Question: Reading Assignment Class 3 1. Event Study: An Example Delta, United, and American Airlines announced purchases of planes on July 18 (7/18), February 12 (2/12),

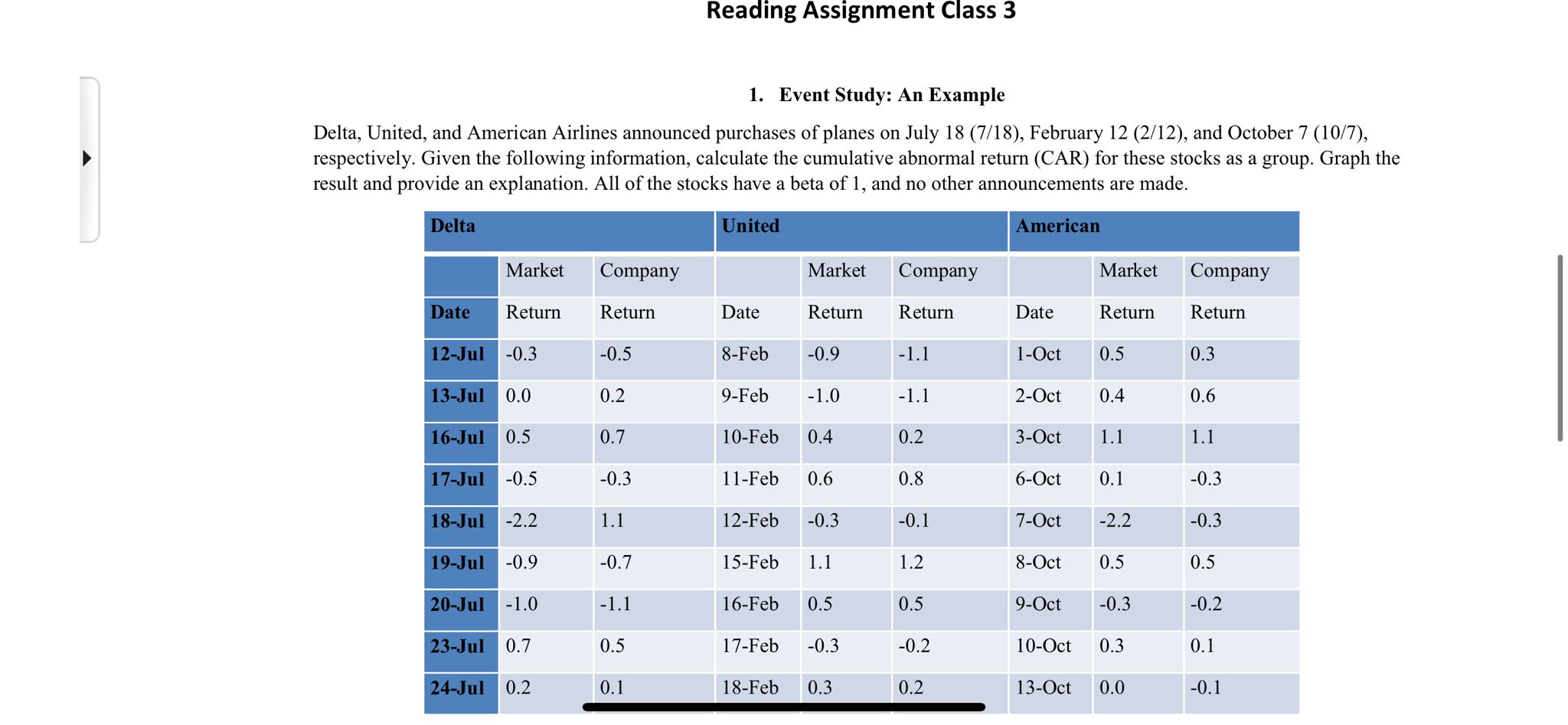

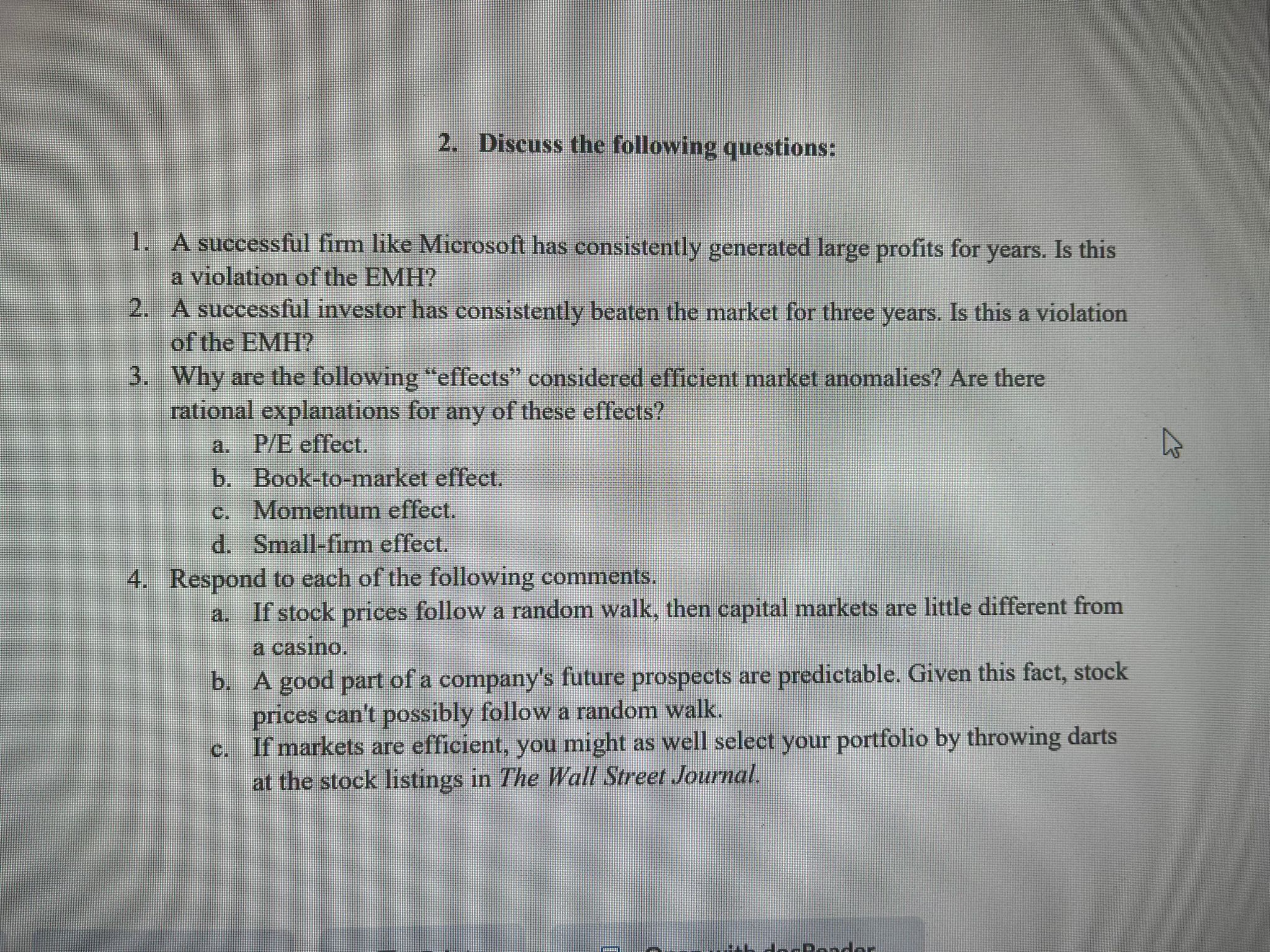

Reading Assignment Class 3 1. Event Study: An Example Delta, United, and American Airlines announced purchases of planes on July 18 (7/18), February 12 (2/12), and October 7 (10/7), respectively. Given the following information, calculate the cumulative abnormal return (CAR) for these stocks as a group. Graph the result and provide an explanation. All of the stocks have a beta of 1 , and no other announcements are made. 2. Discuss the following questions: 1. A successful firm like Microsoft has consistently generated large profits for years. Is this a violation of the EMH ? 2. A successful investor has consistently beaten the market for three years. Is this a violation of the EMH? 3. Why are the following "effects" considered efficient market anomalies? Are there rational explanations for any of these effects? a. P/E effect. b. Book-to-market effect. c. Momentum effect. d. Small-firm effect. 4. Respond to each of the following comments. a. If stock prices follow a random walk, then capital markets are little different from a casino. b. A good part of a company's future prospects are predictable. Given this fact, stock prices can't possibly follow a random walk. c. If markets are efficient, you might as well select your portfolio by throwing darts at the stock listings in The Wall Street Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts