Question: Real and nominal flows ( S 6 . 1 ) Guandong Machinery is evaluating a new project to pro - duce encapsulators. The initial investment

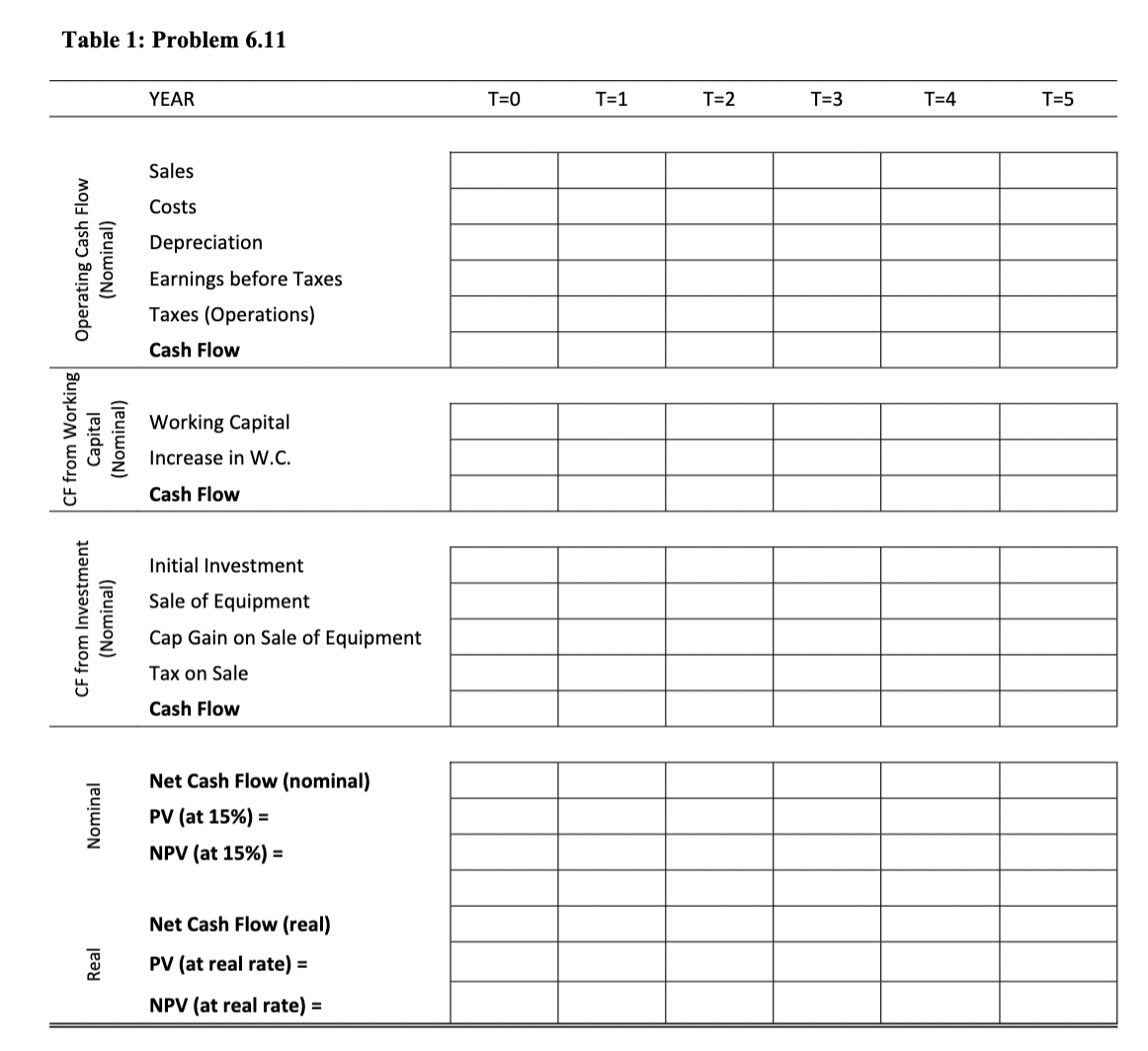

Real and nominal flows S Guandong Machinery is evaluating a new project to pro duce encapsulators. The initial investment in plant and equipment is CNY Sales of encapsulators in year are forecasted at CNY and costs at CNY Both are expected to increase by a year in line with inflation. Profits are taxed at Working capital in each year consists of inventories of raw materials and is forecasted at of sales in the following year. The project will last five years, and the equipment at the end of this period will have no further value. For tax purposes, the equipment can be depreciated straightline over these five years. If the nominal discount rate is show that the net present value of the project is the same whether calculated using real cash flows or nominal flows.Table : Problem

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock