Question: Read the following statement and answer question 8-9. Kiner, Inc. began work in 2018 on a contract for 21,000,000. Other data are as follows: 2018

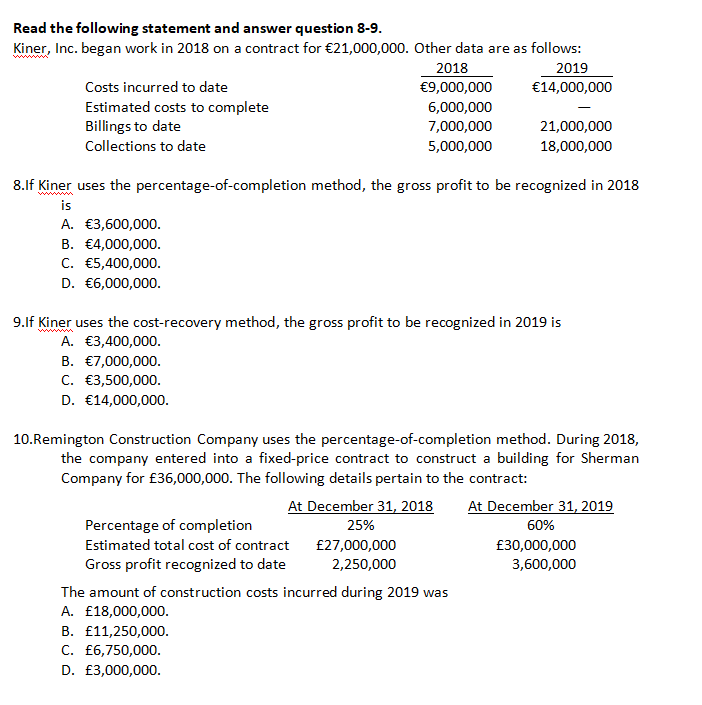

Read the following statement and answer question 8-9. Kiner, Inc. began work in 2018 on a contract for 21,000,000. Other data are as follows: 2018 2019 Costs incurred to date 9,000,000 14,000,000 Estimated costs to complete 6,000,000 Billings to date 7,000,000 21,000,000 Collections to date 5,000,000 18,000,000 8.If Kiner uses the percentage-of-completion method, the gross profit to be recognized in 2018 A. 3,600,000. B. 4,000,000. C. 5,400,000. D. 6,000,000. 9.If Kiner uses the cost-recovery method, the gross profit to be recognized in 2019 is A. 3,400,000. B. 7,000,000. C. 3,500,000 D. 14,000,000. 10. Remington Construction Company uses the percentage-of-completion method. During 2018, the company entered into a fixed-price contract to construct a building for Sherman Company for 36,000,000. The following details pertain to the contract: At December 31, 2018 At December 31, 2019 Percentage of completion 25% 60% Estimated total cost of contract 27,000,000 30,000,000 Gross profit recognized to date 2,250,000 3,600,000 The amount of construction costs incurred during 2019 was A. 18,000,000. B. 11,250,000. C. 6,750,000. D. 3,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts