Question: Really need help on this asset management question Question 3 You are consultant to a large institutional investor who has a series of liabilities to

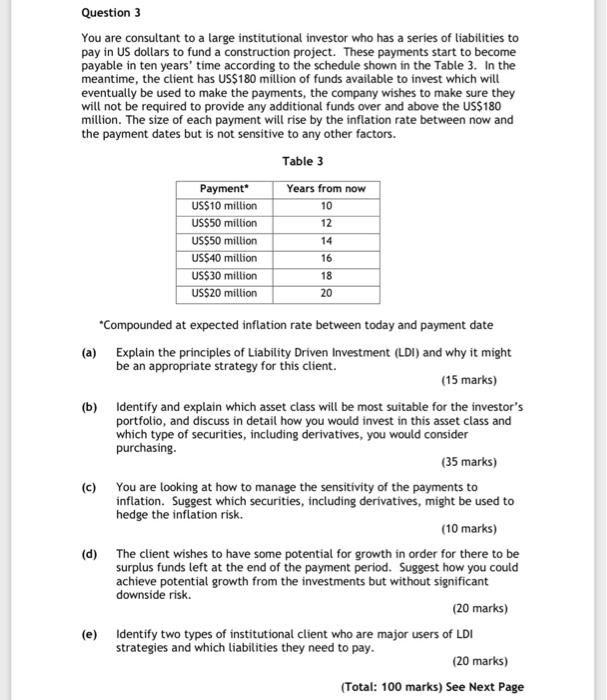

Question 3 You are consultant to a large institutional investor who has a series of liabilities to pay in US dollars to fund a construction project. These payments start to become payable in ten years' time according to the schedule shown in the Table 3. In the meantime, the client has US$180 million of funds available to invest which will eventually be used to make the payments, the company wishes to make sure they will not be required to provide any additional funds over and above the US$180 million. The size of each payment will rise by the inflation rate between now and the payment dates but is not sensitive to any other factors. Table 3 Payment Years from now US$10 million 10 US$50 million 12 US$50 million US$40 million US$ 30 million US$20 million 20 14 16 18 Compounded at expected inflation rate between today and payment date (a) Explain the principles of Liability Driven Investment (LDI) and why it might be an appropriate strategy for this client. (15 marks) (b) Identify and explain which asset class will be most suitable for the investor's portfolio, and discuss in detail how you would invest in this asset class and which type of securities, including derivatives, you would consider purchasing. (35 marks) (c) You are looking at how to manage the sensitivity of the payments to inflation. Suggest which securities, including derivatives, might be used to hedge the inflation risk. (10 marks) (d) The client wishes to have some potential for growth in order for there to be surplus funds left at the end of the payment period. Suggest how you could achieve potential growth from the investments but without significant downside risk. (20 marks) (e) Identify two types of institutional client who are major users of LDI strategies and which liabilities they need to pay. (20 marks) (Total: 100 marks) See Next Page Question 3 You are consultant to a large institutional investor who has a series of liabilities to pay in US dollars to fund a construction project. These payments start to become payable in ten years' time according to the schedule shown in the Table 3. In the meantime, the client has US$180 million of funds available to invest which will eventually be used to make the payments, the company wishes to make sure they will not be required to provide any additional funds over and above the US$180 million. The size of each payment will rise by the inflation rate between now and the payment dates but is not sensitive to any other factors. Table 3 Payment Years from now US$10 million 10 US$50 million 12 US$50 million US$40 million US$ 30 million US$20 million 20 14 16 18 Compounded at expected inflation rate between today and payment date (a) Explain the principles of Liability Driven Investment (LDI) and why it might be an appropriate strategy for this client. (15 marks) (b) Identify and explain which asset class will be most suitable for the investor's portfolio, and discuss in detail how you would invest in this asset class and which type of securities, including derivatives, you would consider purchasing. (35 marks) (c) You are looking at how to manage the sensitivity of the payments to inflation. Suggest which securities, including derivatives, might be used to hedge the inflation risk. (10 marks) (d) The client wishes to have some potential for growth in order for there to be surplus funds left at the end of the payment period. Suggest how you could achieve potential growth from the investments but without significant downside risk. (20 marks) (e) Identify two types of institutional client who are major users of LDI strategies and which liabilities they need to pay. (20 marks) (Total: 100 marks) See Next Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts