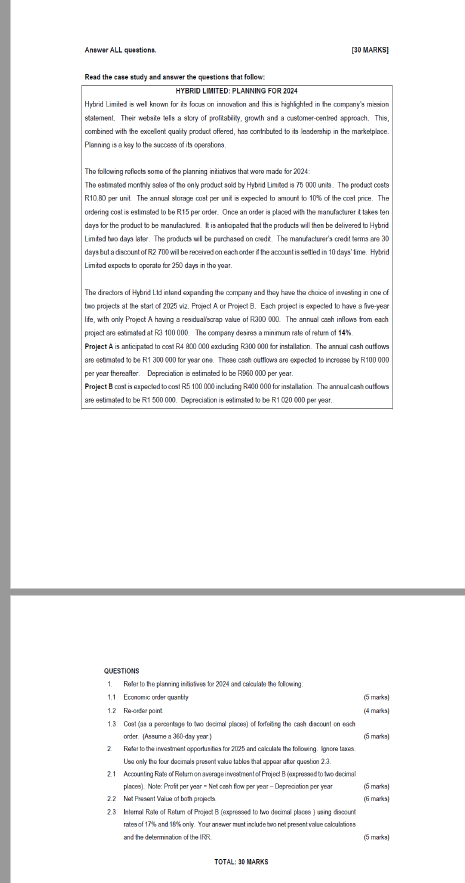

Question: Read the case study and answer the questions that follow: HYBRID LMITED: PLAMNING FOR 2 0 2 4 Hptrid Limied is wel known for is

Read the case study and answer the questions that follow:

HYBRID LMITED: PLAMNING FOR

Hptrid Limied is wel known for is fous on imowetion and lisis is highighted in the company's mission

slatement. Their webaite fels a slory of proflatilify, growh and a castomeroented spproach. This,

combined with the excelent quality product offered, has contruted to its lesdestip in the markelplace.

Plenning is a kay to the succoss of its operators.

The following roflects some of the planring intiativss that were made for :

The estinsted monfly selea of the snly prosuct sold by Hybed Liabod is units. The posdust costs

R per unit. The annul storage cust per unif is expecied to amount to of the cost price. The

ordering cost is estmsted to be R per order. Once an ordar ia placed with the mambacturer liskes ten

days for the product to be manufactured. Eis antopated that the products will then be detiwered to Hytrid

Limted tao daye leter. The probucts ail be perchased on ceedt. The mandacturer's credt tarms are

dars but a discout of R wil be recired on eachorder if the account is setled in days' ime. Hytrid

Limitod expocts to opsrate for dajs in the year.

The drectors of Hybrid Lid intend expanding the compary and they hawe the choice of investing in one of

theo projects at le start of viz. Frojed A or Project B Each project is expecled to have a freeyesr

Ife, with only Project A howing a residealscrap value of Ra The anrual cash inflows from each

project are cecimated at FC The company desirs a minum rale of retus of

Project is anticipatad to coat R axcluaing R C for instalation. The anrual cash cutfows

are estingiad to be R co for year ons. These cash outllowa are expected to ircreese by R

per year theresfler. Depreciation is estmstod to be R per year.

Project B cost is eupecled to cosi R including Ra for installation. The anrualcach outfows

are estinatad to be R Deprecistion is eatimated to be R CQ pee year.

QUESTIOUS

Fobler to fe pliming isliagress tor and calaulale the following:

Econonic order guantty maks

Forover point maks

order. Assume a dsy yer.

Futar to the investment opportintias for and cicilale the following. Ignore tasca

Use only the four doomals prosent value tables that appoar ator quastion

places Note: Profit per your Net cash fow per jear Olapreostion per year maks

Nat Psesent Walue of bofh projocts. i maks

rates of and only. Your answer must include bwo net present value coloulations

and the debermination of the IFR.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock