Question: read the case and ans the qus 1 Question- Using Green's financial information, calculate relevant preliminary analytical procedures to obtain a better understanding of the

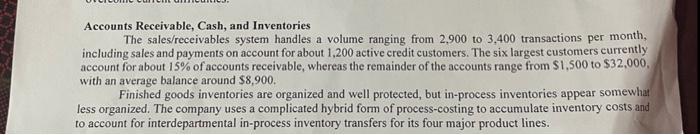

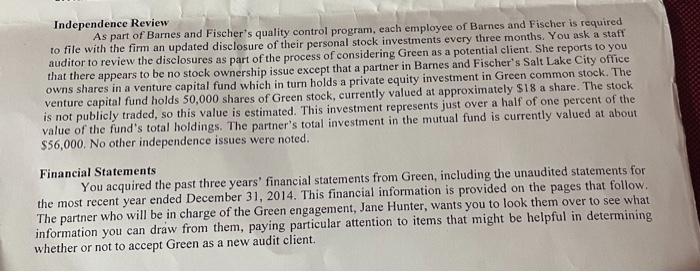

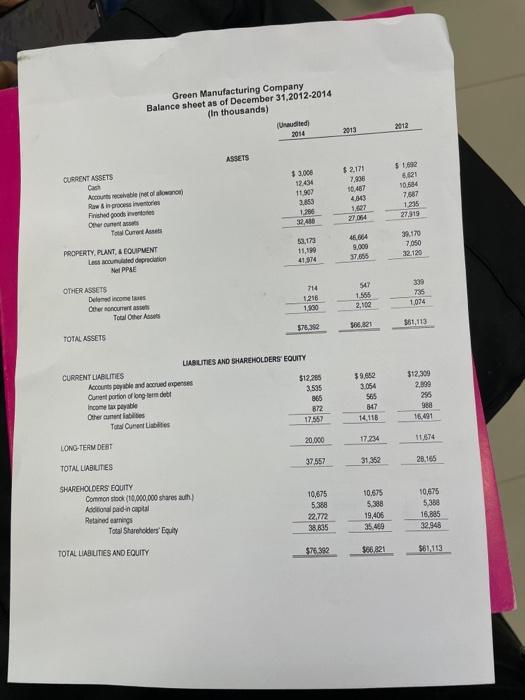

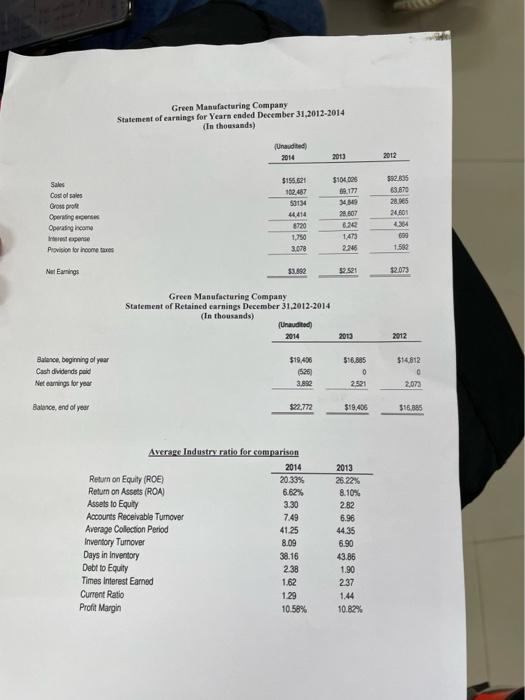

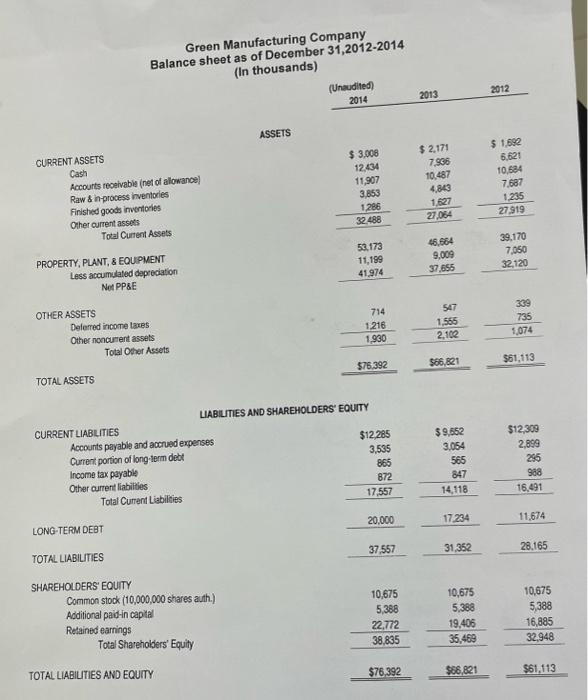

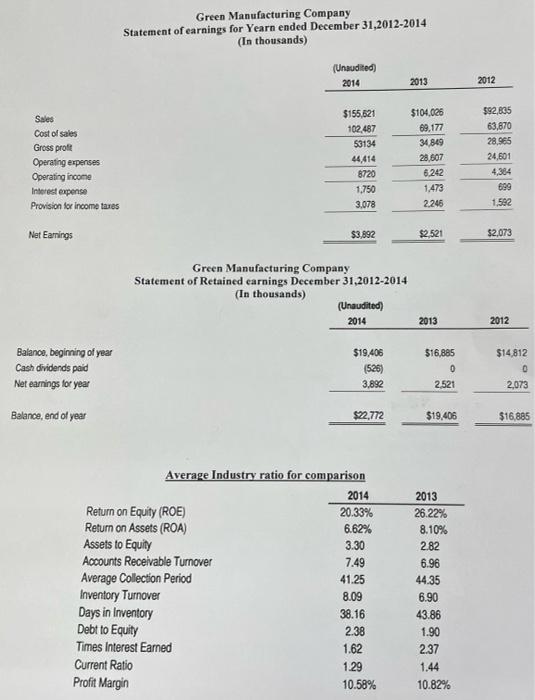

Accounts Receivable, Cash, and Inventories The sales/receivables system handles a volume ranging from 2,900 to 3,400 transactions per month, including sales and payments on account for about 1,200 active credit customers. The six largest customers currently account for about 15% of accounts receivable, whereas the remainder of the accounts range from $1,500 to $32,000, with an average balance around $8,900. Finished goods inventories are organized and well protected, but in-process inventories appear somewhat less organized. The company uses a complicated hybrid form of process-costing to accumulate inventory costs and to account for interdepartmental in-process inventory transfers for its four major product lines. Independence Review As part of Barnes and Fischer's quality control program, each employee of Barnes and Fischer is required to file with the firm an updated disclosure of their personal stock investments every three months. You ask a staff auditor to review the disclosures as part of the process of considering Green as a potential client. She reports to you that there appears to be no stock ownership issue except that a partner in Barnes and Fischer's Salt Lake City office owns shares in a venture capital fund which in turn holds a private equity investment in Green common stock. The venture capital fund holds 50,000 shares of Green stock, currently valued at approximately $18 a share. The stock is not publicly traded, so this value is estimated. This investment represents just over a half of one percent of the value of the fund's total holdings. The partner's total investment in the mutual fund is currently valued at about $56,000. No other independence issues were noted. Financial Statements You acquired the past three years' financial statements from Green, including the unaudited statements for the most recent year ended December 31,2014 . This financial information is provided on the pages that follow, The partner who will be in charge of the Green engagement, Jane Hunter, wants you to look them over to see what information you can draw from them, paying particular attention to items that might be helpful in determining whether or not to accept Green as a new audit client. Green Manufacturing Company Balance sheet as of December 31.2012-2014 (In thousands) UASUTIESAND SHAREWOLDERS EOUTY Green Manufacturing Company Statement of earnings for Yearn ended December 31,2012-2014 (In thoesands) Grecn Manufacturing Coanany Statement of Retained carnings December 31,2012-2014 (In theusands) Green Manufacturing Company Balance sheet as of December 31,2012-2014 in thousands) IIARI ITES AND SHAREHOLDERS' EQUITY Green Manufacturing Company Statement of earnings for Yearn ended December 31,2012-2014 (In thousands) Green Manufacturing Company Statement of Retained earnings December 31,2012-2014 (In thousands)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts