Question: Read through the information below for selected transactions during the month of December, 2021 and prepare the required jounal entry to record the fransaction. Post

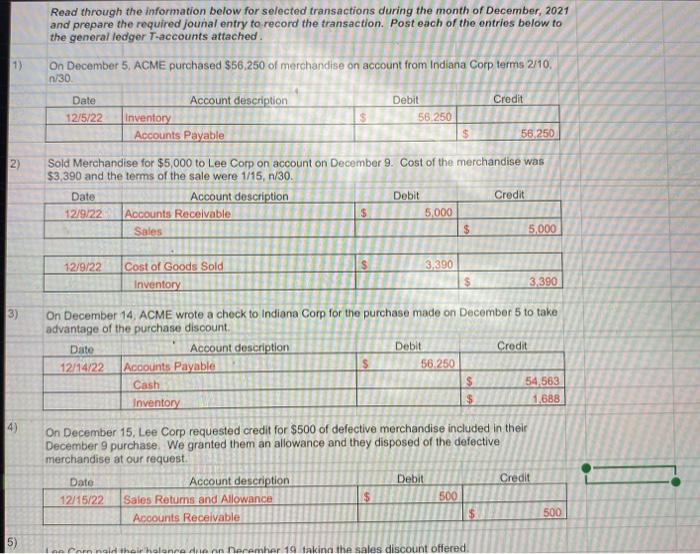

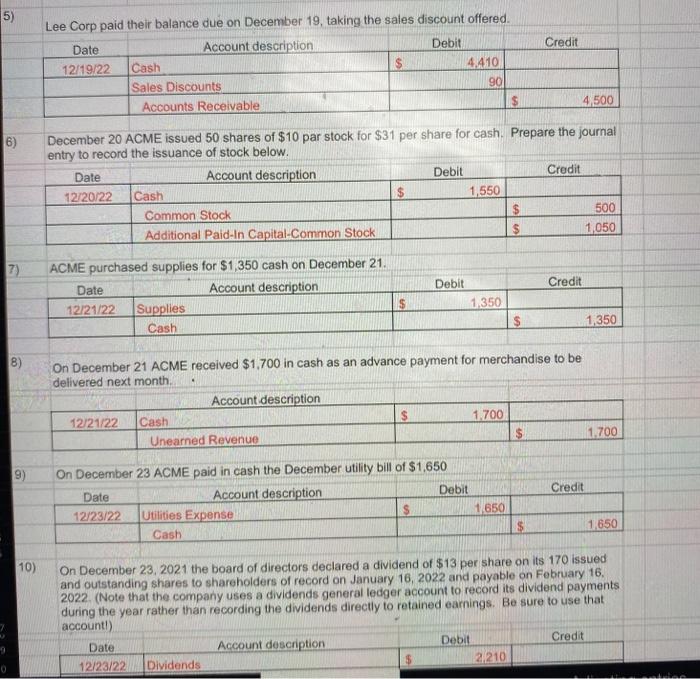

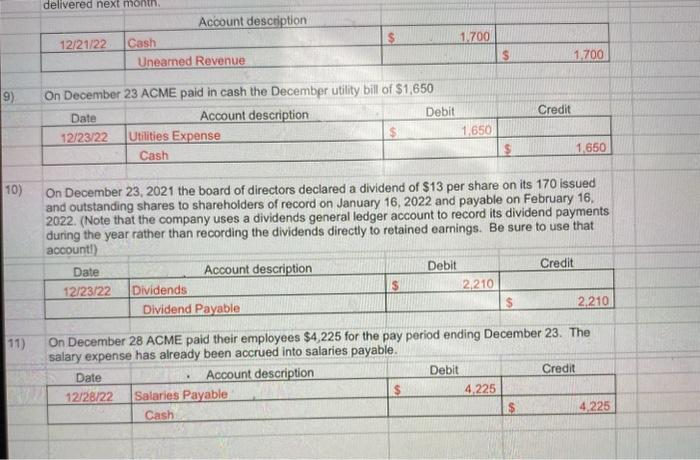

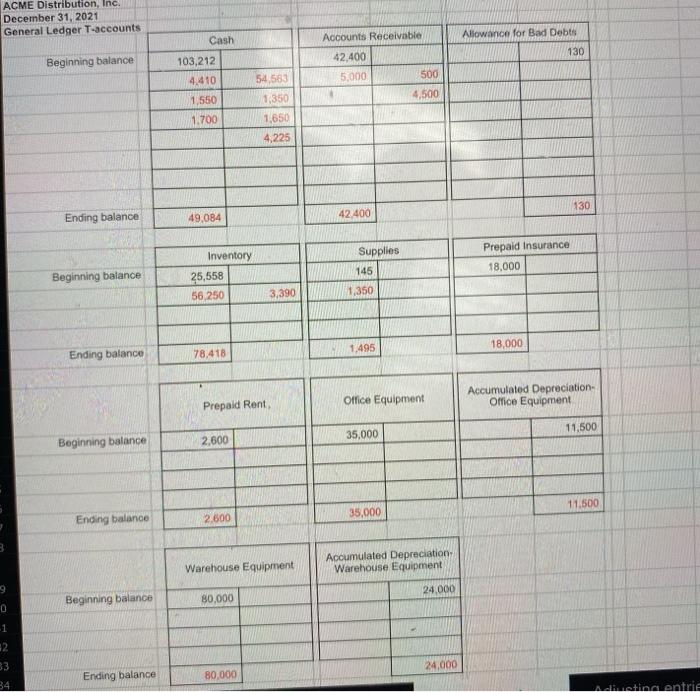

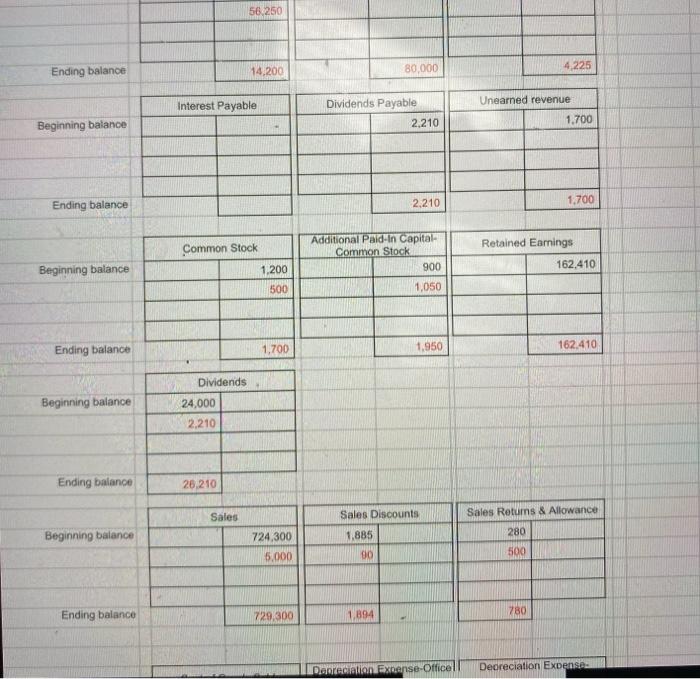

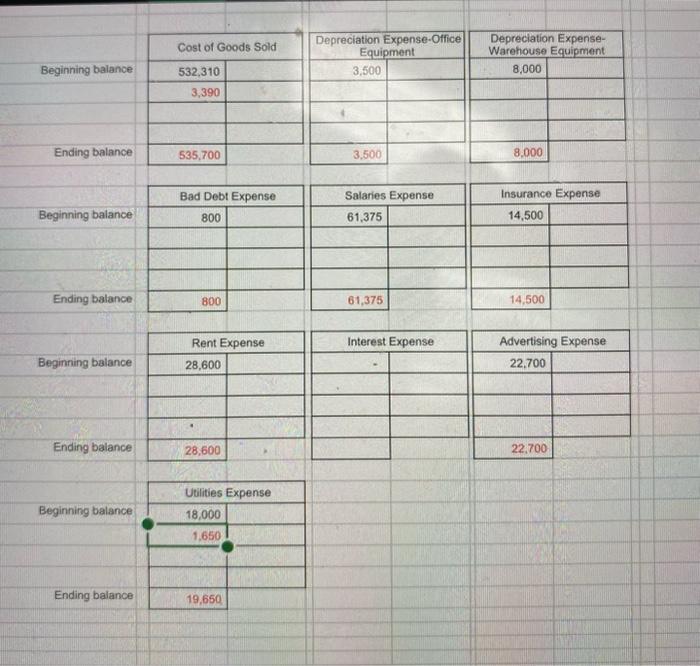

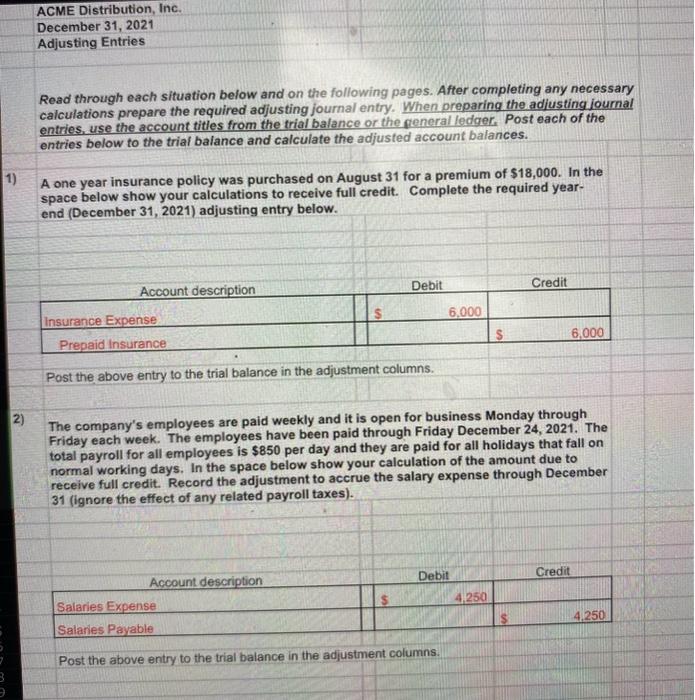

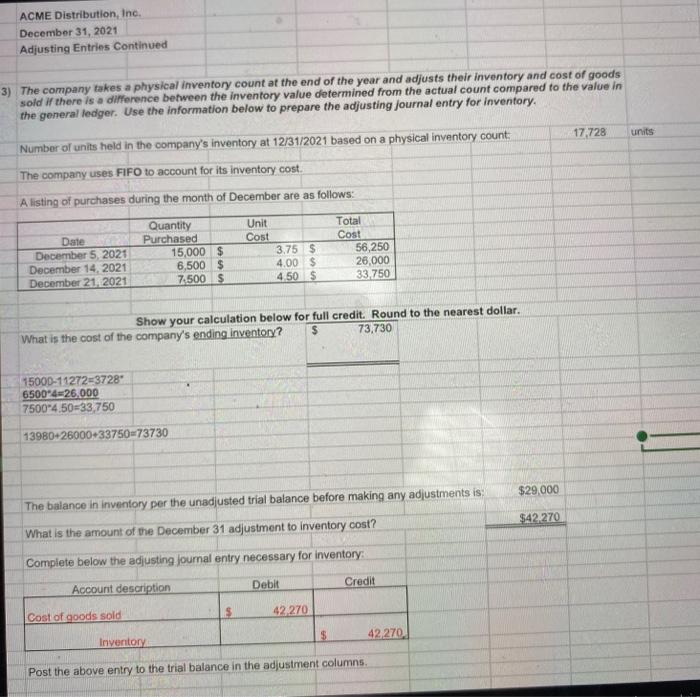

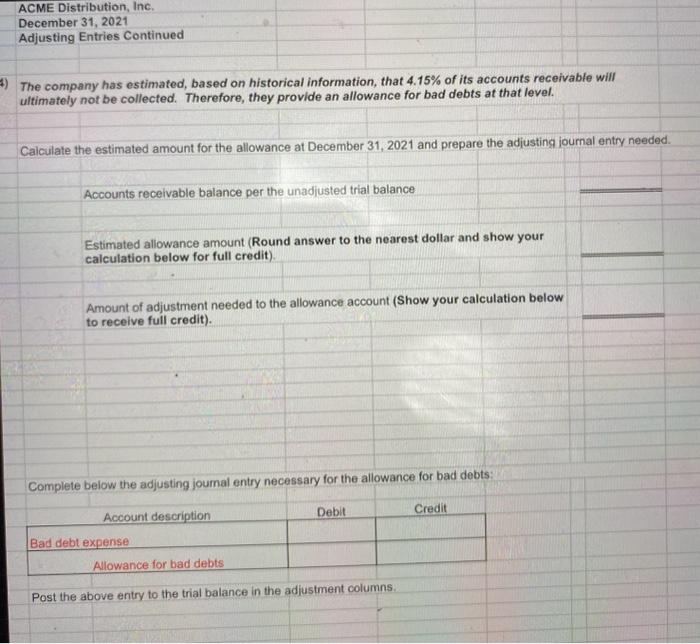

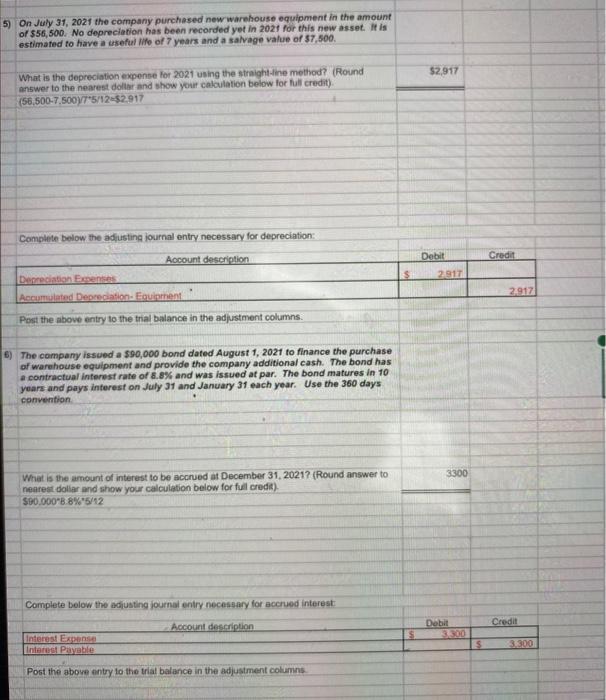

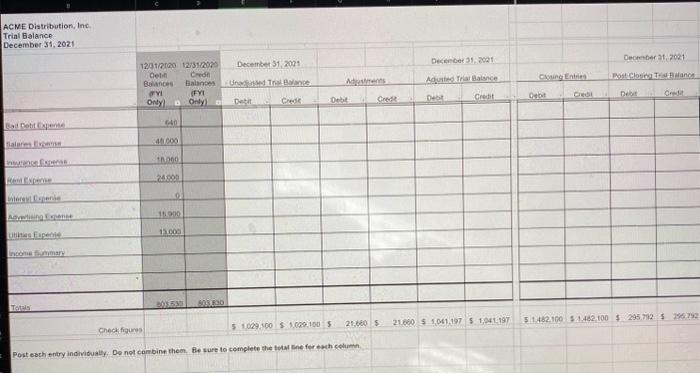

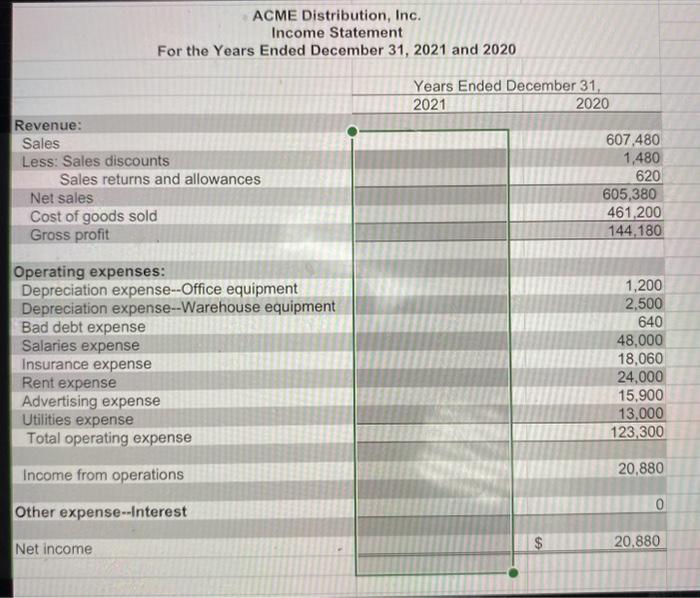

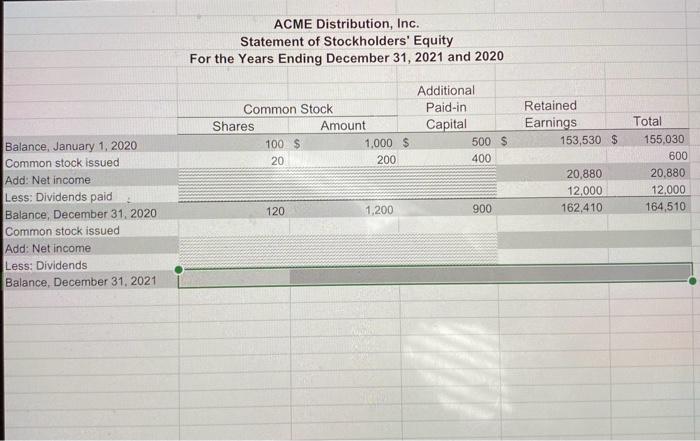

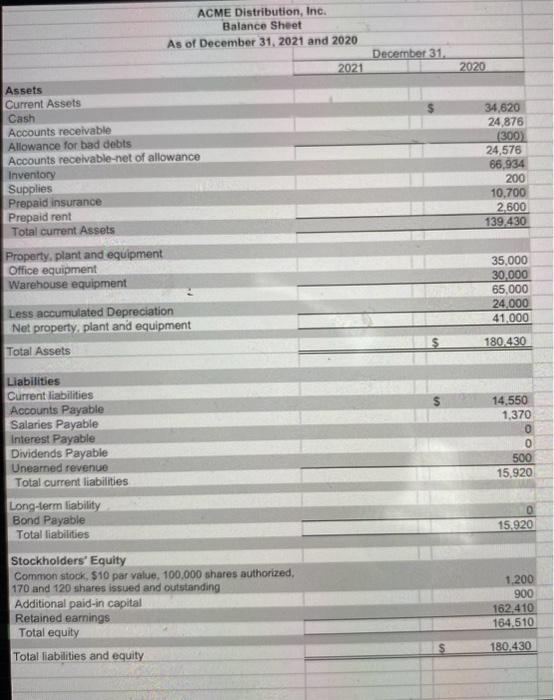

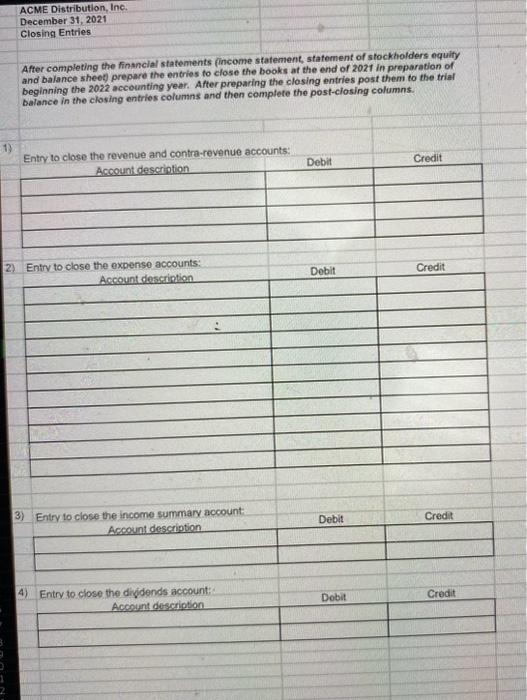

Read through the information below for selected transactions during the month of December, 2021 and prepare the required jounal entry to record the fransaction. Post each of the entries below to the general ledger T-accounts attached. On December 5, ACME purchased $56,250 of merchandise on account from Indiana Corp terms 2/10. n/30. Sold Merchandise for $5,000 to Lee Corp on account on December 9. Cost of the merchandise was $3,390 and the terms of the sale were 1/15, n/30. On December 14, ACME wrote a check to Indiana Corp for the purchase made on December 5 to take advantage of the purchase discount. On December 15, Lee Corp requested credit for $500 of defective merchandise included in their December 9 purchase. We granted them an allowance and they disposed of the defective merchandise at our request. Lee Corb paid their balance due on December 19 , taking the sales discount offered. December 20ACME issued 50 shares of $10 par stock for $31 per share for cash. Prepare the journal antru to record the issuance of stock below. On December 21 ACME received $1.700 in cash as an advance payment for merchandise to be Anlliarmad novt manth nn nanamhar 23 ACME paid in cash the December utility bill of $1,650 On December 23, 2021 the board of directors declared a dividend of $13 per share on its 170 issued and outstanding shares to shareholders of record on January 16,2022 and payable on February 16. 2022. (Note that the company uses a dividends general ledger account to record its dividend payments during the year rather than recording the dividends directly to retained earnings. Be sure to use that On December 23 ACME paid in cash the December utility bill of $1,650 On December 23, 2021 the board of directors declared a dividend of $13 per share on its 170 issued and outstanding shares to sharehoiders of record on January 16, 2022 and payable on February 16. 2022. (Note that the company uses a dividends general ledger account to record its dividend payments during the year rather than recording the dividends directly to retained earnings. Be sure to use that On December 28 ACME paid their employees $4,225 for the pay period ending December 23. The salarv expense has already been accrued into salaries payable. ACME Distribution, Inc. December 31, 2021 General Ledger T-accounts Ending balance Beginning balance Ending balance Beginning balance Ending balance Accumulated DepreciationOffice Equipment Beginning balance Accumulated Depreciation- Warehouse Equipment. Ending balance \begin{tabular}{|r|l|} \hline \multicolumn{2}{|c|}{ Cost of Goods Sold } \\ \hline 532,310 & \\ \hline 3,390 & \\ \hline & \\ \hline & \\ \hline 535,700 & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline \multicolumn{2}{|c|}{ Depreciation Expense-Office Equipment } & \multicolumn{2}{|c|}{ Depreciation ExpenseWarehouse Equipment } \\ \hline 3,500 & & 8,000 & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline 3,500 & & 8,000 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{ Bad Debt Expense } \\ \hline 800 & \\ \hline & \\ \hline & \\ \hline & \\ \hline 800 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Salaries Expense } \\ \hline 61,375 & \\ \hline & \\ \hline & \\ \hline & \\ \hline 61,375 & \\ \hline \end{tabular} \begin{tabular}{|r|l|} \hline \multicolumn{2}{|c|}{ Insurance Expense } \\ \hline 14,500 & \\ \hline & \\ \hline & \\ \hline & \\ \hline 14,500 & \\ \hline \end{tabular} Ending balance \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Rent Expense } \\ \hline 28,600 & \\ \hline & \\ \hline & \\ \hline & \\ \hline 28,600 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline \multicolumn{2}{|c|}{ Interest Expense } & \multicolumn{3}{|c|}{ Advertising Expense } \\ \hline & & 22.700 & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & 22.700 & \\ \hline \end{tabular} Ending balance Read through each situation below and on the following pages. After completing any necessary calculations prepare the required adjusting journal entry. When preparing the adjusting journal entries, use the account titles from the trial balance or the fieneral fedger. Post each of the entries below to the trial balance and calculate the adjusted account balances. A one year insurance policy was purchased on August 31 for a premium of $18,000. In the space below show your calculations to receive full credit. Complete the required yearend (December 31, 2021) adjusting entry below. Post the above entry to the trial balance in the adjustment columns. The company's employees are paid weekly and it is open for business Monday through Friday each week. The employees have been paid through Friday December 24, 2021. The total payroll for all employees is $850 per day and they are paid for all holidays that fall on normal working days. In the space below show your calculation of the amount due to receive full credit. Record the adjustment to accrue the salary expense through December 31 (ignore the effect of any related payroll taxes). The company takes a physical inventory count at the end of the year and adjusts their inventory and cost or goous sold If there is a difference between the inventory value determined from the actual count compared to the value in the general ledger. Use the information below to prepare the adjusting journal entry for inventory. Number of units held in the company's inventory at 12/31/2021 based on a physical inyentory count: 17,728 units The company uses FIFO to account for its inventory cost. A listinn of purchases during the month of December are as follows: Show your calculation below for full credit. Round to the nearest dollar. What is the cost of the company's ending inventory? 1500011272=372865004=26,00075004.50=33,75013980+26000+33750=73730 The balance in inventory per the unadjusted trial balance before making any adjustments is: What is the amount of the December 31 adjustment to inventory cost? $42,270 Complete below the adjusting joumal entry necessary for inventory: Post the above entry to the trial balance in the adjustment columns. Amount of adjustment needed to the allowance account (Show your calculation below to receive full credit). Complete below the adjusting joumal entry necessary for the allowance for bad debts: Post the above entry to the trial balance in the adiustment columns. Post the above entry to the tral balance in the adjustment columns: 5) The company issued a $90,000 bond dated August 1, 2021 to finance the purchase of warehouse equipment and provide the company additional cash. The bond has a contractual interest rate of 8.8% and was issued at par. The bond matures in 10 years and pays interest on July 31 and January 31 each year. Use the 360 days converition. What is the amount of interest to be accrued at December 31, 2021? (Round answer to nearest dollar and ahow your calculation below for full credit). 570.0008.8%5/12 Complete bolow the adiusting journal entry necessary for accrued interest: ACME Distribution, inc. Trial Balance December 31,2021 Decenter 31,2021 \begin{tabular}{|l|l|l|l|} \hline Cabot Detat & Ciesi & Dief \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Post coch entry individually. Do not combina them. the sure to complete the total Ene fer toin cotumn. ACME Distribution, Inc. Income Statement For the Years Ended December 31, 2021 and 2020 ACME Distribution, Inc. Statement of Stockholders' Equity For the Years Ending December 31, 2021 and 2020 ACME Distribution, Inc. Balance Sheet As of December 31, 2021 and 2020 December 31. \begin{tabular}{|cc} \hline 2021 & December3. \\ \hline \end{tabular} Assets Current Assets Cash Accounts receivable Allowance for bad debts Accounts recelvable-net of allowance Inventory Supplies Prepaid insurance Prepaid rent Total current Assets Property, plant and equipment Office equipment Warehouse equipment Less accumulated Depreciation Net property, plant and equipment Total Assets Liabilities Current liabilities Accounts Payable Salaries Payable Interest Payable Dividends Payable Unearned revenue Total current liabilities Long-term liability Bond Payable Total liabilities Stockholders' Equity Common stock, $10 par value, 100.000 shares authorized, 170 and 120 shares issued and outstanding Additional paid-in capital Retained earnings: Total equity Total liabilities and equity After completing the financlal statements fincome statement, statement of stockholders equity and balance sheot, prepare the entries to close the books at the end of 202t in preparation of beginning the 2022 accounting year. After preparing the closing entries post them to the trial balance in the closing entries columns and then complete the post-ciosing columns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts