Question: Read the Mathematical Note before you answer. you invest $100 today and the interest rate is 10 percent a year (r=0.1), 1 year from today

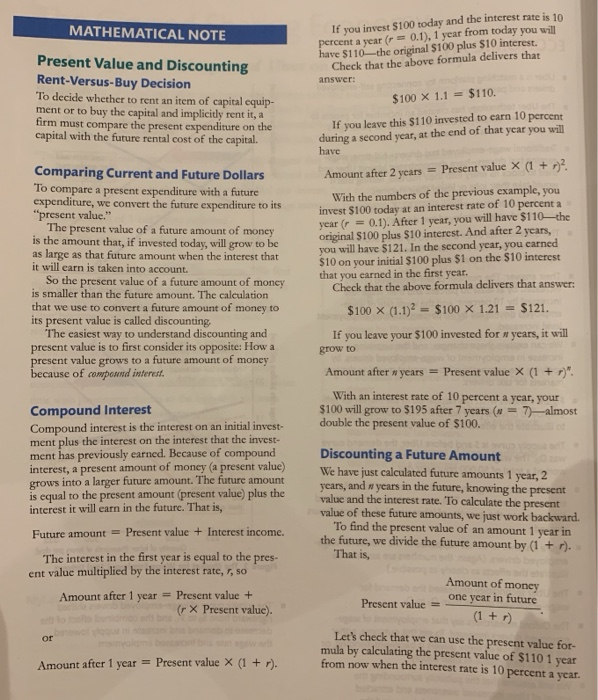

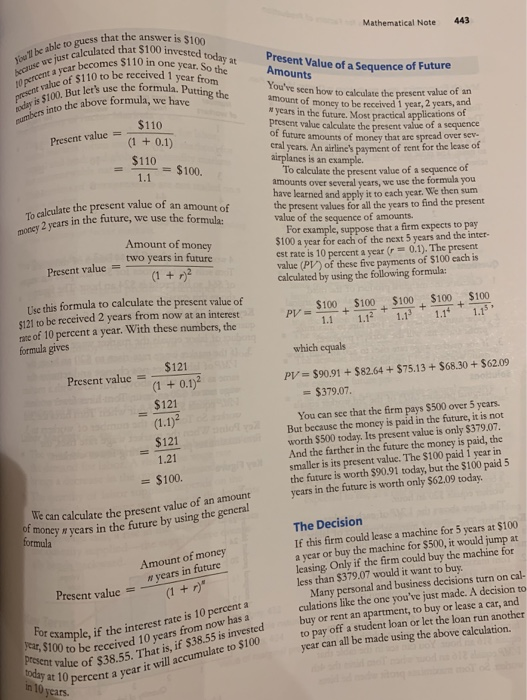

you invest $100 today and the interest rate is 10 percent a year (r=0.1), 1 year from today you will have $110-the original $100 plus $10 interest. Check that the above formula delivers that MATHEMATICAL NOTE If Present Value and Discounting Rent-Versus-Buy Decision To decide whether to rent an item of capital equip- ment or to buy the capital and implicitly rent it, a firm must compare the present expenditure on the capital with the future rental cost of the capital. answer: $100 X 1.1 = $110. you leave this $110 invested to earn 10 percent during a second year, at the end of that year you will have If Present value X (1 + 2 Comparing Current and Future Dollars To compare a present expenditure with a future expenditure, we convert the future expenditure to its "present value." The present value of a future amount of money is the amount that, if invested today, will grow to be as large as that future amount when the interest that it will earn is taken into account. Amount after 2 years With the numbers of the previous example, you invest $100 today at an interest rate of 10 percent a year (r0.1). After 1 year, you will have $110-the original $100 plus $10 interest. And after 2 years, you will have $121. In the sccond year, you carned $10 on your initial $100 plus $1 on the $10 interest that you earned in the first year. Check that the above formula delivers that answer: So the present value of a future amount of money is smaller than the future amount. The caleulation that we use to convert a future amount of money to its present value is called discounting The easiest way to understand discounting and present value is to first consider its opposite: How a present value grows to a future amount of money because of compeund interest. $100 x (1.1)2 $100 x 1.21 $121. you leave grow to If your $100 invested for n years, it will Present value X (1+" Amount after n years With an interest rate of 10 percent a year, your $100 will grow to $195 after 7 years (# 7-almost double the present value of $100. Compound Interest Compound interest is the interest on an initial invest- ment plus the interest on the interest that the invest- ment has previously earned. Because of compound interest, a present amount of money (a present value) grows into a larger future amount. The future amount is equal to the present amount (present value) plus the interest it will earn in the future. That is, Discounting a Future Amount We have just calculated future amounts 1 year, 2 years, and years in the future, knowing the present value and the interest rate. To calculate the present value of these future amounts, we just work backward. To find the present value of an amount 1 year in the future, we divide the future amount by (1 +r). That is, Future amount= Present value + Interest income. The interest in the first year is equal to the pres- ent value multiplied by the interest rate, r, so Amount of moncy one year in future Amount after 1 year= Present value + (r X Present value). Present value (1+ r) Let's check that we can use the present value for- mula by calculating the present value of $110 1 year from now when the interest rate is 10 percent a year. or Amount after 1 year Present value X (1 + r) Noul be able to guess that the answer is $100 because we just calculated that $100 invested today at 10 percent a year becomes $110 in one year. So the present value of $110 to be received 1 year from Roday is $100. But let's use the formula. Putting the mumbers into the above formula, we have Mathematical Note 443 Present Value of a Seguence of Future Amounts You've scen how to calculate the present value of an amount of money to be received 1 year, 2 years, and N years in the future, Most practical applications of present value calculate the present value of a sequence of future amounts of money that are spread over sev- eral years. An airline's payment of rent for the lease of airplanes is an example. To calculate the present value of a sequence of amounts over several years, we use the formula you have learned and apply it to each year. We then sum the present values for all the years to find the present value of the sequence of amounts. For example, suppose that a firm expects to pay $100 a year for each of the next 5 years and the inter- est rate is 10 percent a year (r0.1). The present value (PV) of these five payments of $100 cach is calculated by using the following formula: $110 Present value = (1 +0.1) $110 - $100. 1.1 To calculate the present value of an amount of money 2 years in the future, we use the formula: Amount of money two years in future Present value (1+ r T'se this formula to calculate the present value of S121 to be received 2 years from now at an interest ate of 10 percent a year. With these numbers, the formula gives $100 + 1.1 $100 $100 $100 $100 + PV= + 1.1 1.1 1.12 1.1 which equals $121 Present value = PV $90.91 + $82.64 +$75.13 + $68.30 +$62.09 tnobule (1 0.1)2 $379.07 $121 (1.1)2 You can see that the firm pays $500 over 5 years. But because the money is paid in the future, it is not worth $500 today. Its present value is only $379.07. And the farther in the future the moncy is paid, the smaller is its present value. The $100 paid 1 year in the future is worth $90.91 today, but the $100 paid 5 years in the future is worth only $62.09 today. $121 1.21 = $100. We can calculate the present value of an amount of moncy years in the future by using the general formula The Decision If this firm could lease a machine for 5 years at $100 a year or buy the machine for $500, it would jump at leasing. Only if the firm could buy the machine for less than $379.07 would it want to buy. Many personal and business decisions turn on cal- culations like the one you've just made. A decision to buy or rent an apartment, to buy or lease a car, and to pay off a student loan or let the loan run another year can all be made using the above calculation. Amount of money n years in future (1+ r)" Present value For example, if the interest rate is 10r year, $100 to be received 10 years from now has a present value of $38.55. That is, if $38.55 is invested percent a today at 10 in 10 years percent a year it will accumulate to $100 Read the Mathematical Note on pages 442 & 443. If you know how to use Excel, do so. 1. Suppose you invest $100 for ten years. The interest rate is r 0.06 (six percent) per year and the interest payment is reinvested (added to the principal) each year. Calculate the interest payment and future value (FV) at the end of each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts