Question: Read the requirements. Requirement c . How would your answer in Part a change if Eugene and Catherine's modified AGI for 2 0 2 3

Read the requirements.

Requirement c How would your answer in Part a change if Eugene and Catherine's modified AGI for was $Round the AOTC phaseout to the nearest whole dollar. Complete all

input fields. Enter a if there is no credit or phaseout amount.

Requirement d How would your answer in Part a change if Nathan had been a junior during Spring semester and a senior during Fall semester? Round all amounts to the nearest whole dollar.

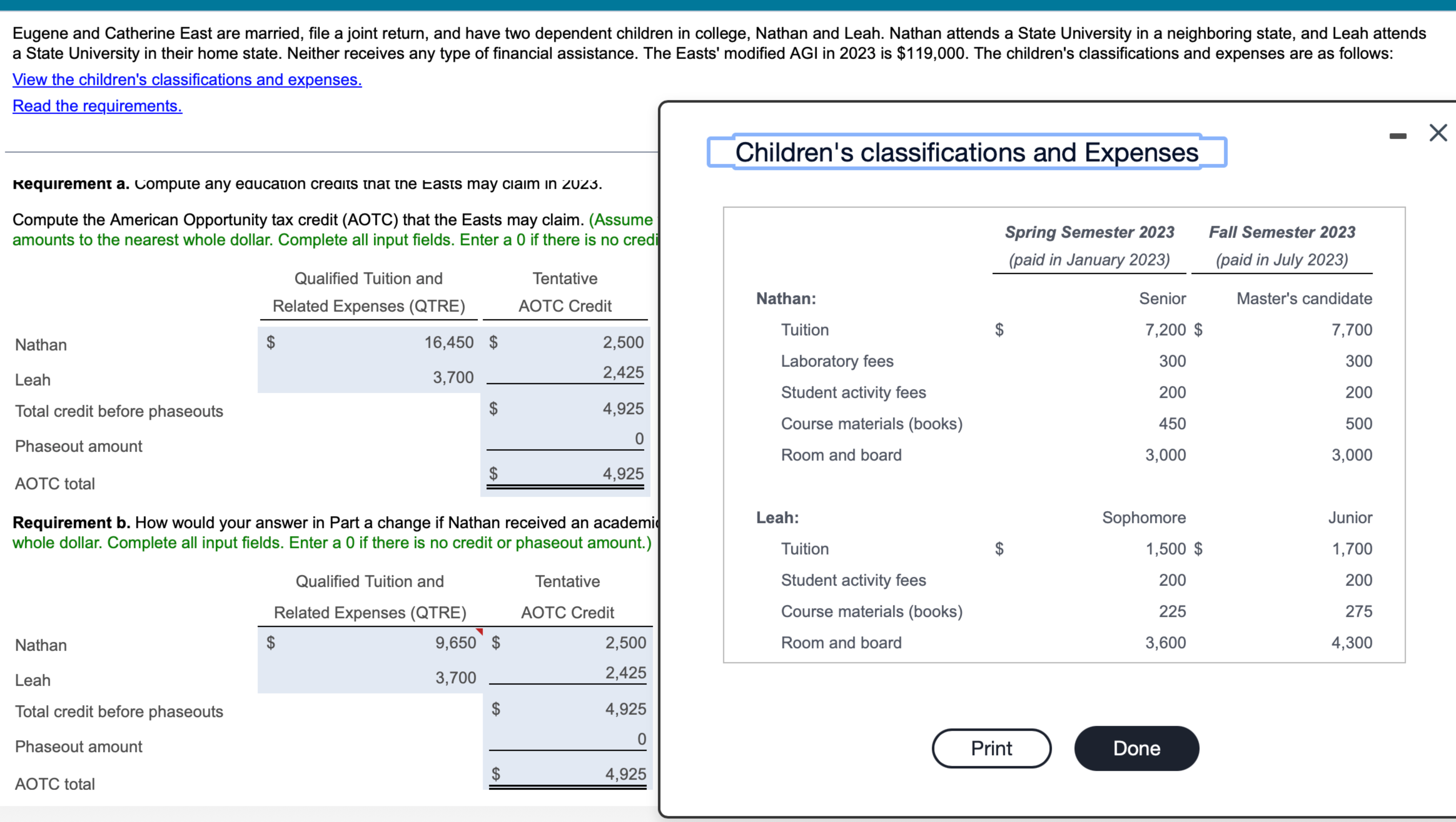

Complete all input fields. Enter a if there is no credit or phaseout amount.Eugene and Catherine East are married, file a joint return, and have two dependent children in college, Nathan and Leah. Nathan attends a State University in a neighboring state, and Leah attends

a State University in their home state. Neither receives any type of financial assistance. The Easts' modified AGI in is $ The children's classifications and expenses are as follows:

View the children's classifications and expenses.

Read the requirements.

equirement a Compute any eaucaton creats that the tasts may ciam in

Requirement b How would your answer in Part a change if Nathan received an academic

whole dollar. Complete all input fields. Enter a if there is no credit or phaseout amount.

Children's classifications and Expenses

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock