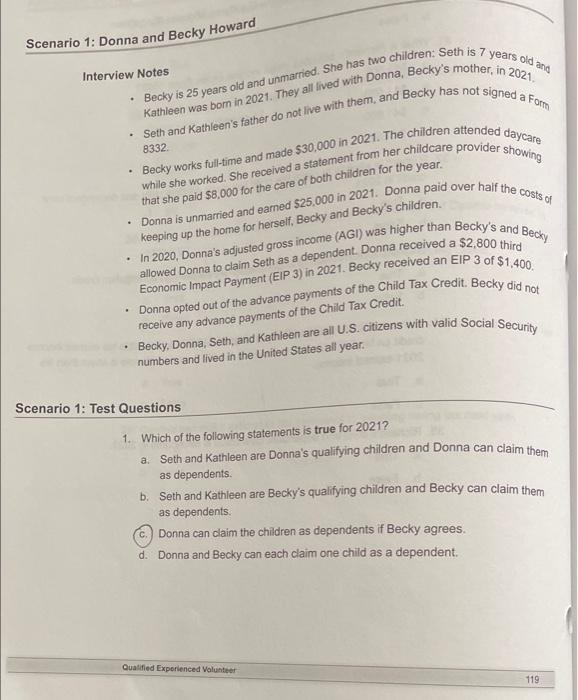

Question: Read the scenario to answer the following questions. Interview Notes was a 8332. that she paid $8,000 for the care of both children for the

Read the scenario to answer the following questions.

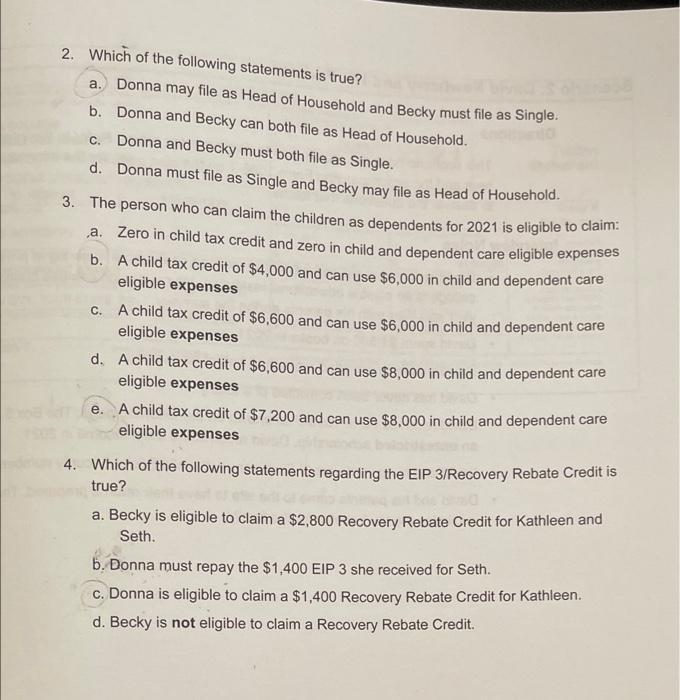

Interview Notes was a 8332. that she paid $8,000 for the care of both children for the year. Donna is unmarried and earned $25,000 in 2021. Donna paid over haif th keeping up the home for herself, Becky and Becky's children. Donna opted out of the advance payments of the Child Tax Credit. Becky du receive any advance payments of the Child Tax Credit. Becky. Donna, Seth, and Kathleen are all U.S. citizens with valid Social Secu numbers and lived in the United States all year. Scenario 1: Test Questions 1. Which of the following statements is true for 2021? a. Seth and Kathleen are Donna's qualifying children and Donna can claim them as dependents. b. Seth and Kathleen are Becky's qualifying children and Becky can claim them as dependents. C. Donna can claim the children as dependents if Becky agrees. d. Donna and Becky can each claim one child as a dependent. Qualified Experienced Volunteer 119

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

1 D Donna and Becky can each claim one child as a dependent This statement is true since Becky has a... View full answer

Get step-by-step solutions from verified subject matter experts