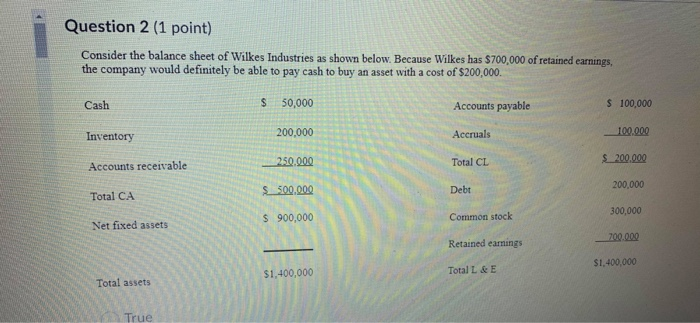

Question: really need help Question 2 (1 point) Consider the balance sheet of Wilkes Industries as shown below. Because Wilkes has $700,000 of retained earnings the

Question 2 (1 point) Consider the balance sheet of Wilkes Industries as shown below. Because Wilkes has $700,000 of retained earnings the company would definitely be able to pay cash to buy an asset with a cost of $200,000. $ Cash 50,000 Accounts payable $ 100,000 Inventory Accruals 100.000 200,000 250.000 $ 500.000 Total CL $ 200.000 Accounts receivable 200,000 Debt Total CA 300,000 $ 900,000 Common stock Net fixed assets 200.000 Retained earings $1,400,000 $1,400,000 Total L & E Total assets Question 4 (1 point) A bond has a $1,000 par value, makes annual coupon payments of $100, has 6 years to maturity, cannot be called, and is not expected to default. The bond should sell at a premium if interest rates are above 10% and at a discount if interest rates are below 10%. True False Page 4 of 40 Previous Page Next Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts