Question: Really need help please. (Answer the next 7 questions with the following information.) A fictitious VC firm, EBV, that is considering a series A investment

Really need help please.

Really need help please.

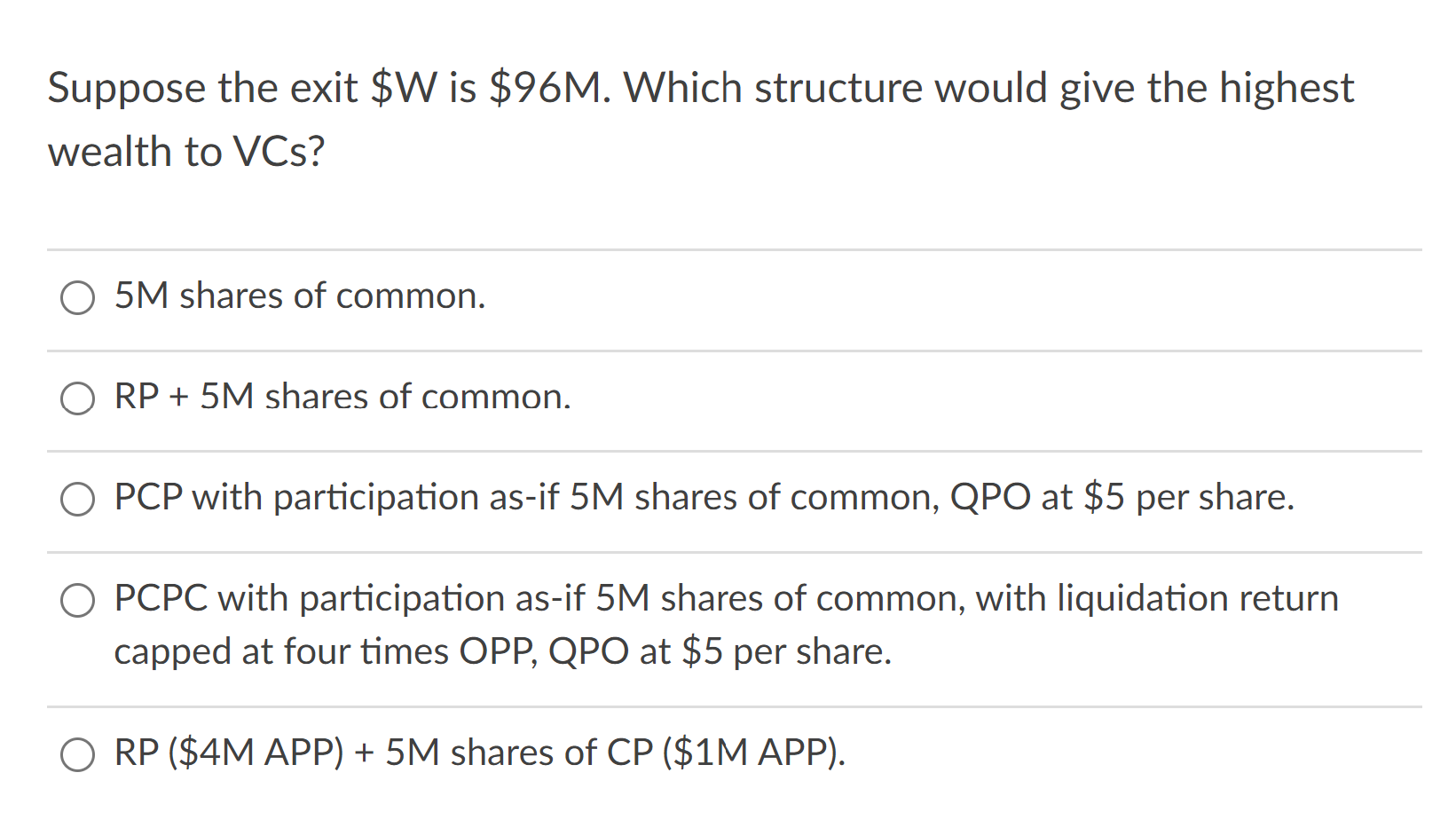

(Answer the next 7 questions with the following information.) A fictitious VC firm, EBV, that is considering a series A investment in a start-up company named Newco. The terms specify that EBV invests $5 million into Newco for 5M shares, which currently has 10M shares allotted to employees and founders. There are five structures that defines the wealth to VCs ($VC in vertical axis) against the exit value of portfolio firm ($W in horizontal axis). Choose the correct structure listed in the following that matches the diagram given in the question. Suppose the exit $W is $96M. Which structure would give the highest wealth to VCs? 5M shares of common. RP + 5M shares of common. O PCP with participation as-if 5M shares of common, QPO at $5 per share. OPCPC with participation as-if 5M shares of common, with liquidation return capped at four times OPP, QPO at $5 per share. O RP ($4M APP) + 5M shares of CP ($1M APP). (Answer the next 7 questions with the following information.) A fictitious VC firm, EBV, that is considering a series A investment in a start-up company named Newco. The terms specify that EBV invests $5 million into Newco for 5M shares, which currently has 10M shares allotted to employees and founders. There are five structures that defines the wealth to VCs ($VC in vertical axis) against the exit value of portfolio firm ($W in horizontal axis). Choose the correct structure listed in the following that matches the diagram given in the question. Suppose the exit $W is $96M. Which structure would give the highest wealth to VCs? 5M shares of common. RP + 5M shares of common. O PCP with participation as-if 5M shares of common, QPO at $5 per share. OPCPC with participation as-if 5M shares of common, with liquidation return capped at four times OPP, QPO at $5 per share. O RP ($4M APP) + 5M shares of CP ($1M APP)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts