Question: Read the following article and then answer the questions below. Forward rate agreements iFRAsI denitions, examples and applications https:wwwjotanance.comfeanrticle- ForwardrateagreementsFRAs.html 1. What is a Forward

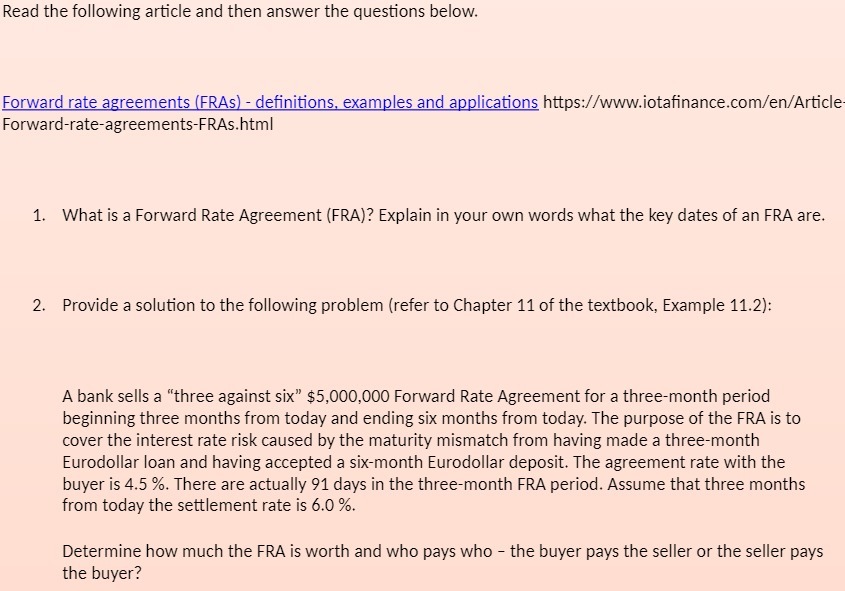

Read the following article and then answer the questions below. Forward rate agreements iFRAsI denitions, examples and applications https:wwwjotanance.comfeanrticle- ForwardrateagreementsFRAs.html 1. What is a Forward Rate Agreement (FRA)? Explain in your own words what the key dates of an FHA are. 2. Provide a solution to the following problem (refer to Chapter 11 of the textbook, Example 11.2]: A bank sells a "three against six" $5,000,000 Forward Rate Agreement for a threemonth period beginning three months from today and ending six months from today. The purpose of the FHA is to cover the interest rate risk caused by the maturity mismatch from having made a three-month Eurodollar loan and having accepted a sixmonth Eurodollar deposit. The agreement rate with the buyer is 4.5 96. There are actually 91 days in the threemonth FRA period. Assume that three months from today the settlement rate is 6.0 9%}. Determine how much the FRA is worth and who pays who the buyer pays the seller or the seller pays the buyer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts