Question: Read the scenario on the teaching note p. 9, discuss the following questions: What you would do if you were Miho, sell or borrow? If

- Read the scenario on the teaching note p. 9, discuss the following questions:

- What you would do if you were Miho, sell or borrow?

- If Miho decides to sell, what percentage of her equity she should offer Amy in exchange for $30,000? Please read the next page before answering the questions. A quantitative analysis in support of your answer is preferred. You may try the discounted future cash flows approach or an online calculator (see the teaching note p. 9) to calculate the business value first, then decide on the percentage.

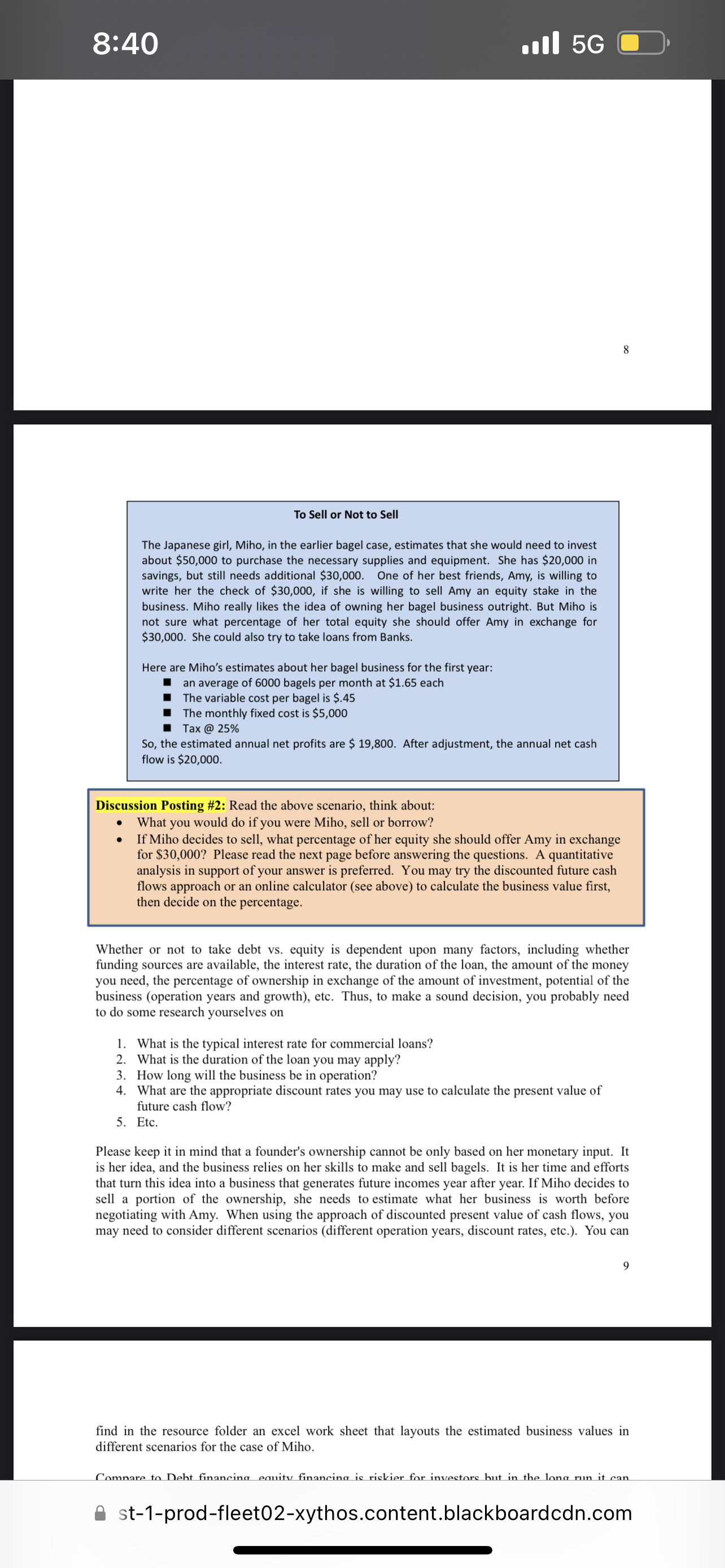

To Sell or Not to Sell The Japanese girl, Miho, in the earlier bagel case, estimates that she would need to invest about $50,000 to purchase the necessary supplies and equipment. She has $20,000 in savings, but still needs additional $30,000. One of her best friends, Amy, is willing to write her the check of $30,000, if she is willing to sell Amy an equity stake in the business. Miho really likes the idea of owning her bagel business outright. But Miho is not sure what percentage of her total equity she should offer Amy in exchange for $30,000. She could also try to take loans from Banks. Here are Miho's estimates about her bagel business for the first year: an average of 6000 bagels per month at $1.65 each The variable cost per bagel is $.45 The monthly fixed cost is $5,000 Tax@25\% So, the estimated annual net profits are $19,800. After adjustment, the annual net cash flow is $20,000. Discussion Posting \#2: Read the above scenario, think about: - What you would do if you were Miho, sell or borrow? - If Miho decides to sell, what percentage of her equity she should offer Amy in exchange for $30,000 ? Please read the next page before answering the questions. A quantitative analysis in support of your answer is preferred. You may try the discounted future cash flows approach or an online calculator (see above) to calculate the business value first, then decide on the percentage. Whether or not to take debt vs. equity is dependent upon many factors, including whether funding sources are available, the interest rate, the duration of the loan, the amount of the money you need, the percentage of ownership in exchange of the amount of investment, potential of the business (operation years and growth), etc. Thus, to make a sound decision, you probably need to do some research yourselves on 1. What is the typical interest rate for commercial loans? 2. What is the duration of the loan you may apply? 3. How long will the business be in operation? 4. What are the appropriate discount rates you may use to calculate the present value of future cash flow? 5. Etc. Please keep it in mind that a founder's ownership cannot be only based on her monetary input. It is her idea, and the business relies on her skills to make and sell bagels. It is her time and efforts that turn this idea into a business that generates future incomes year after year. If Miho decides to sell a portion of the ownership, she needs to estimate what her business is worth before negotiating with Amy. When using the approach of discounted present value of cash flows, you may need to consider different scenarios (different operation years, discount rates, etc.). You can 9 find in the resource folder an excel work sheet that layouts the estimated business values in different scenarios for the case of Miho. Comnare to Deht finansind equity financind is rickier for invectore hut in the lono run it can st-1-prod-fleet02-xythos.content.blackboardcdn.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts