Question: Read the textbook, lecture notes and all other posts BEFORE you post. Using capital investment handout problem #92 as an example to follow, create YOUR

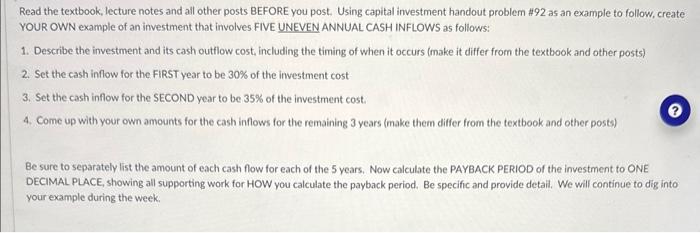

Read the textbook, lecture notes and all other posts BEFORE you post. Using capital investment handout problem \#92 as an example to follow, create YOUR OWN example of an investment that involves FIVE UNEVEN ANNUAL CASH INFLOWS as follows: 1. Describe the investment and its cash outflow cost, including the timing of when it occurs (make it differ from the textbook and other posts) 2. Set the cash inflow for the FIRST year to be 30% of the investment cost 3. Set the cash inflow for the SECOND year to be 35% of the investment cost. 4. Come up with your own amounts for the cash inflows for the remaining 3 years (make them differ from the textbook and other posts) Be sure to separately list the amount of each cash flow for each of the 5 years. Now calculate the PAYBACK PERIOD of the investment to ONE DECIMAL PLACE, showing all supporting work for HOW you calculate the payback period. Be specific and provide detail. We will continue to dig into your example during the week

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts