Question: Really need help on this asset management question Question 4 You are reviewing the performance of a fund that invests in world equity markets and

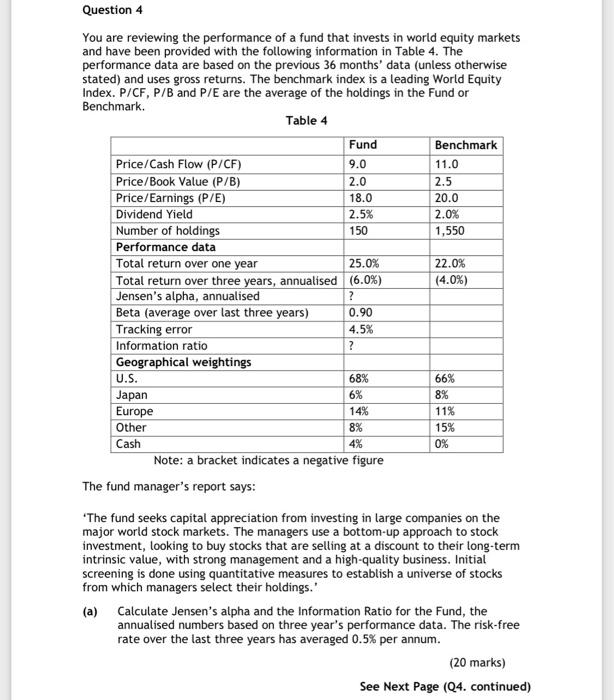

Question 4 You are reviewing the performance of a fund that invests in world equity markets and have been provided with the following information in Table 4. The performance data are based on the previous 36 months' data (unless otherwise stated) and uses gross returns. The benchmark index is a leading World Equity Index. P/CF, P/B and P/E are the average of the holdings in the Fund or Benchmark. Table 4 Fund Benchmark Price/Cash Flow (P/CF) 9.0 11.0 Price/Book Value (P/B) 2.0 2.5 Price/Earnings (P/E) 18.0 20.0 Dividend Yield 2.5% 2.0% Number of holdings 150 1,550 Performance data Total return over one year 25.0% 22.0% Total return over three years, annualised (6.0%) (4.0%) Jensen's alpha, annualised ? Beta (average over last three years) 0.90 Tracking error 4.5% Information ratio ? Geographical weightings U.S. 68% 66% Japan 6% Europe 14% 11% Other 8% 15% Cash 4% 0% Note: a bracket indicates a negative figure The fund manager's report says: 8% 'The fund seeks capital appreciation from investing in large companies on the major world stock markets. The managers use a bottom-up approach to stock investment, looking to buy stocks that are selling at a discount to their long-term intrinsic value, with strong management and a high-quality business. Initial screening is done using quantitative measures to establish a universe of stocks from which managers select their holdings.' (a) Calculate Jensen's alpha and the Information Ratio for the Fund, the annualised numbers based on three year's performance data. The risk-free rate over the last three years has averaged 0.5% per annum. (20 marks) See Next Page (04. continued) (b) Explain the performance measures provided and comment in detail on the investment manager's performance record. (50 marks) (c) From the information given what investment strategy does the manager appear to be employing to outperform the benchmark? Explain your answer. (30 marks) (Total: 100 marks) See Next Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts