Question: read the question 1 and answer it REVIEW QUESTIONS 1. Exhibit 12.13 presents free cash flow and economic-profit forecasts for ApparelCo, a $250 million company

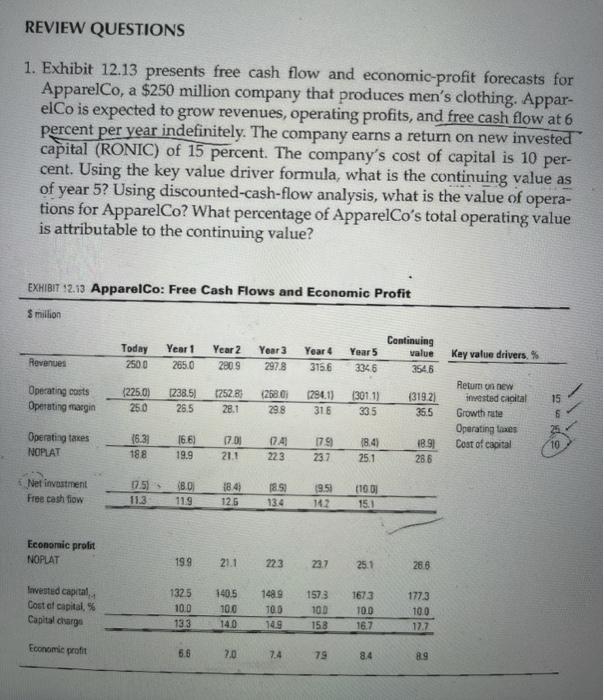

REVIEW QUESTIONS 1. Exhibit 12.13 presents free cash flow and economic-profit forecasts for ApparelCo, a $250 million company that produces men's clothing. Appar- elCo is expected to grow revenues, operating profits, and free cash flow at 6 percent per year indefinitely. The company earns a return on new invested capital (RONIC) of 15 percent. The company's cost of capital is 10 per- cent. Using the key value driver formula, what is the continuing value as of year 5? Using discounted-cash-flow analysis, what is the value of opera- tions for ApparelCo? What percentage of ApparelCo's total operating value is attributable to the continuing value? EXHIBIT 12.13 ApparelCo: Free Cash Flows and Economic Profit Smillion Today 250.0 Year 1 2650 Revenues Year 2 2009 Year 3 2978 Year 4 3156 Continuing value 3546 Year 5 3346 Key value drivers. % Operating costs Operating margin (225.0) 250 1238.5) 26.5 12528) 28.1 (268.00 298 1284.11 316 (3011) 335 1319.21 35.5 Return on new invested capital Growth rate Operating taxes Cost of capital Operating taxes NOPLAT 16.30 188 166) 19.9 17.01 21.1 14 223 179 237 18.4 25.1 18.91 286 Net investment Free cash flow 17.5 11.3 8.0 11.9 18.4 125 18.5 134 19.5 142 (100 15.1 Economic profit NOPLAT 199 21.1 223 23.7 25.1 28.6 Invested capital Costet capital, % Capital ang 1325 10.0 133 140.5 100 140 1489 100 149 1573 100 158 1673 100 16.7 1773 100 17.7 Economic profit 5.6 7.0 7.4 79 84 8.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts