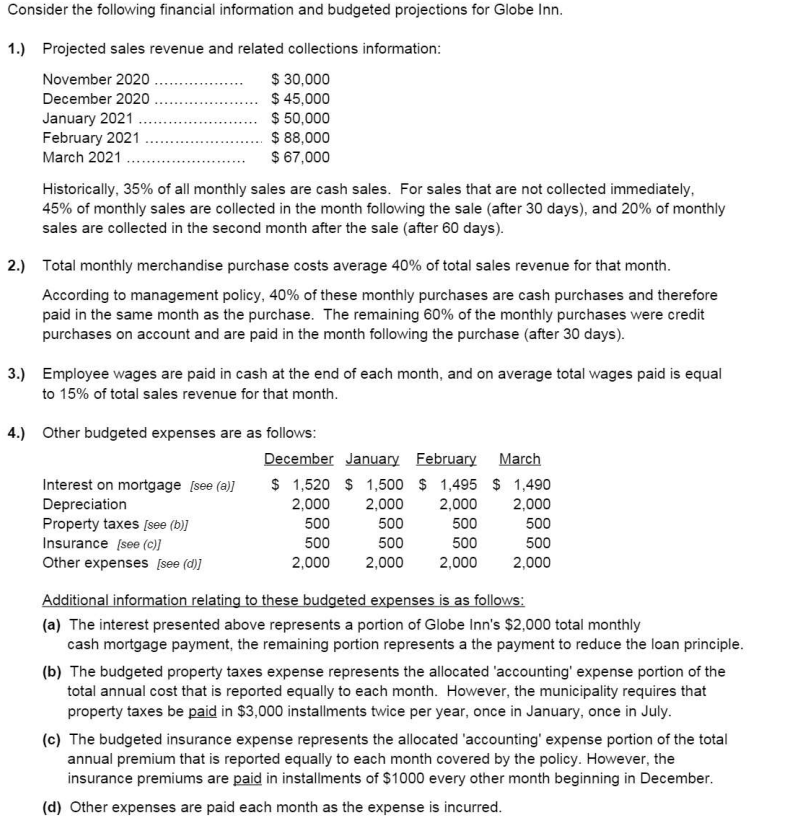

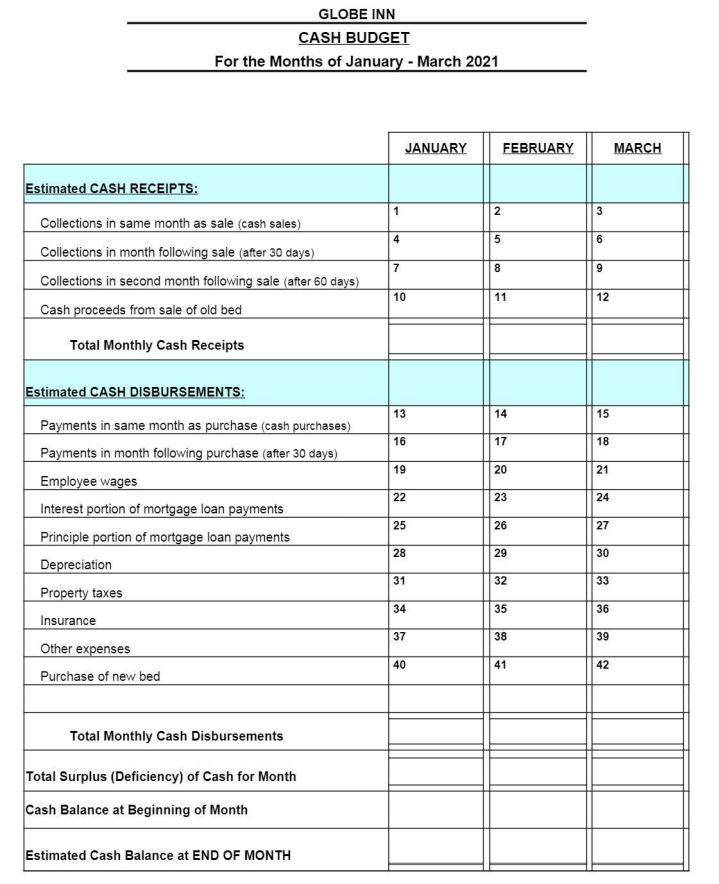

Consider the following financial information and budgeted projections for Globe Inn. 1.) Projected sales revenue and related collections information: November 2020. December 2020 January 2021 February 2021 March 2021 $ 30,000 $ 45,000 $ 50,000 $ 88,000 $ 67,000 Historically, 35% of all monthly sales are cash sales. For sales that are not collected immediately, 45% of monthly sales are collected in the month following the sale (after 30 days), and 20% of monthly sales are collected in the second month after the sale (after 60 days). 2.) Total monthly merchandise purchase costs average 40% of total sales revenue for that month. According to management policy, 40% of these monthly purchases are cash purchases and therefore paid in the same month as the purchase. The remaining 60% of the monthly purchases were credit purchases on account and are paid in the month following the purchase (after 30 days). 3.) Employee wages are paid in cash at the end of each month, and on average total wages paid is equal to 15% of total sales revenue for that month. 4.) Other budgeted expenses are as follows: Interest on mortgage [see (a)] Depreciation Property taxes [see (b)] Insurance (see (c)] Other expenses [see (d)] December January February March $ 1,520 $1,500 $ 1,495 $ 1,490 2,000 2,000 2,000 2,000 500 500 500 500 500 500 500 500 2,000 2,000 2,000 2,000 Additional information relating to these budgeted expenses is as follows: (a) The interest presented above represents a portion of Globe Inn's $2,000 total monthly cash mortgage payment, the remaining portion represents a the payment to reduce the loan principle. (b) The budgeted property taxes expense represents the allocated 'accounting' expense portion of the total annual cost that is reported equally to each month. However, the municipality requires that property taxes be paid in $3,000 installments twice per year, once in January, once in July. (c) The budgeted insurance expense represents the allocated 'accounting' expense portion of the total annual premium that is reported equally to each month covered by the policy. However, the insurance premiums are paid in installments of $1000 every other month beginning in December. (d) Other expenses are paid each month as the expense is incurred. 5.) Additional Information: (i) During February, a new bed is to be purchased for $10,000 cash. In the same month, some old beds will be sold for expected cash proceeds of $1,500. (ii) The cash balance on January 1, 2021, is expected to be $8,000. GLOBE INN CASH BUDGET For the Months of January - March 2021 Estimated CASH RECEIPTS: Collections in same month as sale (cash sales) Collections in month following sale (after 30 days) Collections in second month following sale (after 60 days) Cash proceeds from sale of old bed Total Monthly Cash Receipts Estimated CASH DISBURSEMENTS: Payments in same month as purchase (cash purchases) Payments in month following purchase (after 30 days) Employee wages Interest portion of mortgage loan payments Principle portion of mortgage loan payments Depreciation Property taxes Insurance Other expenses Purchase of new bed Total Monthly Cash Disbursements Total Surplus (Deficiency) of Cash for Month Cash Balance at Beginning of Month Estimated Cash Balance at END OF MONTH 1 4 7 JANUARY 10 13 16 19 22 25 28 31 34 37 40 2 5 FEBRUARY 8 11 14 17 20 23 26 29 32 35 38 41 3 6 9 12 15 18 21 24 27 30 33 36 39 42 MARCH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts