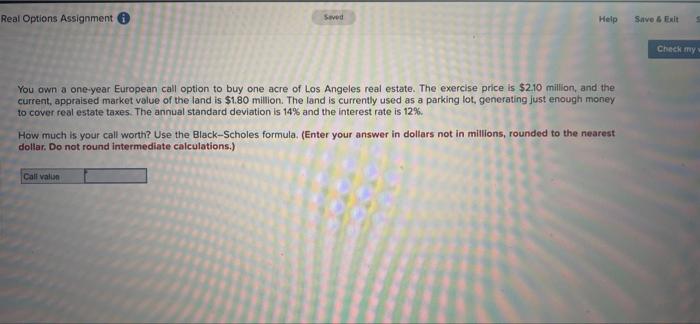

Question: Real Options Assignment Seved Help Save Exit Check my You own a one-year European call option to buy one acre of Los Angeles real estate.

Real Options Assignment Seved Help Save Exit Check my You own a one-year European call option to buy one acre of Los Angeles real estate. The exercise price is $2.10 million, and the current, appraised market value of the land is $1.80 million. The land is currently used as a parking lot, generating just enough money to cover real estate taxes. The annual standard deviation is 14% and the interest rate is 12%. How much is your call worth? Use the Black-Scholes formula (Enter your answer in dollars not in millions, rounded to the nearest dollar. Do not round intermediate calculations.) Call value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts