Question: Read the case linked in the assignments below carefully and identify the problem. Using FASB codification answer the problem correctly. (As followed) - Case 3

Read the case linked in the assignments below carefully and identify the problem. Using FASB codification answer the problem correctly. (As followed) -

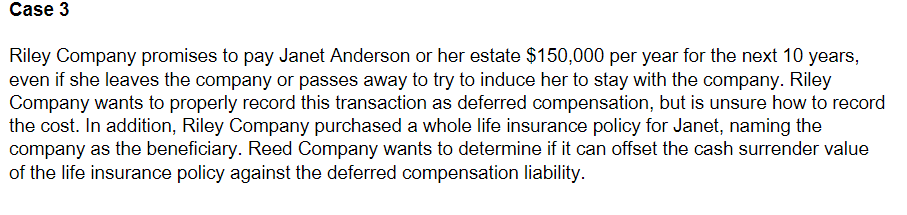

Case 3 Riley Company promises to pay Janet Anderson or her estate $150,000 per year for the next 10 years, even if she leaves the company or passes away to try to induce her to stay with the company. Riley Company wants to properly record this transaction as deferred compensation, but is unsure how to record the cost. In addition, Riley Company purchased a whole life insurance policy for Janet, naming the company as the beneficiary. Reed Company wants to determine if it can offset the cash surrender value of the life insurance policy against the deferred compensation liability. Week 2 In a minimum of 5 to 7 sentences, summarize the background of your case and indicate any assumptions that you are making regarding the case. Define your problem statement and research question(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts