Question: Really need help with 1-3 please show the excel formulas Pandemie Brewery COVID-19 Version Pandemic Brewery is preparing to open downtown St Pete, and the

Really need help with 1-3 please show the excel formulas

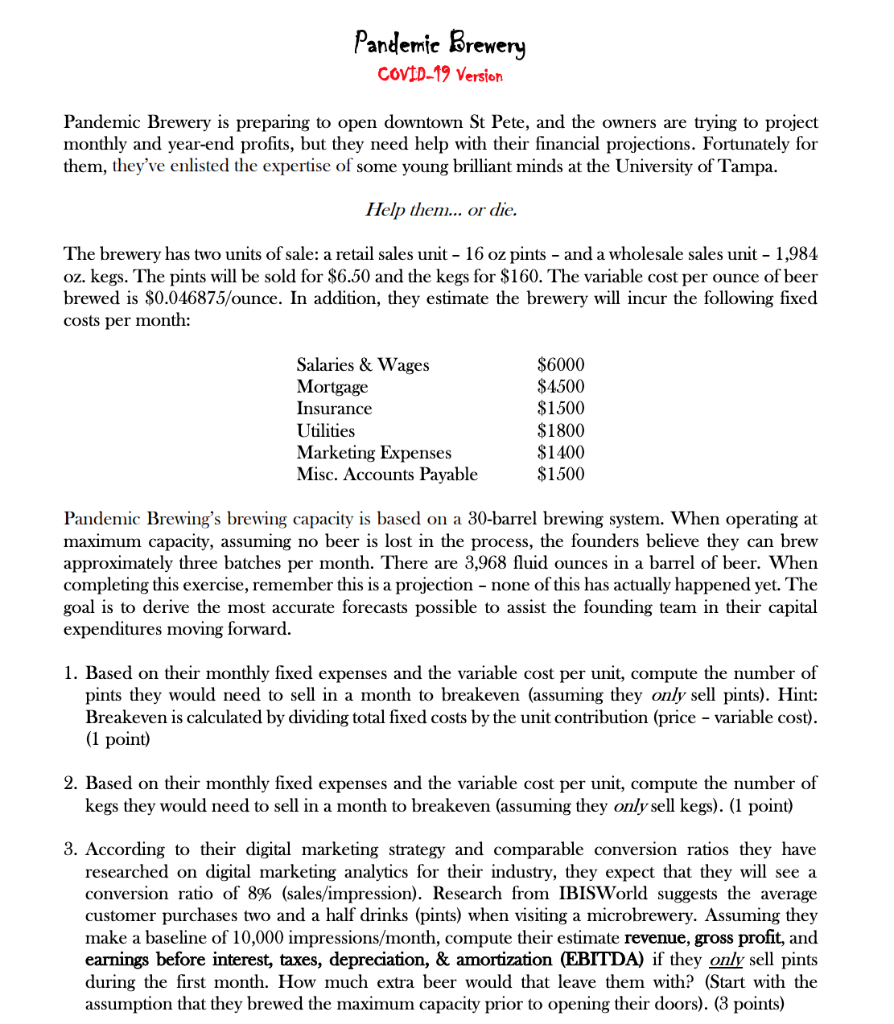

Pandemie Brewery COVID-19 Version Pandemic Brewery is preparing to open downtown St Pete, and the owners are trying to project monthly and year-end profits, but they need help with their financial projections. Fortunately for them, they've enlisted the expertise of some young brilliant minds at the University of Tampa. Help them... or die. The brewery has two units of sale: a retail sales unit - 16 oz pints - and a wholesale sales unit - 1,984 oz. kegs. The pints will be sold for $6.50 and the kegs for $160. The variable cost per ounce of beer brewed is $0.046875/ounce. In addition, they estimate the brewery will incur the following fixed costs per month: Salaries & Wages Mortgage Insurance Utilities Marketing Expenses Misc. Accounts Payable $6000 $4500 $1500 $1800 $1400 $1500 Pandemic Brewing's brewing capacity is based on a 30-barrel brewing system. When operating at maximum capacity, assuming no beer is lost in the process, the founders believe they can brew approximately three batches per month. There are 3,968 fluid ounces in a barrel of beer. When completing this exercise, remember this is a projection - none of this has actually happened yet. The goal is to derive the most accurate forecasts possible to assist the founding team in their capital expenditures moving forward. 1. Based on their monthly fixed expenses and the variable cost per unit, compute the number of pints they would need to sell in a month to breakeven (assuming they only sell pints). Hint: Breakeven is calculated by dividing total fixed costs by the unit contribution (price - variable cost). (1 point) 2. Based on their monthly fixed expenses and the variable cost per unit, compute the number of kegs they would need to sell in a month to breakeven (assuming they only sell kegs). (1 point) 3. According to their digital marketing strategy and comparable conversion ratios they have researched on digital marketing analytics for their industry, they expect that they will see a conversion ratio of 8% (sales/impression). Research from IBISWorld suggests the average customer purchases two and a half drinks (pints) when visiting a microbrewery. Assuming they make a baseline of 10,000 impressions/month, compute their estimate revenue, gross profit, and earnings before interest, taxes, depreciation, & amortization (EBITDA) if they only sell pints during the first month. How much extra beer would that leave them with? (Start with the assumption that they brewed the maximum capacity prior to opening their doors). (3 points) Pandemie Brewery COVID-19 Version Pandemic Brewery is preparing to open downtown St Pete, and the owners are trying to project monthly and year-end profits, but they need help with their financial projections. Fortunately for them, they've enlisted the expertise of some young brilliant minds at the University of Tampa. Help them... or die. The brewery has two units of sale: a retail sales unit - 16 oz pints - and a wholesale sales unit - 1,984 oz. kegs. The pints will be sold for $6.50 and the kegs for $160. The variable cost per ounce of beer brewed is $0.046875/ounce. In addition, they estimate the brewery will incur the following fixed costs per month: Salaries & Wages Mortgage Insurance Utilities Marketing Expenses Misc. Accounts Payable $6000 $4500 $1500 $1800 $1400 $1500 Pandemic Brewing's brewing capacity is based on a 30-barrel brewing system. When operating at maximum capacity, assuming no beer is lost in the process, the founders believe they can brew approximately three batches per month. There are 3,968 fluid ounces in a barrel of beer. When completing this exercise, remember this is a projection - none of this has actually happened yet. The goal is to derive the most accurate forecasts possible to assist the founding team in their capital expenditures moving forward. 1. Based on their monthly fixed expenses and the variable cost per unit, compute the number of pints they would need to sell in a month to breakeven (assuming they only sell pints). Hint: Breakeven is calculated by dividing total fixed costs by the unit contribution (price - variable cost). (1 point) 2. Based on their monthly fixed expenses and the variable cost per unit, compute the number of kegs they would need to sell in a month to breakeven (assuming they only sell kegs). (1 point) 3. According to their digital marketing strategy and comparable conversion ratios they have researched on digital marketing analytics for their industry, they expect that they will see a conversion ratio of 8% (sales/impression). Research from IBISWorld suggests the average customer purchases two and a half drinks (pints) when visiting a microbrewery. Assuming they make a baseline of 10,000 impressions/month, compute their estimate revenue, gross profit, and earnings before interest, taxes, depreciation, & amortization (EBITDA) if they only sell pints during the first month. How much extra beer would that leave them with? (Start with the assumption that they brewed the maximum capacity prior to opening their doors). (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts