Question: Read the Pulse Candy case study: Please complete the following question and cite accordingly 1. When do customers purchase the firms products? How does purchase

Read the Pulse Candy case study: Please complete the following question and cite accordingly

1. When do customers purchase the firms products? How does purchase behavior vary based on different promotional events (communication and price changes) or customer services (hours of operation, online/mobile applications, delivery speed/cost)? How does purchase behavior vary based on uncontrollable influences such as seasonal demand patterns, time-based demand patterns, physical/social surroundings, or competitive activities?

2. Why (and how) do customers select the firms products? Describe the advantages of the firms products relative to competing products. How well do the firms products fulfill customers needs relative to competing products? What products have emerged as new competition? Describe how issues such as brand loyalty, value, commoditization, and relational exchange processes affect customers purchase behaviors. Describe how credit or financing is used in purchasing the firms products. Also, do customers seek long-term relationships with the firm, or do they buy in a transactional fashion (based primarily on price)? Is the product sold via a subscription model, or should it be?

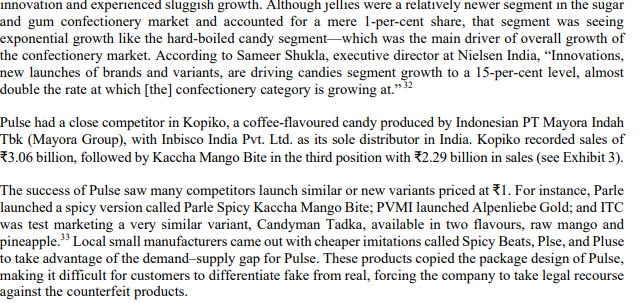

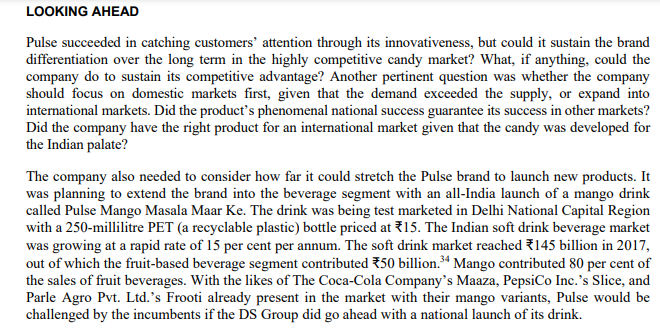

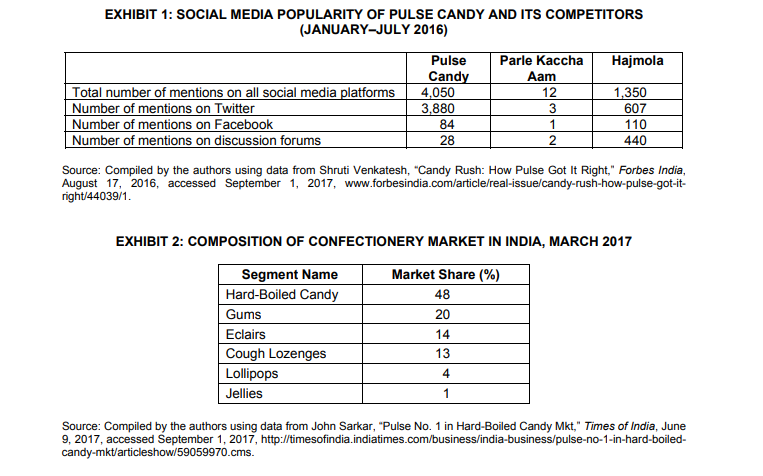

By April 2017 , within two years of its launch, Pulse, a raw-mango-flavoured, hard-boiled candy, had reached 3.26 billion 2 in sales and become the leader in the hard-boiled candy segment, beating leading brands like Parle Products Pvt. Ltd. (Parle)'s Kaccha Mango Bite and Perfetti Van Melle Group B.V.'s Alpenliebe. 3 Pulse sales were even higher than those of multinational brands Oreo and Mars, which had been in the Indian market since 2011.4 Pulse achieved this astounding success with hardly any promotion or advertising for the brand. The journey for Pulse began in April 2015 when the Dharampal Satyapal (DS) Group, a diversified conglomerate operating out of Noida, India, launched Pulse in three states in India as test markets. 5 In the very first year of its launch, sales of Pulse exceeded 1 billion. 6 With its stupendous success, the brand was launched in other states, and by January 2016, the company had a pan-India presence. 7 Within two years, Pulse had surpassed 3 billion in sales and the company was able to meet only 6070 per cent of the demand. 8 Eventually, competitors launched similar products, and cheap imitations started to be sold at roadside kiosks. In view of these developments, the DS Group needed to consider how it could keep up with Pulse's sales momentum. Should it extend the Pulse brand to other formats and flavours? Should it focus on meeting the domestic demand or should it explore overseas markets? These were some of the options the company could explore to sustain Pulse's competitive advantage. COMPANY BACKGROUND The DS Group was founded by Lala Dharampal (the "D" in DS) in 1929. He started with a small perfume store in Chandni Chowk, Delhi, and eventually launched chewing tobacco in 1948. He was later joined by his son, Satyapal (the "S" in DS), who earned the title of sugandhi (perfumer) as a result of his profound knowledge of perfumes. He used this knowledge to innovatively blend tobacco with various fragrances. Under Satyapal's guidance, the company launched its flagship brand, BABA, the first branded chewing tobacco. The brand took the country by storm and since then, the company had engaged in launching a host of innovative products, including the famous chewing tobacco brand Tulsi 9 and Rajnigandha pan masala, a hetel nut nroduct. The DS Group slowly diversified into non-tobacco businesses. It entered the food and beverage industry (F\&B) in 1987 by introducing Catch, a branded salt packaged in tabletop rotary dispensers - the first of its kind in India. 10 The DS Group eventually launched a portfolio of spices and beverages under the brand name Catch. In 1999, the DS Group also entered the confectionery segment with the pioneering launch of a herbal mouth freshener called Pass. The DS Group further diversified its offerings, making its presence felt in the hospitality, dairy, agro forestry, and printing and packaging industries. With the government tightening regulations on the sale of smokeless tobacco products, the company's focus in the consumer goods segment, especially F\&B, increased over the years. The DS Group launched Chingles, mini chewing gums, in 2012, and in 2013 it expanded into dairy products under the Ksheer brand. Pulse was the latest brand in the confectionery segment, launched in 2015 under the umbrella brand of Pass Pass. The company's revenues and profits in fiscal year (FY) 2012/13 were 33.6 billion and 2.9 billion, respectively. 11 The F\&B segment contributed approximately 22 per cent to the firm's turnover, which was reported to be around 77 billion in FY 2015/16.12 THE CONFECTIONERY MARKET IN INDIA The per capita consumption of confectionery in India was among the lowest globally, providing a great opportunity for growth. 13 With the country's economic boom and increase in customer spending, several domestic and multi-national companies expanded their operations in the Indian confectionery market, and the per capita consumption of confectionery items increased. The confectionery market was broadly divided into three categories: chocolate, gum, and sugar confectionery. Within the non-gum, non-chocolate, sugar confectionery market, hard-boiled candies formed the largest segment and showed promising growth. 14 The hot climate in India led to a preference for hard-boiled candies over chocolates, which would quickly melt in the high temperatures, especially in summers. Gum was seen by the Indian middle class as a luxury item and was mostly consumed in urban markets. Although the margins were larger in high-end chocolates, about 40 per cent of the confectionery unit sales came from candies priced at 0.515 Most of these sales were through unorganized retail, comprising small kirana (mom-and-pop) stores and roadside kiosks, and the candies were sold as single units rather than multi-unit packs or bulk purchases. The purchases were frequently made on impulse, and children were the primary consumers. Many of the shopkeepers used low priced candies instead of coins to provide change to customers. Since entry and exit barriers in the hard-boiled confectionery segment were low, many small local manufacturers also operated and sold through unorganized retail. Thus, success in the low-priced, lowmargin hard-boiled confectionery segment depended largely on volumes. However, customers' brand loyalty was low and whatever little loyalty they exhibited was toward a particular flavour, such as mango, orange, or coffee. Mango flavour ( 24 per cent) and the raw mango flavour ( 26 per cent) constituted 50 per cent of the hard-boiled candy segment, followed by caramel ( 20 per cent) and orange flavour ( 16 per cent). 16 Companies that dominated the hard-boiled candy market included Perfetti Van Melle India Pvt. Ltd. (PVMI), Parle, and ITC Ltd. PVMI was the leader in the confectionery market. It had entered the Indian market in 1994 with its brand Center Fresh in the gums category; it gradually expanded its portfolio to include approximately 15 brands across different sub-categories. 17 PVMI's revenues in the confectionery segment surpassed 20 billion in FY 2014/15.18 Some of its leading brands included Alpenliebe, a mix of caramel, milk, and butter; Mentos, a chewy mint candy; and Chlormint, a breath-freshener candy. PVMI was known for its quirky and clever television commercials that appealed to and connected with a wide audience. Some of its notable taglines were "dimag ki batti jala de" (lights up one's brain) for Mentos, "dobara mat puchna" (dare not ask again) for Chlormint, and "zubaan par rakhe lagaam" (keeps one's mouth shut) for Center Fresh. PVMI enjoyed a strong distribution network, comprising nearly 5,000 distributors and approximately 10,000 sub-stockists that made PVMI's products available to small towns as well. 19 The company created a multi-tiered distribution system, dividing the products into three categories based on the brands. Each category had a different distributor, each of whom visited the retailer once every week. Thus, PVMI managed three visits to each retailer per week while the rivals' distributors paid the retailers a once-weekly visit. The kiosk owners who found it difficult to buy multiple product types at one time because of limited working capital would end up buying some of PVMI's products during every visit. This led to an increase in the volume of sales of PVMI's candies in these outlets. The other dominant company was the homegrown, Mumbai-based Parle, known for its Parle-G biscuits, the largest selling biscuit brand in the world. The company participated in different categories of the confectionery market. Its best-known brands included hard-boiled candies Mango Bite and Kaccha Mango Bite, 20 Melody, a caramel candy with chocolate interior; and Kismi, flavoured caramel bars. Kaccha Mango Bite was Parle's largest selling candy. It was advertised as "kacche aam ka Xerox" (an exact copy of raw mango) with actor Amitabh Bachchan as an endorser of the brand. The other strong company, ITC, had a number of variants and flavours under two brands-Mint-o and Candyman. With ITC's presence in cigarettes and packaged food products, it enjoyed strong distribution in urban as well as rural India. Because of its cigarette business, the company's products were also made available at its large network of paan shops. 21 The DS Group launched Pulse in April 2015 after thoroughly researching the market over two years. Rajiv Kumar, vice-chairman of DS Group, noted, "We never focus on bottom lines; if the product is fine, then bottom lines have to come. Most of our [research and development] projects involve a lot of time, and that is our biggest investment. We don't launch till we are completely confident about the product." The company studied the taste preferences of Indians and learned that the tangy flavour of raw mango was liked by all age groups across the country. This result was nothing new for the company, given the success of Parle's Kaccha Mango Bite candy. However, the study also revealed that raw mango was not consumed as it was but almost always had a pinch of salt sprinkled over it, the chatpata (sweet and sour) flavour tickling the taste buds. Kumar said in an interview that his briefing to the research and development team was, "Your eyes should close automatically to relish it [the taste of candy]." Based on consumer insights, the company developed Pulse, a hard-boiled candy with a raw mango flavour and tangy, salty powder filling the centre. The product was different from other candies both in form and in taste. The candy initially gave a mix of sweet and sour tastes, and as one reached the core of the candy, the powdered salt and spices within the hard exterior of the candy imparted a strong sour taste. The green-coloured candy was initially launched in pillow packs in Gujarat, Rajasthan, and Delhi National Capital Region as test markets. These territories were chosen on the basis of preference for a mix of sweet and sour tastes. The demand in the test markets exceeded the company's expectations, so it decided to launch the candy in other major cities of India, and, eventually, to establish presence across India. Marketing The DS Group had decided to use its famous mouth freshener brand, Pass Pass, to expand its portfolio in the confectionery business. Earlier in 2012, the DS Group had launched Chingles, mini chewing gums, with Pass Pass as the umbrella brand. Thus, Pulse candy was also launched under Pass Pass. Pulse candy had appealing packaging with shiny green and black colours, giving the candy a distinctive look compared to other candies available at the retail outlet. The candy's unique taste and form instantly struck a chord with customers, who began talking about the candy among their family and friends. The two-stage taste experience of the candy was described by consumers as "masala [spicy] bomb" or "magical core," highlighting the enthusiasm created by the candy in the market. 23 The overall feel and taste of the candy left most consumers amazed and craving more. This craze drove customers to buy in greater volumes, usually five to 10 candies in one purchase. Many of them talked about the brand on social media. Initially, most purchases were made by youth, but word-of-mouth publicity and online reviews helped the brand gain quick awareness and adoption among all segments, including schoolchildren, college students, and working professionals. Traditionally, candies were sold at 0.5, but fewer 0.5 coins in circulation and higher raw material costs were increasingly driving the industry to increase the unit prices of candy to 1.24 However, around the ime Pulse was launched in 2015, 86 per cent of the candies in the market, including Parle's Mango Bite and Perfetti's Alpenliebe, were priced at 0.5; most of these candies weighed around 2-2.5 grams. Pulse weighed 4 grams and was priced at 1125 The huge demand and short supply led many retailers to sell Pulse at a premium of 50 per cent in spite of the company's efforts to keep a check on the retail price. A senior But, the presence is too limited. Pulse received a good acceptance, and then a supply shortage was created. It is a good marketing trick."226 The DS Group used its existing distribution network of about 1 million retailers to sell Pulse. 27 The DS Group enjoyed an extensive network because its leading brand, Rajnigandha, had more than 70 per cent of the market share in the paan-masala category and was available in different nooks of the country. 28 The DS Group used this strength to establish a pan-India presence for Pulse by January 2016. Simultaneously, the company focused on increasing its production in India. Instead of establishing its own plants, the company relied on contract manufacturing. Shashank Surana, vice-president, New Product Development at DS Group, stated in April 2016, "Instead of locking up capital in setting up our own manufacturing units for Pulse, we decided that it was best to tie up with contract manufacturers. We just had two partners initially, which we have expanded to seven to be able to cover the entire country, and we are in talks to tie up with another." 29 The group initially spent nothing on above-the-line advertising or sales promotion. However, the candy earned extremely favourable responses from early adopters, who shared their experience with Pulse on social media. Some of them even posted videos on YouTube detailing the candy's attributes. Gradually, the company established below-the-line activities such as in-store promotions and displays, and outdoor advertising. many of the fans to describe the candy, was adopted by the company in its hoardings. Inspired by how the digital communities shared their journey with Pulse right from opening the package to experiencing the taste inside the mouth, the company launched a digital media campaign and started actively engaging with the customers. Interestingly, Pulse had many more mentions on social media platforms than established products like Parle's Kaccha Aam and Dabur India Ltd.'s Hajmola candy (see Exhibit 1). In 2016, the DSGroup introduced two more flavours to Pulse-guava and orange-also under the umbrella brand Pass Pass. The candies were also made available through the leading online retailer in India, Amazon.com, in special bulk packs designed in the shape of a pyramid. Pulse had also strengthened its position in organized retail stores where it was also made available in bulk packs. The company launched a television commercial for Pulse in April 2017, almost two years after its introduction. Surana explained, "We believe this was the right time to launch the TVC [television commercial] as now we are at a situation when we are catering to the demand of the markets across India. The TVC now will help us in reaching out to more consumers." "30 With the tagline "Pran Jaaye, Par Pulse Na Jaaye" (Life can be given up, but not Pulse candy), the advertisement reflected the heights to which individuals could go to save their Pulse candy from others. The advertisement, laden with humour, connected well with its primary target audience in the age group 15-35 years and garnered about 20 million views across different social media platforms. 31 Opportunities and Challenges Within two years of its launch, Pulse had become the leader of the hard-boiled candy segment, and it recorded sales of 3.26 billion in FY 2016/17. The Indian sugar and gum confectionery market had reached 85 billion, with the hard-boiled candy segment growing rapidly from one-third to nearly half of this market over one year. The gums and eclairs segments came a distant second and third, with a 20 per cent and 14 per cent market share, respectively (see Exhibit 2). The gums and eclairs segments displayed lack of innovation and experienced sluggish growth. Although jellies were a relatively newer segment in the sugar and gum confectionery market and accounted for a mere 1-per-cent share, that segment was seeing exponential growth like the hard-boiled candy segment - which was the main driver of overall growth of the confectionery market. According to Sameer Shukla, executive director at Nielsen India, "Innovations, new launches of brands and variants, are driving candies segment growth to a 15-per-cent level, almost double the rate at which [the] confectionery category is growing at." 32 Pulse had a close competitor in Kopiko, a coffee-flavoured candy produced by Indonesian PT Mayora Indah Tbk (Mayora Group), with Inbisco India Pvt. Ltd. as its sole distributor in India. Kopiko recorded sales of 3.06 billion, followed by Kaccha Mango Bite in the third position with 2.29 billion in sales (see Exhibit 3 ). The success of Pulse saw many competitors launch similar or new variants priced at 1 . For instance, Parle launched a spicy version called Parle Spicy Kaccha Mango Bite; PVMI launched Alpenliebe Gold; and ITC was test marketing a very similar variant, Candyman Tadka, available in two flavours, raw mango and pineapple. 33 Local small manufacturers came out with cheaper imitations called Spicy Beats, Plse, and Pluse to take advantage of the demand-supply gap for Pulse. These products copied the package design of Pulse, making it difficult for customers to differentiate fake from real, forcing the company to take legal recourse Pulse succeeded in catching customers' attention through its innovativeness, but could it sustain the brand differentiation over the long term in the highly competitive candy market? What, if anything, could the company do to sustain its competitive advantage? Another pertinent question was whether the company should focus on domestic markets first, given that the demand exceeded the supply, or expand into international markets. Did the product's phenomenal national success guarantee its success in other markets? Did the company have the right product for an international market given that the candy was developed for the Indian palate? The company also needed to consider how far it could stretch the Pulse brand to launch new products. It was planning to extend the brand into the beverage segment with an all-India launch of a mango drink called Pulse Mango Masala Maar Ke. The drink was being test marketed in Delhi National Capital Region with a 250-millilitre PET (a recyclable plastic) bottle priced at 15. The Indian soft drink beverage market was growing at a rapid rate of 15 per cent per annum. The soft drink market reached 145 billion in 2017 , out of which the fruit-based beverage segment contributed 50 billion. 34 Mango contributed 80 per cent of the sales of fruit beverages. With the likes of The Coca-Cola Company's Maaza, PepsiCo Inc.'s Slice, and Parle Agro Pvt. Ltd.'s Frooti already present in the market with their mango variants, Pulse would be challenged by the incumbents if the DS Group did go ahead with a national launch of its drink. EXHIBIT 1: SOCIAL MEDIA POPULARITY OF PULSE CANDY AND ITS COMPETITORS (JANUARY-JULY 2016) Source: Compiled by the authors using data from Shruti Venkatesh, "Candy Rush: How Pulse Got It Right," Forbes India, August 17, 2016, accessed September 1, 2017, www.forbesindia.com/article/real-issue/candy-rush-how-pulse-got-itright/44039/1. EXHIBIT 2: COMPOSITION OF CONFECTIONERY MARKET IN INDIA, MARCH 2017 Source: Compiled by the authors using data from John Sarkar, "Pulse No. 1 in Hard-Boiled Candy Mkt," Times of India, June 9, 2017, accessed September 1, 2017, http://timesofindia.indiatimes.com/business/india-business/pulse-no-1-in-hard-boiledcandy-mkt/articleshow/59059970.cms. EXHIBIT 3: SALES OF TOP CANDIES IN HARD-BOILED CANDY MARKET IN INDIA Note: = INR = Indian rupee; US $1=66.33 on March 31,2016 . Source: Compiled by the authors using data from John Sarkar, "Pulse No. 1 in Hard-Boiled Candy Mkt," Times of India, June 9, 2017, accessed September 1, 2017, http://timesofindia.indiatimes.com/business/india-business/pulse-no-1-in-hard-boiledcandy-mkt/articleshow/59059970.cms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts