Question: really need help on loans, thank you so much ! Clearly and neatly show all work for each problem. Round all final answers to the

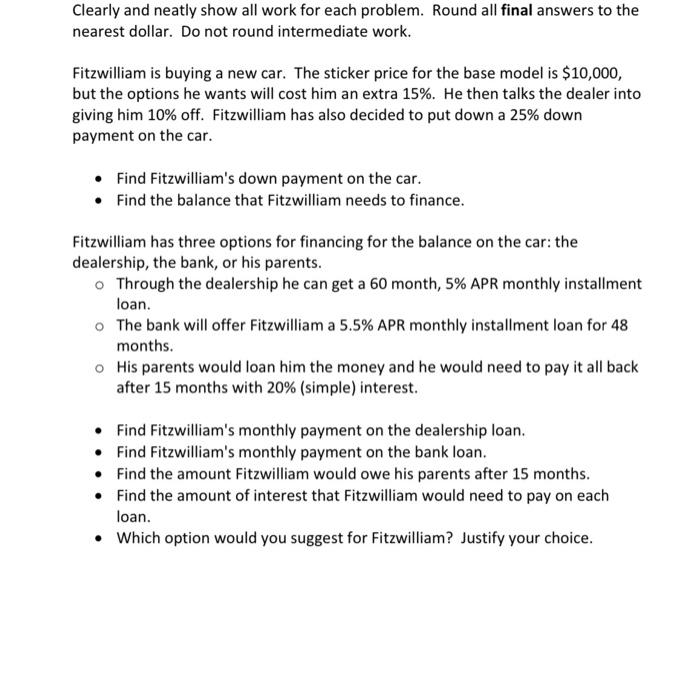

Clearly and neatly show all work for each problem. Round all final answers to the nearest dollar. Do not round intermediate work. Fitzwilliam is buying a new car. The sticker price for the base model is $10,000, but the options he wants will cost him an extra 15%. He then talks the dealer into giving him 10% off. Fitzwilliam has also decided to put down a 25% down payment on the car. - Find Fitzwilliam's down payment on the car. - Find the balance that Fitzwilliam needs to finance. Fitzwilliam has three options for financing for the balance on the car: the dealership, the bank, or his parents. - Through the dealership he can get a 60 month, 5% APR monthly installment loan. The bank will offer Fitzwilliam a 5.5\% APR monthly installment loan for 48 months. His parents would loan him the money and he would need to pay it all back after 15 months with 20% (simple) interest. - Find Fitzwilliam's monthly payment on the dealership loan. - Find Fitzwilliam's monthly payment on the bank loan. - Find the amount Fitzwilliam would owe his parents after 15 months. - Find the amount of interest that Fitzwilliam would need to pay on each loan. - Which option would you suggest for Fitzwilliam? Justify your choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts