Question: Read the following statements regarding financial statement analysis. Select the correct statement(s). A. One would expect the times- interest-earned ratio of a company to increase

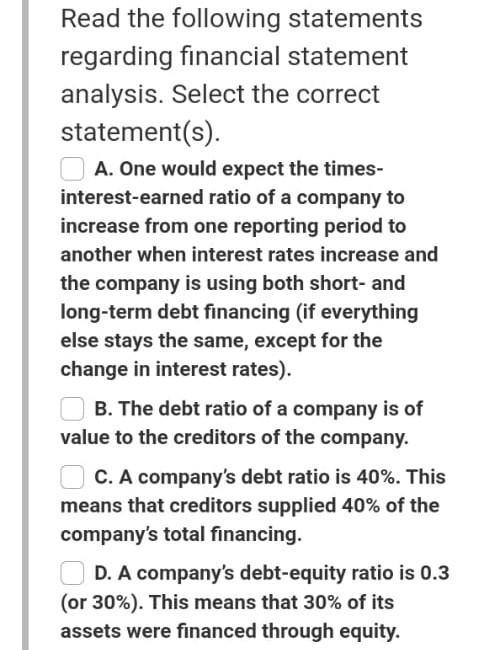

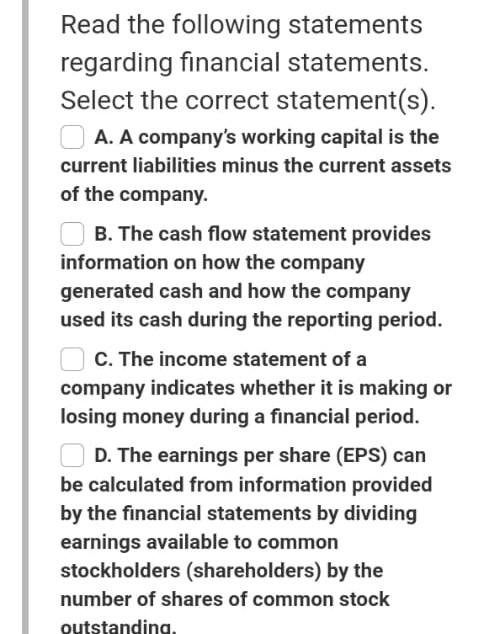

Read the following statements regarding financial statement analysis. Select the correct statement(s). A. One would expect the times- interest-earned ratio of a company to increase from one reporting period to another when interest rates increase and the company is using both short- and long-term debt financing (if everything else stays the same, except for the change in interest rates). B. The debt ratio of a company is of value to the creditors of the company. C. A company's debt ratio is 40%. This . means that creditors supplied 40% of the company's total financing. D. A company's debt-equity ratio is 0.3 (or 30%). This means that 30% of its assets were financed through equity. Read the following statements regarding financial statement analysis. Select the correct statement(s). A. One would expect the times- interest-earned ratio of a company to increase from one reporting period to another when interest rates increase and the company is using both short- and long-term debt financing (if everything else stays the same, except for the change in interest rates). B. The debt ratio of a company is of value to the creditors of the company. C. A company's debt ratio is 40%. This means that creditors supplied 40% of the company's total financing. D. A company's debt-equity ratio is 0.3 (or 30%). This means that 30% of its assets were financed through equity. Read the following statements regarding financial statements. Select the correct statement(s). A. A company's working capital is the current liabilities minus the current assets of the company. B. The cash flow statement provides information on how the company generated cash and how the company used its cash during the reporting period. C. The income statement of a company indicates whether it is making or losing money during a financial period. D. The earnings per share (EPS) can be calculated from information provided by the financial statements by dividing earnings available to common stockholders (shareholders) by the number of shares of common stock outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts