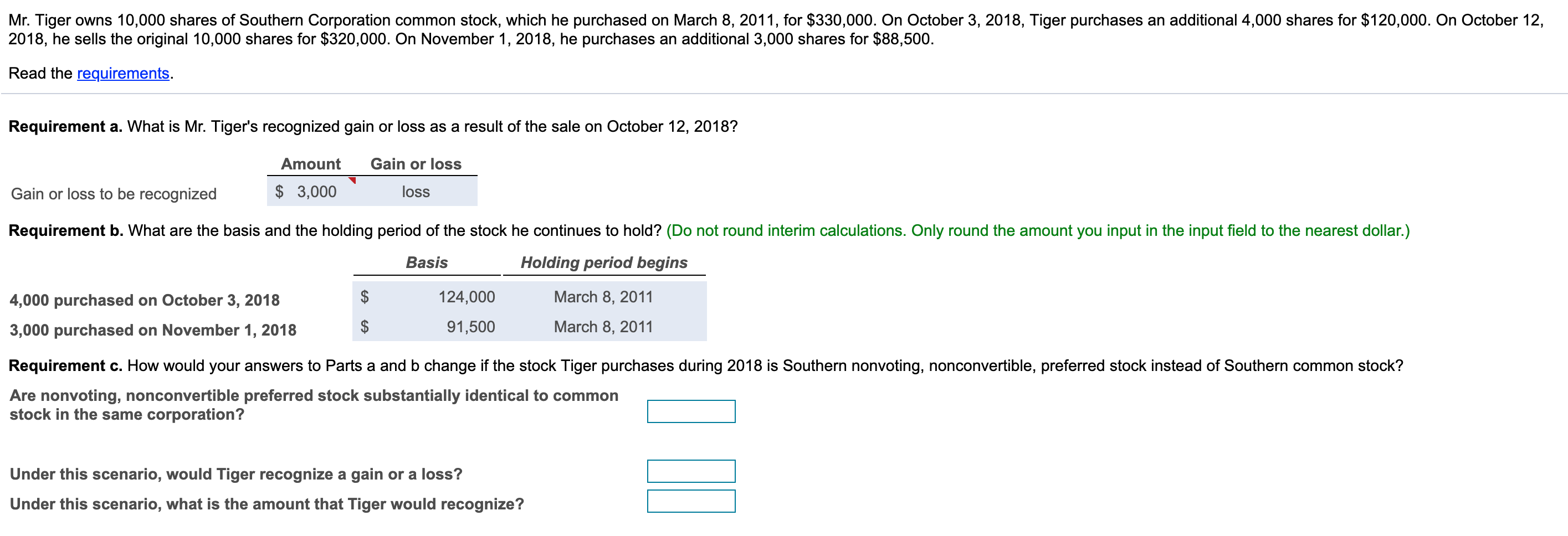

Question: Really need help at the end part real quick Mr. Tiger owns 10,000 shares of Southern Corporation common stock, which he purchased on March 8,

Really need help at the end part real quick

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock