Question: Read the article below and Please answer question 3.Question 3.As the Bell Technology's chief finance officer, you are required to present the analysis below to

Read the article below and Please answer question 3.Question 3.As the Bell Technology's chief finance officer, you are required to present the analysis below to your board of directors (BOD) for approval.A. a. Calculate the cost for each of the capital resources. (9marks)b. Calculate the weighted for each of the capital resources. (6marks)c. Calculate the weighted average cost of capital (WACC). (3marks)d. During your presentation, one of the board of directors question you about the company's capital structure. He wants to know why the company does not use more debt financing compared to equity financing. How you justify? (4 marks) e. Briefly explain three (3) reasons why weighted average cost of capital (WACC) is an important financial precept that is widely used in evaluating a project.(3 marks)Note: please give answers based on the marks allocated. Please don't elaborate in a very long passage.

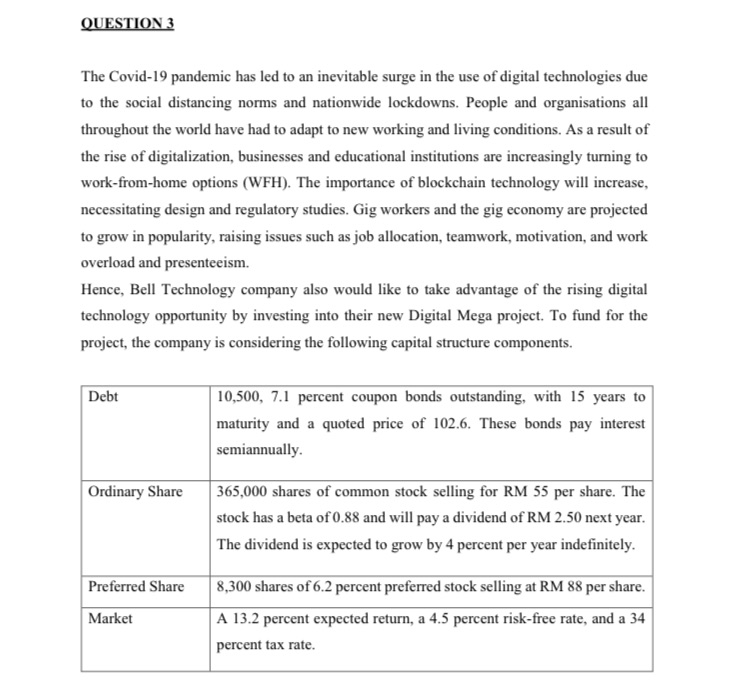

QUESTION 3 The Covid-19 pandemic has led to an inevitable surge in the use of digital technologies due to the social distancing norms and nationwide lockdowns. People and organisations all throughout the world have had to adapt to new working and living conditions. As a result of the rise of digitalization, businesses and educational institutions are increasingly turning to work-from-home options (WFH). The importance of blockchain technology will increase, necessitating design and regulatory studies. Gig workers and the gig economy are projected to grow in popularity, raising issues such as job allocation, teamwork, motivation, and work overload and presenteeism. Hence, Bell Technology company also would like to take advantage of the rising digital technology opportunity by investing into their new Digital Mega project. To fund for the project, the company is considering the following capital structure components. Debt 10,500, 7.1 percent coupon bonds outstanding, with 15 years to maturity and a quoted price of 102.6. These bonds pay interest semiannually. Ordinary Share 365,000 shares of common stock selling for RM 55 per share. The stock has a beta of 0.88 and will pay a dividend of RM 2.50 next year. The dividend is expected to grow by 4 percent per year indefinitely. Preferred Share 8,300 shares of 6.2 percent preferred stock selling at RM 88 per share. Market A 13.2 percent expected return, a 4.5 percent risk-free rate, and a 34 percent tax rate