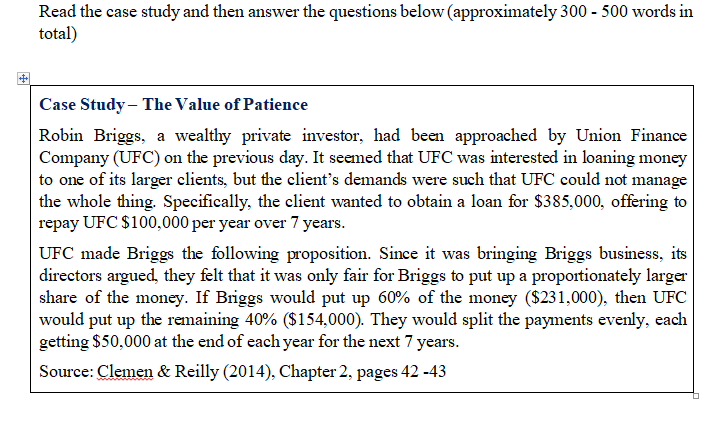

Question: Read the case study and then answer the questions below (approximately 300 - 500 words in total) + Case Study - The Value of Patience

Read the case study and then answer the questions below (approximately 300 - 500 words in total) + Case Study - The Value of Patience Robin Briggs, a wealthy private investor, had been approached by Union Finance Company (UFC) on the previous day. It seemed that UFC was interested in loaning money to one of its larger clients, but the client's demands were such that UFC could not manage the whole thing. Specifically, the client wanted to obtain a loan for $385,000, offering to repay UFC $100,000 per year over 7 years. UFC made Briggs the following proposition. Since it was bringing Briggs business, its directors argued, they felt that it was only fair for Briggs to put up a proportionately larger share of the money. If Briggs would put up 60% of the money ($231,000), then UFC would put up the remaining 40% ($154,000). They would split the payments evenly, each getting $50,000 at the end of each year for the next 7 years. Source: Clemen & Reilly (2014), Chapter 2, pages 42-43 (1) Union Finance (UF) can usually earn 18% on its money. Using this interest rate, what is the net present value (NPV) of the client's original offer to UF? (2) Robin Briggs does not have access to the same investments as UF. In fact, the best available alternative is to invest in a security earning 10% over the next 7 years. Using this interest rate, what is Briggs's NPV of the offer made by UF. Should Briggs accept the offer? (3) What is the NPV of the deal to UF if Briggs participate as proposed? (4) The title of this case study is The Value of Patience". Which of these two investors is more patient? and Why? How is this difference exploited by them in coming to an agreement? (5) Considering your own organisation or one that you're familiar with, is the time value of money or trade-off between current and future revenues accounted for in business/management decisions? If so, how is it accounted for? Read the case study and then answer the questions below (approximately 300 - 500 words in total) + Case Study - The Value of Patience Robin Briggs, a wealthy private investor, had been approached by Union Finance Company (UFC) on the previous day. It seemed that UFC was interested in loaning money to one of its larger clients, but the client's demands were such that UFC could not manage the whole thing. Specifically, the client wanted to obtain a loan for $385,000, offering to repay UFC $100,000 per year over 7 years. UFC made Briggs the following proposition. Since it was bringing Briggs business, its directors argued, they felt that it was only fair for Briggs to put up a proportionately larger share of the money. If Briggs would put up 60% of the money ($231,000), then UFC would put up the remaining 40% ($154,000). They would split the payments evenly, each getting $50,000 at the end of each year for the next 7 years. Source: Clemen & Reilly (2014), Chapter 2, pages 42-43 (1) Union Finance (UF) can usually earn 18% on its money. Using this interest rate, what is the net present value (NPV) of the client's original offer to UF? (2) Robin Briggs does not have access to the same investments as UF. In fact, the best available alternative is to invest in a security earning 10% over the next 7 years. Using this interest rate, what is Briggs's NPV of the offer made by UF. Should Briggs accept the offer? (3) What is the NPV of the deal to UF if Briggs participate as proposed? (4) The title of this case study is The Value of Patience". Which of these two investors is more patient? and Why? How is this difference exploited by them in coming to an agreement? (5) Considering your own organisation or one that you're familiar with, is the time value of money or trade-off between current and future revenues accounted for in business/management decisions? If so, how is it accounted for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts