Question: READ THE INSTRUCTION THEN SOLVE , just write the letter like (48)->c like this go to operating part) 90. Cash payments for and cash receipts

READ THE INSTRUCTION THEN SOLVE , just write the letter like (48)->c like this

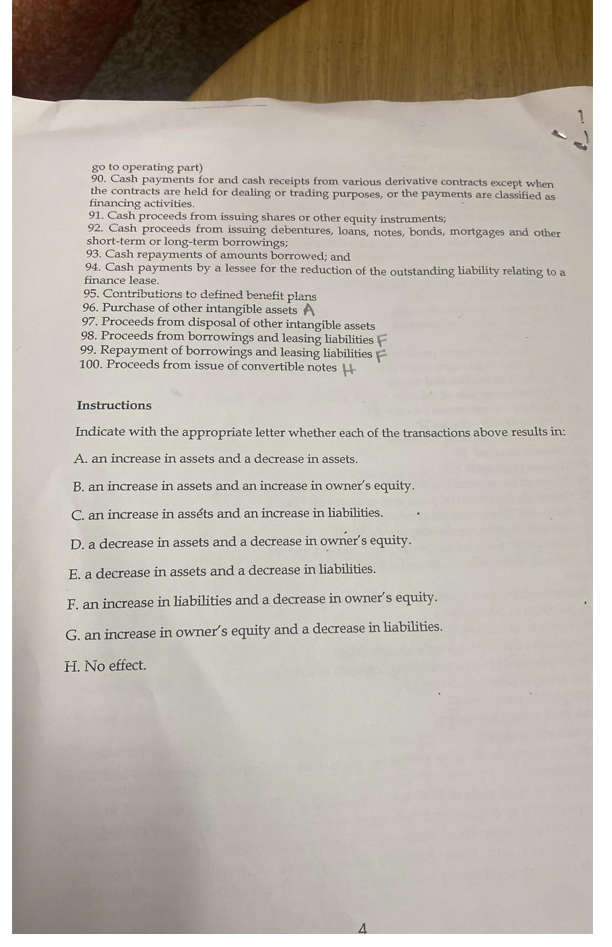

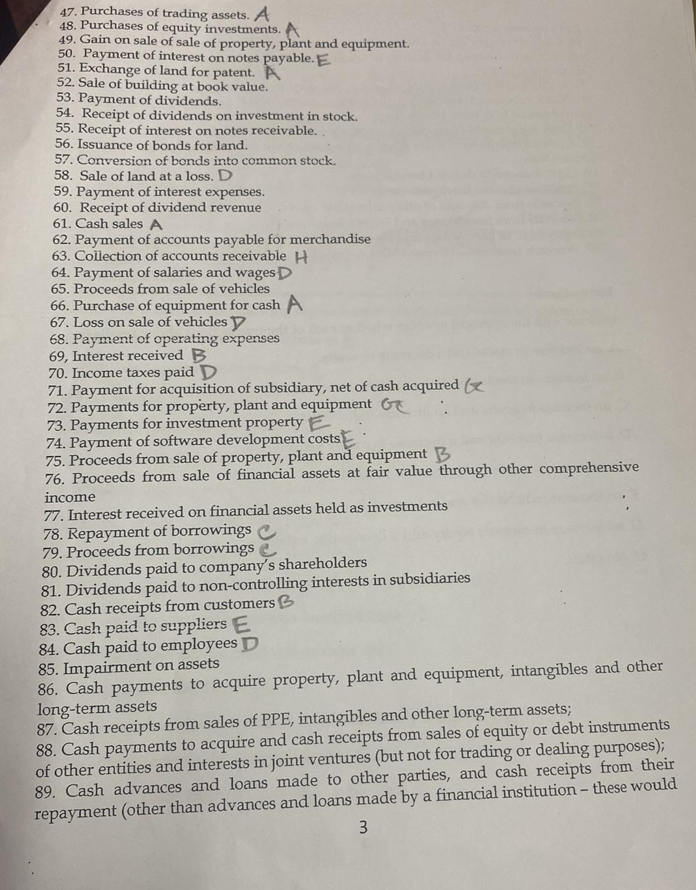

go to operating part) 90. Cash payments for and cash receipts from various derivative contracts except when the contracts are held for dealing or trading purposes, or the payments are classified as financing activities. 91. Cash proceeds from issuing shares or other equity instruments; 92. Cash proceeds from issuing debentures, loans, notes, bonds, mortgages and other short-term or long-term borrowings; 93. Cash repayments of amounts borrowed; and 94. Cash payments by a lessee for the reduction of the outstanding liability relating to a finance lease. 95. Contributions to defined benefit plans 96. Purchase of other intangible assets A 97. Proceeds from disposal of other intangible assets 98. Proceeds from borrowings and leasing liabilities F 99. Repayment of borrowings and leasing liabilities F 100. Proceeds from issue of convertible notes H Instructions Indicate with the appropriate letter whether each of the transactions above results in: A. an increase in assets and a decrease in assets. B. an increase in assets and an increase in owner's equity. C. an increase in assts and an increase in liabilities. D. a decrease in assets and a decrease in owner's equity. E. a decrease in assets and a decrease in liabilities. F. an increase in liabilities and a decrease in owner's equity. G. an increase in owner's equity and a decrease in liabilities. H. No effect. 47. Purchases of trading assets. A 48. Purchases of equity investments. A 49. Gain on sale of sale of property, plant and equipment. 50. Payment of interest on notes payable. E 51. Exchange of land for patent. A 52. Sale of building at book value. 53. Payment of dividends. 54. Receipt of dividends on investment in stock. 55. Receipt of interest on notes receivable.. 56. Issuance of bonds for land. 57. Conversion of bonds into common stock. 58. Sale of land at a loss. D 59. Payment of interest expenses. 60. Receipt of dividend revenue 61. Cash sales A 62. Payment of accounts payable for merchandise 63. Collection of accounts receivable H 64. Payment of salaries and wages D 65. Proceeds from sale of vehicles 66. Purchase of equipment for cash A 67. Loss on sale of vehicles 68. Payment of operating expenses 69, Interest received B 70. Income taxes paid D 71. Payment for acquisition of subsidiary, net of cash acquired ( 72. Payments for property, plant and equipment G 73. Payments for investment property E 74. Payment of software development costs 75. Proceeds from sale of property, plant and equipment B 76. Proceeds from sale of financial assets at fair value through other comprehensive income 77. Interest received on financial assets held as investments 78. Repayment of borrowings 79. Proceeds from borrowings 80. Dividends paid to company's shareholders 81. Dividends paid to non-controlling interests in subsidiaries 82. Cash receipts from customers B 83. Cash paid to suppliers E 84. Cash paid to employees D 85. Impairment on assets 86. Cash payments to acquire property, plant and equipment, intangibles and other long-term assets 87. Cash receipts from sales of PPE, intangibles and other long-term assets; 88. Cash payments to acquire and cash receipts from sales of equity or debt instruments of other entities and interests in joint ventures (but not for trading or dealing purposes); 89. Cash advances and loans made to other parties, and cash receipts from their repayment (other than advances and loans made by a financial institution - these would 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts