Question: Read the case study and answer ALL the questions in this section. QUESTION ONE: CASH BUDGET (25 MARKS) The following budgeted statement of profit or

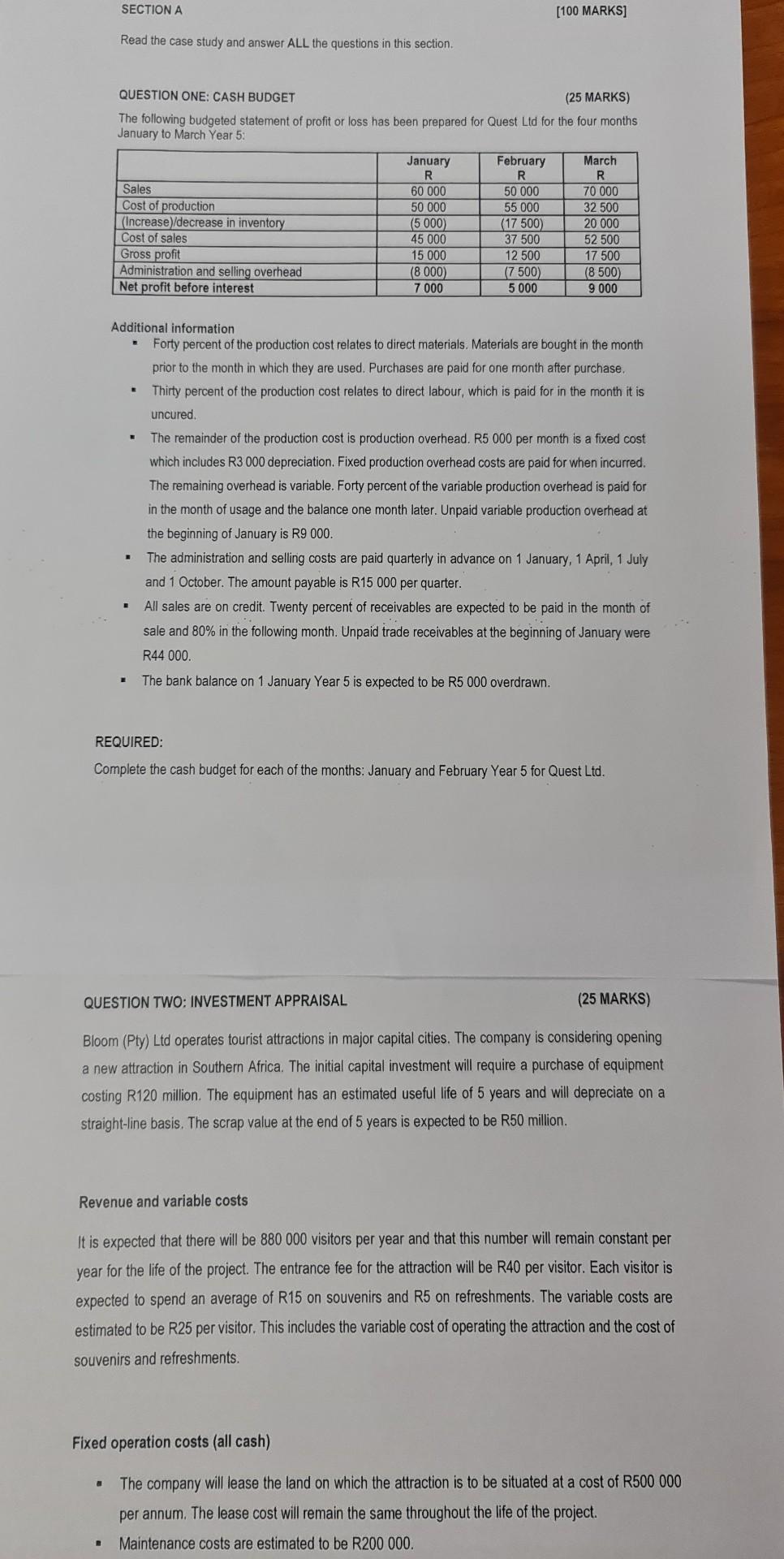

Read the case study and answer ALL the questions in this section. QUESTION ONE: CASH BUDGET (25 MARKS) The following budgeted statement of profit or loss has been prepared for Quest Lid for the four months January to March Year 5 : Additional information - Forty percent of the production cost relates to direct materials. Materials are bought in the month prior to the month in which they are used. Purchases are paid for one month after purchase. - Thirty percent of the production cost relates to direct labour, which is paid for in the month it is uncured. - The remainder of the production cost is production overhead. R5 000 per month is a fixed cost which includes R3000 depreciation. Fixed production overhead costs are paid for when incurred. The remaining overhead is variable. Forty percent of the variable production overhead is paid for in the month of usage and the balance one month later. Unpaid variable production overhead at the beginning of January is R9000. - The administration and selling costs are paid quarterly in advance on 1 January, 1 April, 1 July and 1 October. The amount payable is R15000 per quarter. - All sales are on credit. Twenty percent of receivables are expected to be paid in the month of sale and 80% in the following month. Unpaid trade receivables at the beginning of January were R44 000. - The bank balance on 1 January Year 5 is expected to be R5 000 overdrawn. REQUIRED: Complete the cash budget for each of the months: January and February Year 5 for Quest Ltd. QUESTION TWO: INVESTMENT APPRAISAL (25 MARKS) Bloom (Pty) Ltd operates tourist attractions in major capital cities. The company is considering opening a new attraction in Southern Africa. The initial capital investment will require a purchase of equipment costing R120 million. The equipment has an estimated useful life of 5 years and will depreciate on a straight-line basis. The scrap value at the end of 5 years is expected to be R50 million. Revenue and variable costs It is expected that there will be 880000 visitors per year and that this number will remain constant per year for the life of the project. The entrance fee for the attraction will be R40 per visitor. Each visitor is expected to spend an average of R15 on souvenirs and R5 on refreshments. The variable costs are estimated to be R25 per visitor. This includes the variable cost of operating the attraction and the cost of souvenirs and refreshments. Fixed operation costs (all cash) - The company will lease the land on which the attraction is to be situated at a cost of R500 000 per annum. The lease cost will remain the same throughout the life of the project. - Maintenance costs are estimated to be R200 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts