Question: read the first page and answer the 2nd page. D. Immediate fixed annuity model - Lynda, is concerned about running out of money after reading

read the first page and answer the 2nd page.

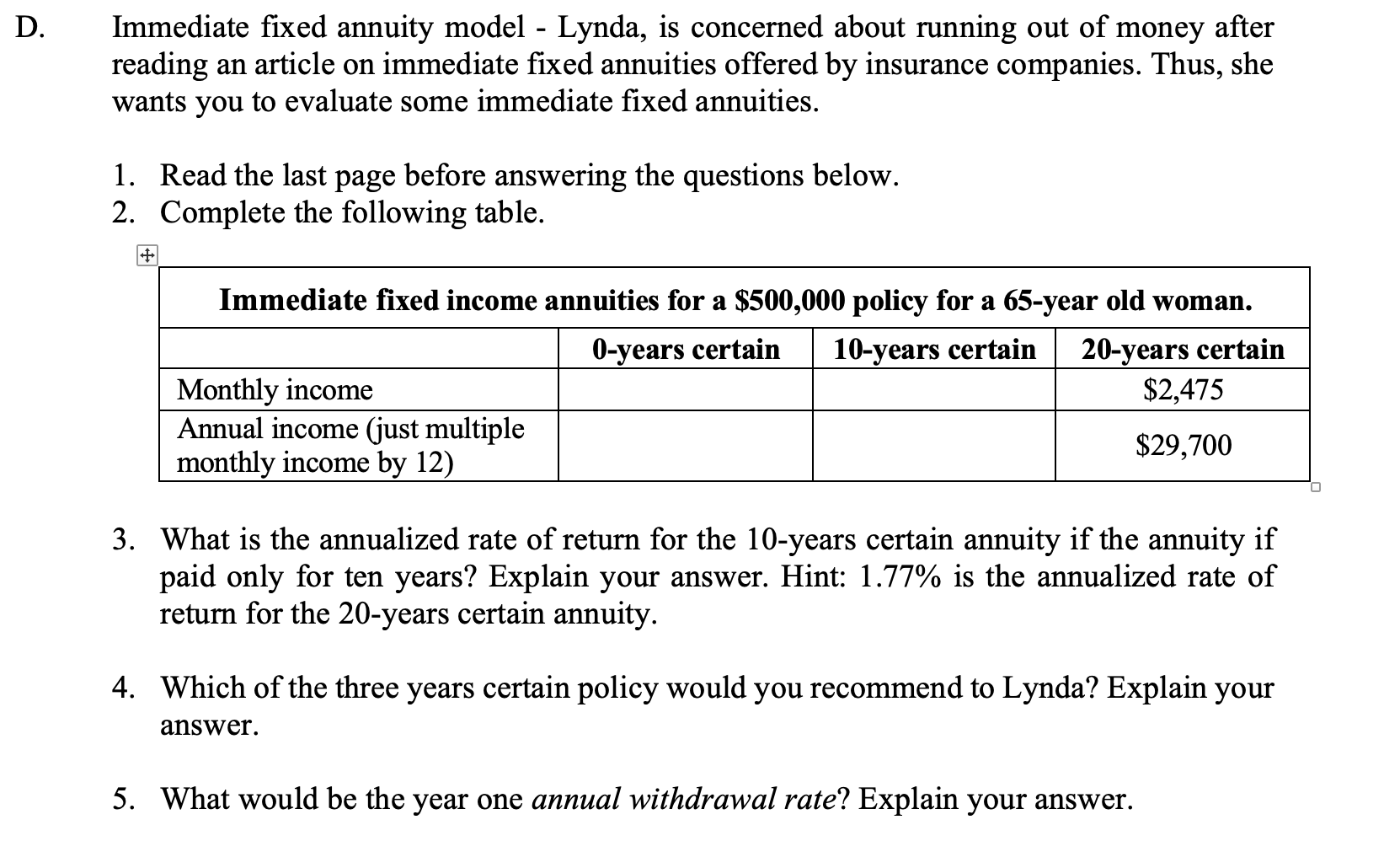

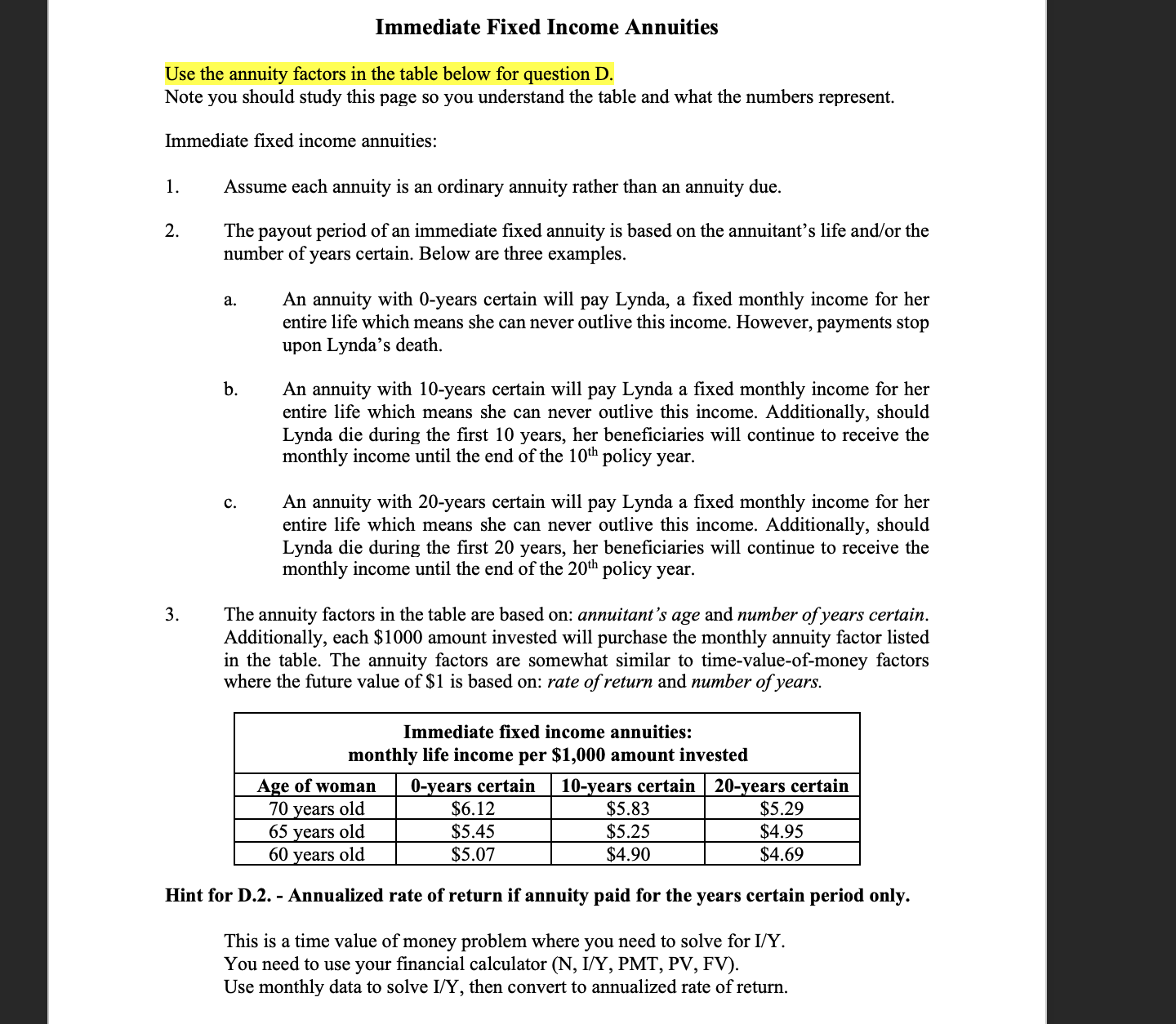

D. Immediate fixed annuity model - Lynda, is concerned about running out of money after reading an article on immediate fixed annuities offered by insurance companies. Thus, she wants you to evaluate some immediate fixed annuities. 1. Read the last page before answering the questions below. 2. Complete the following table. Immediate fixed income annuities for a $500,000 policy for a 65-year old woman. 0-years certain 10-years certain 20-years certain Monthly income $2,475 Annual income (just multiple $29,700 monthly income by 12) 3. What is the annualized rate of return for the 10-years certain annuity if the annuity if paid only for ten years? Explain your answer. Hint: 1.77% is the annualized rate of return for the 20-years certain annuity. 4. Which of the three years certain policy would you recommend to Lynda? Explain your answer. 5. What would be the year one annual withdrawal rate? Explain your answer.Immediate Fixed Income Annuities Use the annuity factors in the table below for question D. Note you should study this page so you understand the table and what the numbers represent. Immediate fixed income annuities: 1 . Assume each annuity is an ordinary annuity rather than an annuity due. 2 . The payout period of an immediate fixed annuity is based on the annuitant's life and/or the number of years certain. Below are three examples. a. An annuity with 0-years certain will pay Lynda, a fixed monthly income for her entire life which means she can never outlive this income. However, payments stop upon Lynda's death. b. An annuity with 10-years certain will pay Lynda a fixed monthly income for her entire life which means she can never outlive this income. Additionally, should Lynda die during the first 10 years, her beneficiaries will continue to receive the monthly income until the end of the 10th policy year. C. An annuity with 20-years certain will pay Lynda a fixed monthly income for her entire life which means she can never outlive this income. Additionally, should Lynda die during the first 20 years, her beneficiaries will continue to receive the monthly income until the end of the 20th policy year. 3. The annuity factors in the table are based on: annuitant's age and number of years certain. Additionally, each $1000 amount invested will purchase the monthly annuity factor listed in the table. The annuity factors are somewhat similar to time-value-of-money factors where the future value of $1 is based on: rate of return and number of years. Immediate fixed income annuities: monthly life income per $1,000 amount invested Age of woman 0-years certain 10-years certain | 20-years certain 70 years old $6.12 $5.83 $5.29 65 years old $5.45 $5.25 $4.95 60 years old $5.07 $4.90 $4.69 Hint for D.2. - Annualized rate of return if annuity paid for the years certain period only. This is a time value of money problem where you need to solve for I/Y. You need to use your financial calculator (N, I/Y, PMT, PV, FV). Use monthly data to solve I/Y, then convert to annualized rate of return