Question: real estate pleasebuse the format provided please use the format below 4. What is the NPV of $500 received for the next four years and

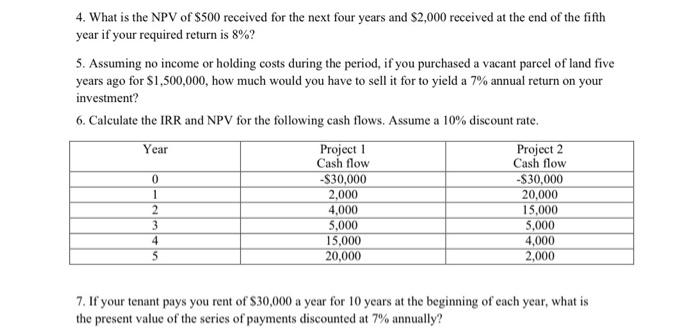

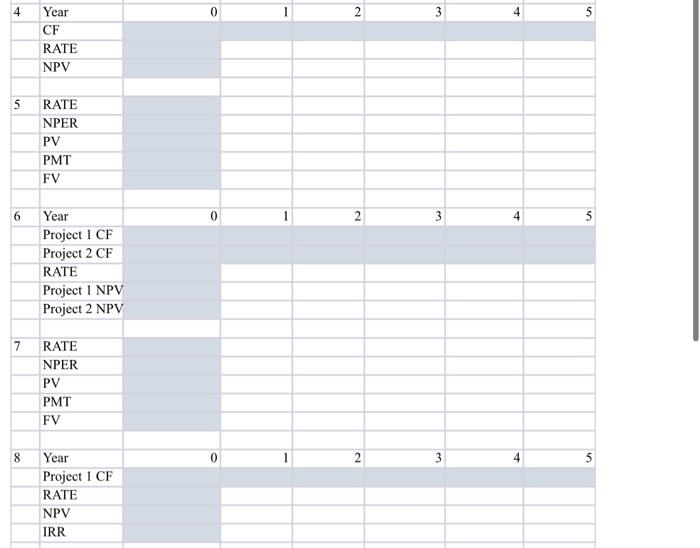

4. What is the NPV of $500 received for the next four years and $2,000 received at the end of the fifth year if your required return is 8%? 5. Assuming no income or holding costs during the period, if you purchased a vacant parcel of land five years ago for $1,500,000, how much would you have to sell it for to yield a 7% annual return on your investment? 6. Calculate the IRR and NPV for the following cash flows. Assume a 10% discount rate. Year Project 1 Project 2 Cash flow Cash flow -$30,000 -$30,000 2,000 20,000 4,000 15.000 5,000 5,000 15,000 4,000 20,000 2,000 0 1 2 3 4 5 7. If your tenant pays you rent of $30,000 a year for 10 years at the beginning of each year, what is the present value of the series of payments discounted at 7% annually? 2 2 3 4 5 5 Year CF RATE NPV 5 RATE NPER PV PMT FV 0 2 3 5 6 Year Project 1 CF Project 2 CF RATE Project I NPV Project 2 NPV 7 RATE NPER PV PMT FV 8 0 2 3 5 Year Project 1 CF RATE NPV IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts